When borrowing money from family members or lending money to loved ones, things can get complicated. That’s where a family loan agreement comes in handy. This contract sets clear terms for the lending and borrowing of money within a family, helping to avoid misunderstandings and conflicts down the road.

What Is a Family Loan Agreement?

A family loan agreement is a legal document that outlines the terms and conditions of a loan between family members.

This agreement is similar to a traditional loan agreement but tailored specifically for transactions between relatives. It includes details such as the loan amount, interest rate (if applicable), repayment schedule, and any collateral offered. By documenting these specifics, both parties can protect their interests and ensure that the loan is repaid on time.

Why Document Family Loans?

While borrowing money from family members may seem like a casual arrangement, it’s crucial to document the loan to avoid potential conflicts in the future. Here are a few reasons why documenting family loans is essential:

Clarity and Transparency

One of the primary reasons for documenting family loans is to provide clarity and transparency regarding the terms of the loan. By clearly outlining the loan amount, interest rate, repayment schedule, and any collateral, both parties can avoid misunderstandings and ensure that everyone is on the same page. This clarity can prevent disputes and maintain harmonious family relationships.

Legal Protection

Having a written family loan agreement offers legal protection to both the borrower and lender. In the event of disagreements or non-repayment, the document can serve as evidence of the loan terms and help resolve disputes more effectively. Without proper documentation, it can be challenging to enforce the loan agreement or protect one’s interests in case of a breach.

Preservation of Relationships

Money has the potential to create tension and strain relationships, especially within families. By documenting family loans, individuals can prevent financial issues from causing rifts among relatives. A formal agreement sets clear boundaries and expectations, reducing the likelihood of misunderstandings or resentment. It allows family members to focus on their personal connections without the added stress of financial transactions.

Financial Security

From the lender’s perspective, documenting family loans provides a sense of financial security. By outlining the terms of the loan in writing, the lender can protect their investment and ensure that the borrowed funds are repaid as agreed. This security is essential for maintaining trust and preventing any financial repercussions that may arise from informal or undocumented loans.

Common Scenarios Where Documentation Matters

Family loan agreements can be beneficial in various scenarios where money is exchanged between relatives. Some common instances where documenting family loans is crucial include:

Assisting with Home Purchases

When a family member helps another purchase a home by providing a loan, it’s essential to have a formal agreement in place. Buying a house is a significant financial transaction, and documenting the terms of the loan can protect both parties’ interests. This agreement can specify the loan amount, repayment terms, and any conditions related to the home purchase.

Starting a Business

Family members who collaborate on a business venture may require a family loan agreement to formalize their financial arrangement. Whether one family member is investing in another’s business or multiple relatives are partnering together, documenting the loan terms can prevent misunderstandings and disputes. This agreement can outline each party’s contribution, expected returns, and responsibilities within the business.

Education Funding

Parents lending money to children for educational expenses should consider a family loan agreement to ensure that the funds are repaid as agreed. Financing a child’s education can be a significant financial commitment, and having a written agreement can clarify the terms of the loan. This document can specify the loan amount, repayment schedule, and any conditions related to the educational expenses.

Debt Consolidation

Consolidating debts with the help of family loans may necessitate a formal contract to protect both the borrower and lender. When family members come together to help pay off existing debts, documenting the loan terms is crucial. This agreement can outline the amounts being consolidated, the repayment plan, and any collateral provided to secure the loan.

The Pros and Cons of Family Loan Agreements

Family loan agreements come with their own set of advantages and disadvantages. Let’s explore the pros and cons of these arrangements:

Pros

Some benefits of family loan agreements include:

- Flexibility: Family loan agreements can offer more flexible terms compared to traditional loans. Lenders and borrowers have the freedom to negotiate interest rates, repayment schedules, and other loan terms based on their unique circumstances.

- Lower Interest Rates: Lenders can often provide loans to family members at lower interest rates than banks or financial institutions. This can result in cost savings for borrowers while still providing a competitive return for lenders.

- Preservation of Family Wealth: Keeping money within the family can help preserve wealth and assets for future generations. By providing financial assistance through family loans, individuals can support their loved ones without depleting external resources.

- Personalized Terms: Family loan agreements allow for personalized terms that cater to the specific needs and preferences of the parties involved. This level of customization can lead to more mutually beneficial and satisfying loan arrangements.

Cons

However, there are also drawbacks to consider:

- Strained Relationships: Disputes over loan terms can strain family relationships if not handled properly. Money matters have the potential to create tension and resentment among relatives, especially if there are disagreements about repayment or other loan conditions.

- Legal Complexities: Without proper documentation, resolving conflicts can become legally complex. Family loan agreements provide a clear framework for addressing disputes, but without a formal contract, parties may struggle to enforce their rights or protect their interests.

- Risk of Default: There’s a risk of default if the borrower fails to repay the loan, leading to financial strain and potential loss for the lender. Family loans carry inherent risks, and without proper safeguards in place, lenders may face challenges in recovering their funds in case of non-repayment.

- Impact on Family Dynamics: Financial transactions within families can impact existing dynamics and relationships. Depending on how a family loan agreement is structured and executed, it may create feelings of obligation, resentment, or imbalance among family members.

The Essential Elements of a Family Loan Agreement

When drafting a family loan agreement, certain key elements should be included to ensure clarity and enforceability. These elements typically consist of:

Loan Amount

Clearly state the amount of money being borrowed in the family loan agreement. This figure should be specified in the agreement to avoid any confusion regarding the total loan amount. Both parties should agree on the exact sum being lent to ensure mutual understanding.

Repayment Terms

Specify the repayment schedule in the family loan agreement to outline when and how the borrowed funds will be repaid. This section should include details such as the frequency of payments, due dates, and any penalties for late payments. By setting clear repayment terms, both parties can manage expectations and avoid misunderstandings.

Interest Rate

If interest will be charged on the loan, the family loan agreement should clearly define the interest rate and how it will be calculated. Lenders may choose to charge a nominal interest rate to compensate for the opportunity cost of lending money. Including this information in the agreement ensures that both parties are aware of the financial implications of the loan and can plan accordingly.

Collateral

If collateral is involved in the family loan agreement, describe the assets being used as security for the loan. Collateral provides an additional layer of protection for the lender and can help mitigate the risk of non-repayment. The agreement should detail the specific collateral being offered and the process for transferring ownership in case of default.

Signatures

Both parties should sign the family loan agreement to acknowledge their acceptance of the terms and conditions. Signatures indicate agreement and consent, making the document legally binding. Having signatures from all involved parties ensures that everyone is committed to honoring the terms of the agreement and reinforces the seriousness of the loan transaction.

Witnesses

While not always required, having witnesses present during the signing of the family loan agreement can provide an additional layer of protection and credibility. Witnesses can attest to the authenticity of the signatures and the voluntary nature of the agreement. Their presence can help validate the document in case of any future disputes or challenges to its validity.

Notarization

For added assurance and legal validity, family loan agreements can be notarized by a public notary. Notarization involves the official certification of the signatures on the document, confirming that the parties signed willingly and were properly identified. A notarized agreement carries more weight in legal proceedings and can help prevent disputes regarding the authenticity of the signatures.

Review by Legal Counsel

Before finalizing a family loan agreement, it’s advisable to have the document reviewed by legal counsel. Family lawyers specialize in handling legal matters within family relationships and can provide valuable insights and guidance. A legal review can ensure that the agreement complies with relevant laws, protects the interests of both parties, and addresses any potential legal pitfalls or ambiguities.

Regular Communication

Once a family loan agreement is in place, both parties need to maintain regular communication regarding the loan. Open and honest communication can help prevent misunderstandings, address any challenges that arise, and ensure that the loan remains on track for repayment. By staying in touch and discussing any concerns or changes in circumstances, family members can uphold the spirit of mutual trust and cooperation.

Periodic Reviews

Periodic reviews of the family loan agreement can help ensure that the terms remain relevant and effective. Over time, circumstances may change, and adjustments to the agreement may be necessary. By reviewing the terms periodically, both parties can assess whether any modifications are needed to better reflect their current situation and financial needs.

Conflict Resolution

In the event of disputes or disagreements related to the family loan agreement, having a clear conflict resolution process can be invaluable. The agreement should outline steps for addressing conflicts, such as mediation or arbitration, to facilitate a resolution without escalating tensions. By establishing a framework for conflict resolution upfront, family members can navigate challenges more effectively and preserve their relationships.

The Critical Role of Family Lawyers

While family loan agreements can be drafted without legal assistance, consulting a family lawyer can provide added protection and peace of mind. A family lawyer can offer valuable advice and expertise in navigating the complexities of family relationships and financial transactions. Here are some ways in which family lawyers play a critical role in the family loan agreement process:

Legal Expertise

Family lawyers have in-depth knowledge of family law and can ensure that the family loan agreement complies with relevant legal requirements. They can advise on the legal implications of the agreement, help draft the document, and address any legal concerns that may arise during the loan transaction. Their expertise can provide clarity and confidence in the agreement’s enforceability.

Protection of Interests

Family lawyers work to protect the interests of their clients in family matters, including lending and borrowing within families. By consulting a family lawyer when drafting a family loan agreement, individuals can safeguard their rights and ensure that the agreement reflects their best interests. Lawyers can identify potential risks, offer solutions to mitigate them, and advocate for their clients’ needs throughout the process.

Guidance on Legal Procedures

Navigating the legal procedures involved in creating a family loan agreement can be challenging without expert guidance. Family lawyers can explain the legal requirements, such as notarization or witnessing, and ensure that the agreement is properly executed. Their knowledge of legal procedures and documentation can streamline the process and prevent errors that could jeopardize the agreement’s validity.

Resolution of Disputes

In case of disputes or conflicts related to the family loan agreement, family lawyers can help mediate and resolve the issues. They can offer legal advice on how to address disagreements, negotiate solutions, or pursue legal action if necessary. By having a legal advocate on their side, individuals can navigate challenging situations with confidence and seek a resolution that protects their interests.

Long-Term Planning

Family lawyers can assist individuals in considering the long-term implications of a family loan agreement. They can help clients assess their financial goals, estate planning objectives, and potential tax implications of the loan transaction. By taking a holistic view of the agreement, family lawyers can ensure that it aligns with their clients’ broader objectives and supports their overall financial well-being.

Peace of Mind

Above all, consulting a family lawyer for a family loan agreement can provide peace of mind to all parties involved. Knowing that a legal professional has reviewed the deal, complies with the law, and protects their interests can alleviate concerns and uncertainties. Family lawyers offer reassurance and confidence in the agreement, allowing family members to focus on their relationships without the added stress of legal complexities.

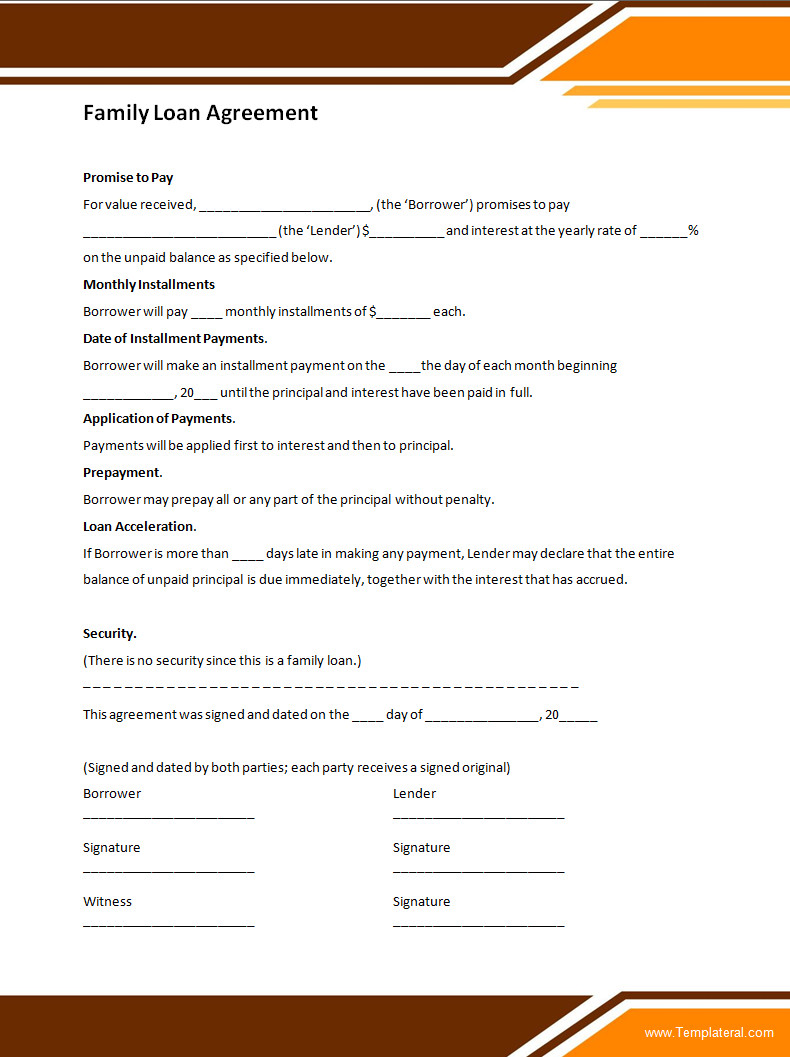

Family Loan Agreement Template

A family loan agreement is a helpful tool for documenting the terms of a loan between relatives, ensuring clarity and avoiding misunderstandings. It outlines repayment schedules, interest (if any), and responsibilities, making the arrangement professional and fair.

To keep financial agreements within the family clear and secure, use our free family loan agreement template and set terms with confidence!

Family Loan Agreement Template – Word