When it comes to estate planning, one of the most common tools used is a living trust form. This legal document allows individuals to transfer their assets into a trust during their lifetime, which can then be managed by a designated trustee and distributed to beneficiaries according to the terms of the trust.

In this comprehensive guide, we will explore everything you need to know about living trust forms, including what they are, why they are important, how to create one, examples of different types of living trusts, and tips for successful estate planning.

What is a Living Trust Form?

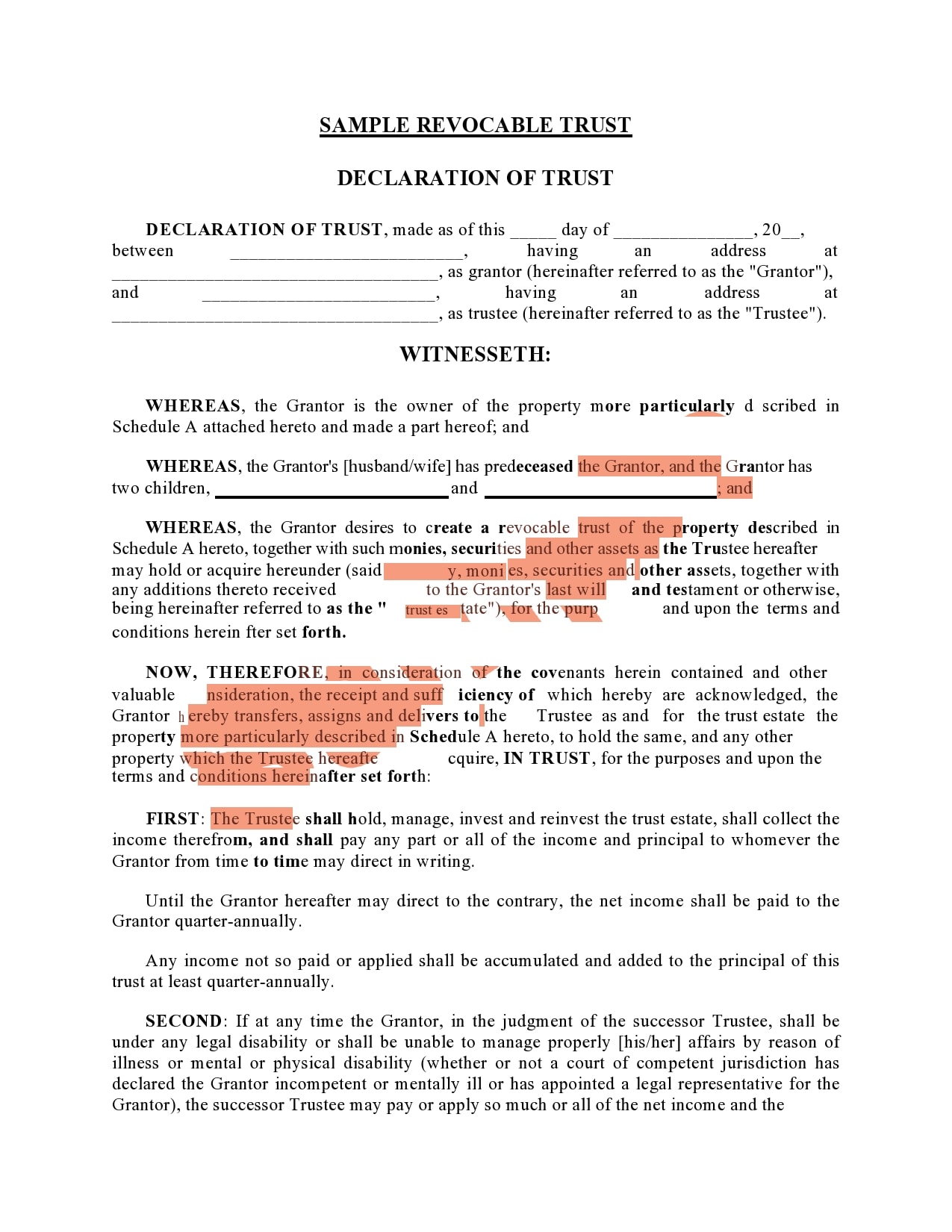

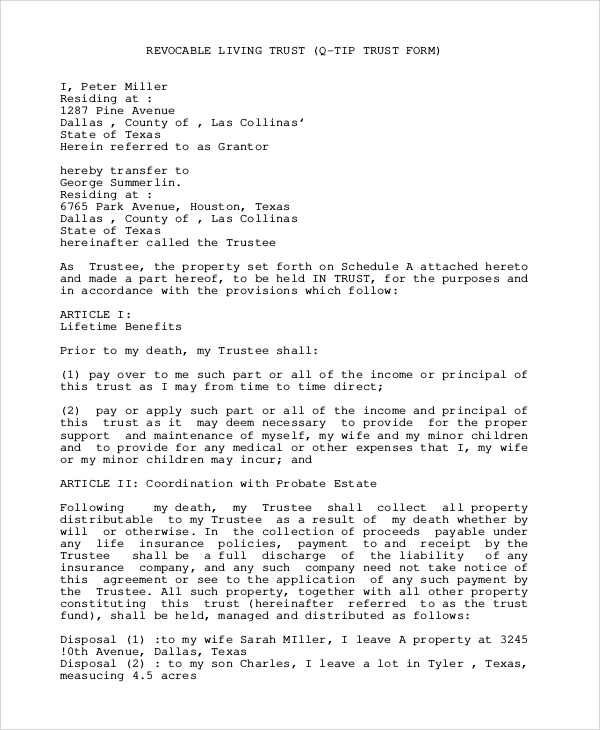

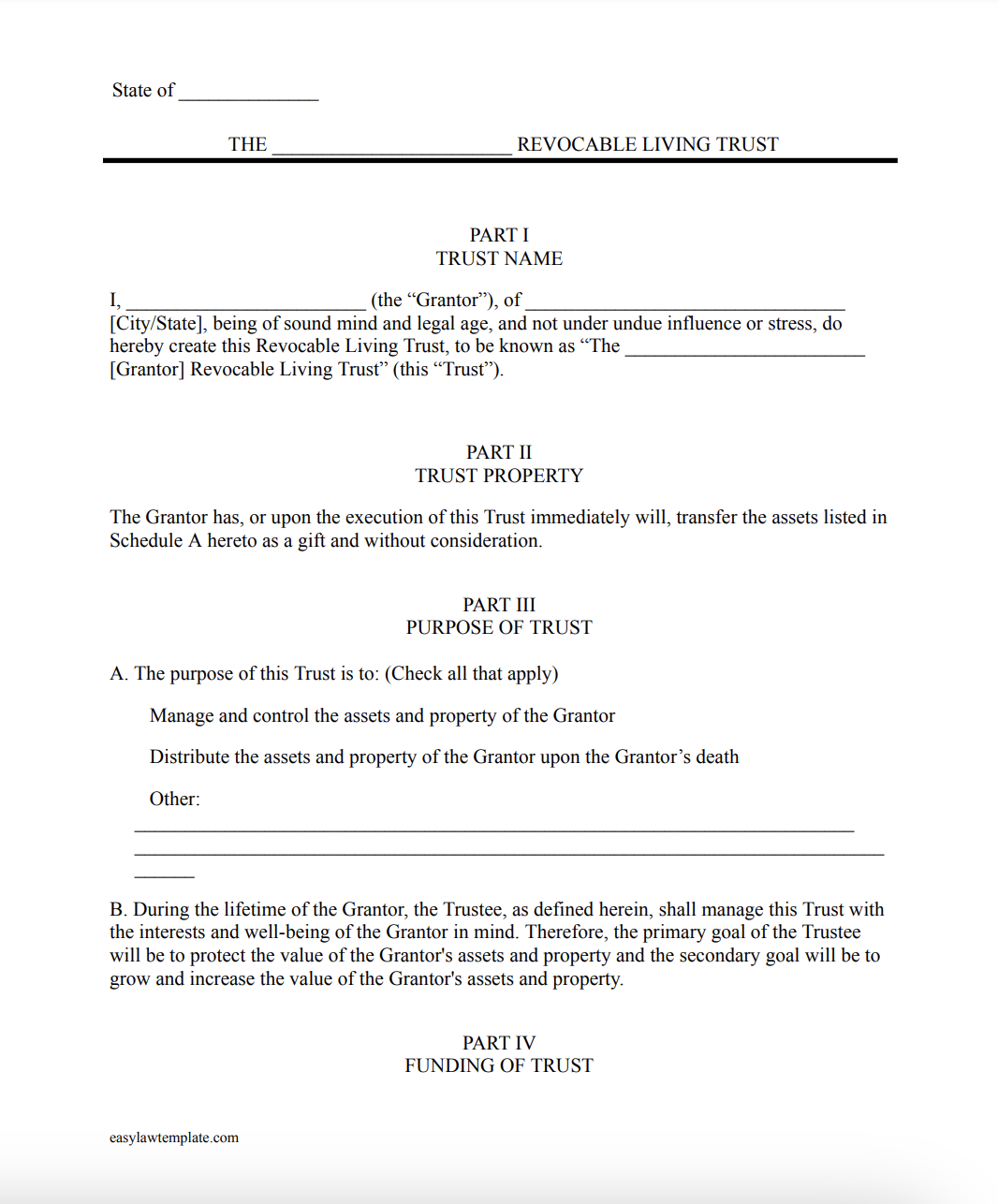

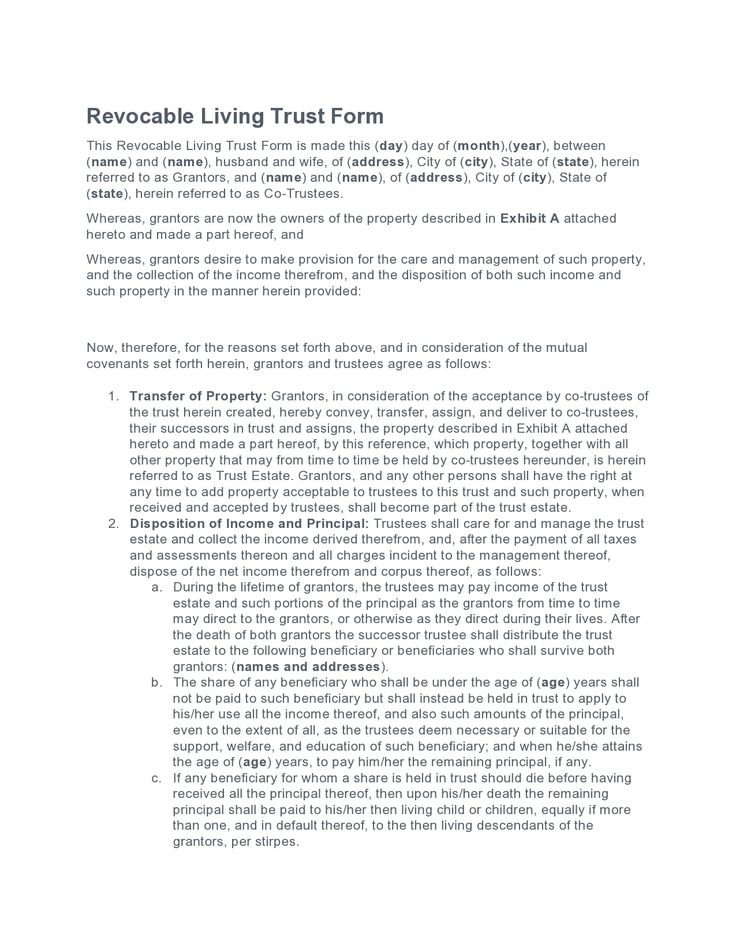

A living trust form, also known as a revocable trust or inter vivos trust, is a legal document that allows individuals to transfer their assets into a trust during their lifetime. The person creating the trust, known as the grantor, can designate themselves as the trustee or appoint someone else to manage the trust on their behalf.

The assets held in the trust are then distributed to beneficiaries according to the terms of the trust, which can be modified or revoked by the grantor at any time.

Why are Living Trust Forms Important?

Living trust forms are important for several reasons. One of the main benefits of creating a living trust is that it allows for the efficient transfer of assets to beneficiaries without the need for probate, which can be a lengthy and costly process.

Additionally, living trusts provide privacy for the grantor and beneficiaries, as the trust document is not a matter of public record like a will. Living trusts also allow for greater control over how assets are managed and distributed, as the grantor can specify detailed instructions for the trustee to follow.

Living Trust Form: How to Create One

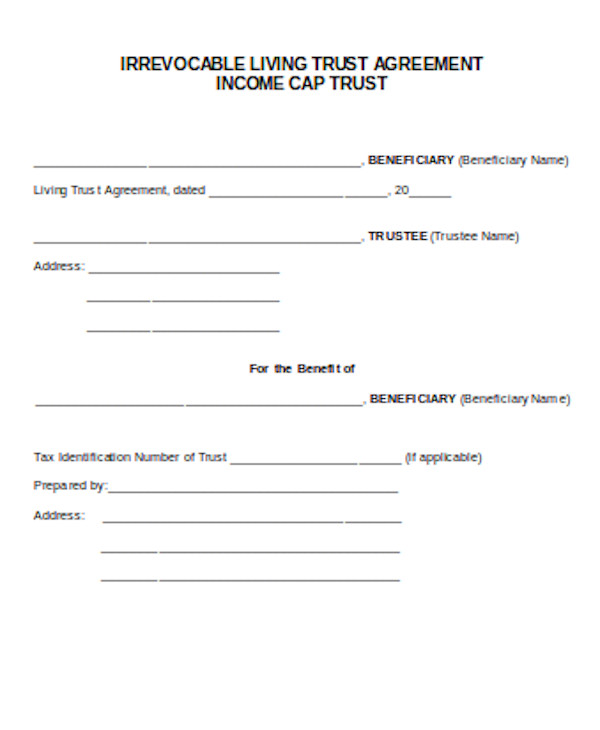

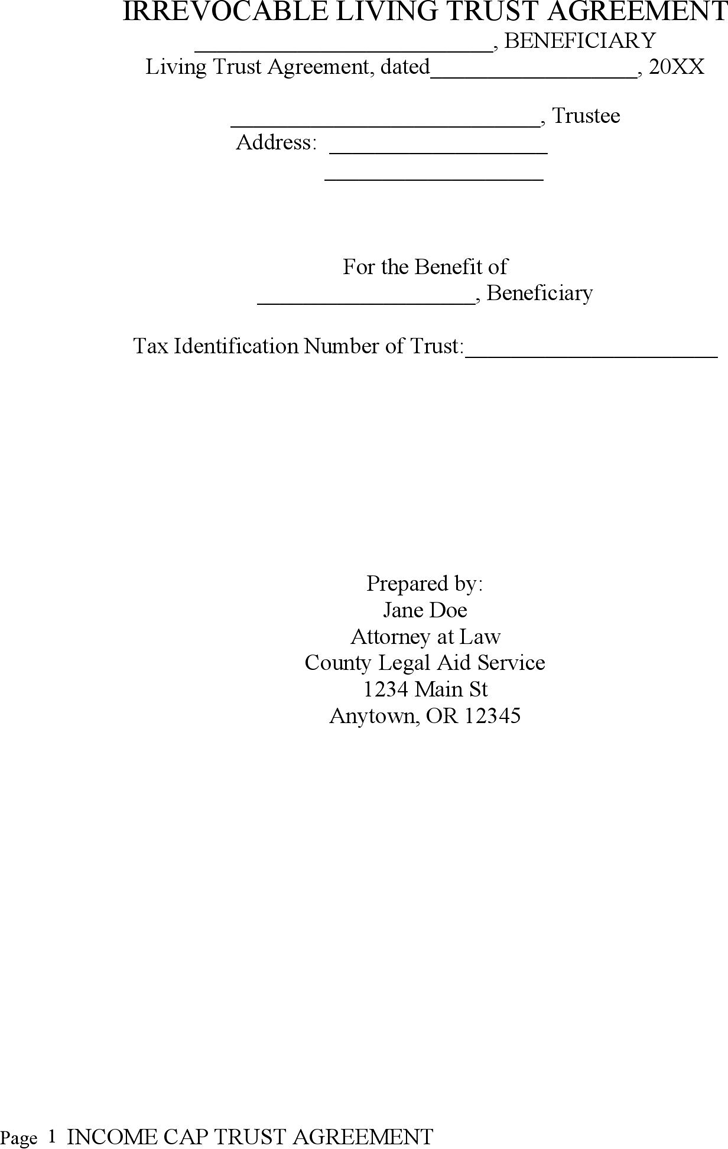

Creating a living trust form involves several key steps. The first step is to gather all relevant financial information, including a list of assets and liabilities that will be transferred into the trust. Next, the grantor must decide who will serve as the trustee and the beneficiaries of the trust. Once these decisions have been made, a trust document must be drafted that outlines the terms of the trust, including how assets will be managed and distributed. Finally, the trust document must be signed in the presence of a notary public to make it legally binding.

Examples of Different Types of Living Trusts

Several different types of living trusts can be used for estate planning purposes. Some common examples include:

- Revocable Living Trust: This type of trust can be modified or revoked by the grantor at any time during their lifetime.

- Irrevocable Living Trust: Once assets are transferred into this type of trust, they cannot be removed by the grantor.

- Asset Protection Trust: Designed to protect assets from creditors and lawsuits.

- Charitable Remainder Trust: Allows for assets to be transferred to a charity while providing income to the grantor during their lifetime.

- Special Needs Trust: Created to provide for the needs of a disabled beneficiary without affecting their eligibility for government benefits.

- Testamentary Trust: Created through a will and only takes effect after the grantor’s death.

- Pour-Over Trust: Used in conjunction with a will to transfer any assets not already in the trust into the trust upon the grantor’s death.

Tips for Successful Estate Planning with a Living Trust Form

When creating a living trust form for estate planning purposes, it is important to consider the following tips for success:

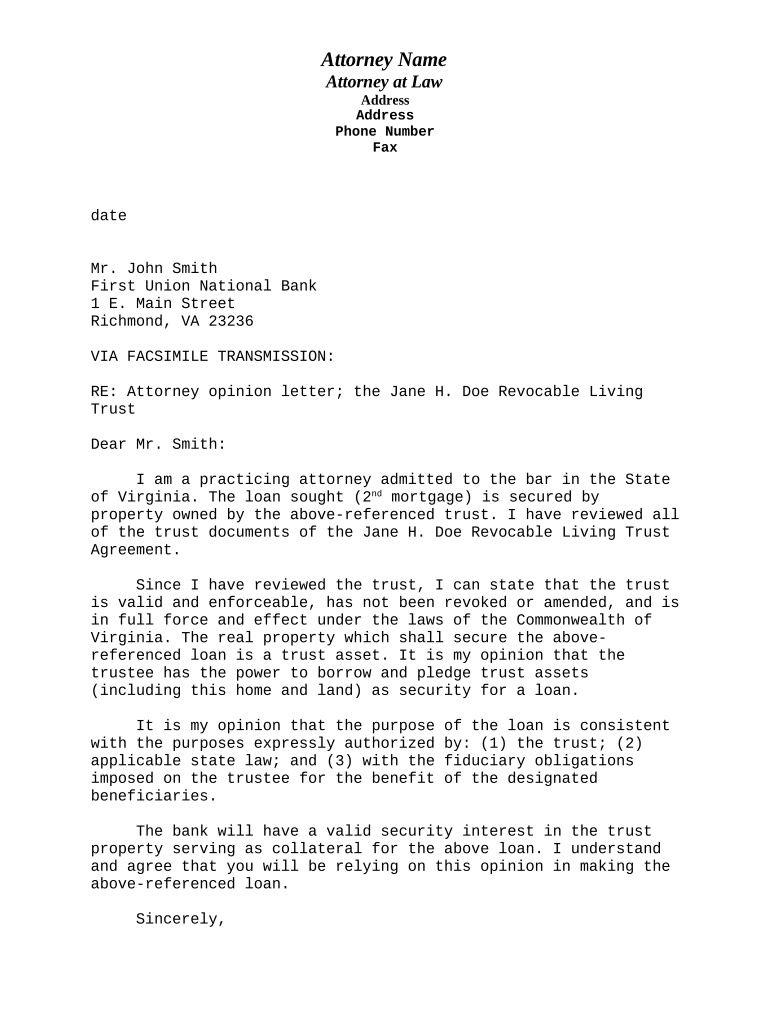

- Consult with an Estate Planning Attorney: An experienced attorney can help ensure that your trust is properly drafted and executed according to state laws.

- Update Your Trust Regularly: Life circumstances change, so it is important to review and update your trust as needed to reflect any changes in your assets or beneficiaries.

- Notify Your Beneficiaries: Make sure your beneficiaries are aware of the existence of the trust and understand how it will impact their inheritance.

- Consider Tax Implications: Work with a financial advisor to understand any potential tax consequences of transferring assets into a trust.

- Organize Your Financial Information: Keep detailed records of your assets and liabilities to make the trust administration process easier for your trustee.

- Communicate Your Wishes Clearly: Clearly outline your wishes for asset distribution in the trust document to avoid confusion or disputes among beneficiaries.

Conclusion

In conclusion, a living trust form is a powerful tool for estate planning that allows individuals to transfer assets to beneficiaries efficiently and privately. By understanding what living trust forms are, why they are important, how to create one, examples of different types of living trusts, and tips for successful estate planning, you can take control of your legacy and ensure that your assets are managed and distributed according to your wishes.

Living Trust Form – Download