Debt collection can be a challenging process, but having a well-crafted debt collection letter template can make the task a bit easier. A debt collection letter is a formal communication sent by a creditor to a debtor requesting payment of an outstanding debt. It is an important tool in the debt collection process as it serves as a written record of the creditor’s attempt to collect the debt.

In this guide, we will explore the what, why, and how of debt collection letter templates, provide examples, and offer tips for successful debt collection.

What is a Debt Collection Letter Template?

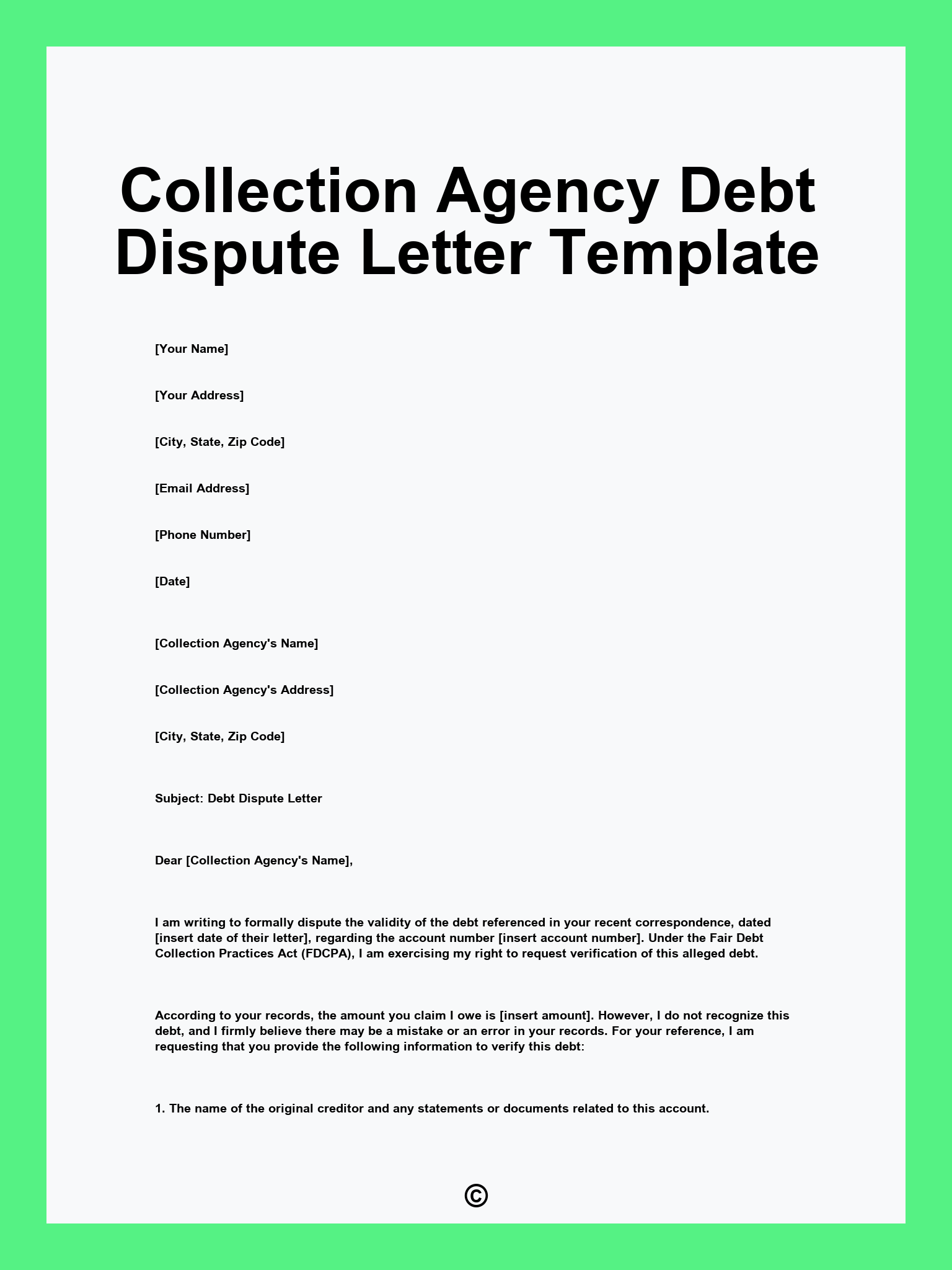

A debt collection letter template is a pre-written document that creditors use to request payment from debtors formally. It typically includes information such as the amount owed, the due date, and instructions on how to make payment. Debt collection letter templates are designed to be clear, concise, and professional in order to communicate the creditor’s expectations to the debtor effectively.

Debt collection letter templates can vary in format and tone, but they generally follow a standard structure. They often begin with a polite reminder of the debt owed, followed by a detailed breakdown of the amount due. The letter may also include consequences for non-payment, such as legal action or credit reporting. Overall, a debt collection letter template is a powerful tool for creditors to communicate with debtors formally and professionally.

Why Use a Debt Collection Letter Template?

Debt collection letter templates offer several benefits for creditors. Firstly, they provide a consistent and standardized approach to debt collection, ensuring that all communications with debtors are clear and professional. Additionally, debt collection letter templates can save time and effort for creditors, as they do not have to draft a new letter for each debtor. Using a template also helps creditors maintain compliance with debt collection laws and regulations.

For debtors, receiving a debt collection letter can serve as a wake-up call to address their outstanding debt. It can also provide them with a clear understanding of the amount owed and the consequences of non-payment. Overall, debt collection letter templates help facilitate communication between creditors and debtors, ultimately leading to a resolution of the debt.

How to Create a Debt Collection Letter Template

Creating a debt collection letter template is a straightforward process. Here are some steps to help you craft an effective template:

1. Start by identifying the key information to include in the letter, such as the debtor’s name, amount owed, and due date.

2. Clearly outline the consequences of non-payment, such as late fees, interest charges, or legal action.

3. Use a professional tone and language throughout the letter to maintain credibility and authority.

4. Include clear instructions on how the debtor can make payment, such as online payment options or a mailing address.

5. Proofread the letter carefully to ensure there are no errors or inconsistencies.

By following these steps, you can create a comprehensive debt collection letter template that effectively communicates your expectations to debtors.

Examples of Debt Collection Letter Templates

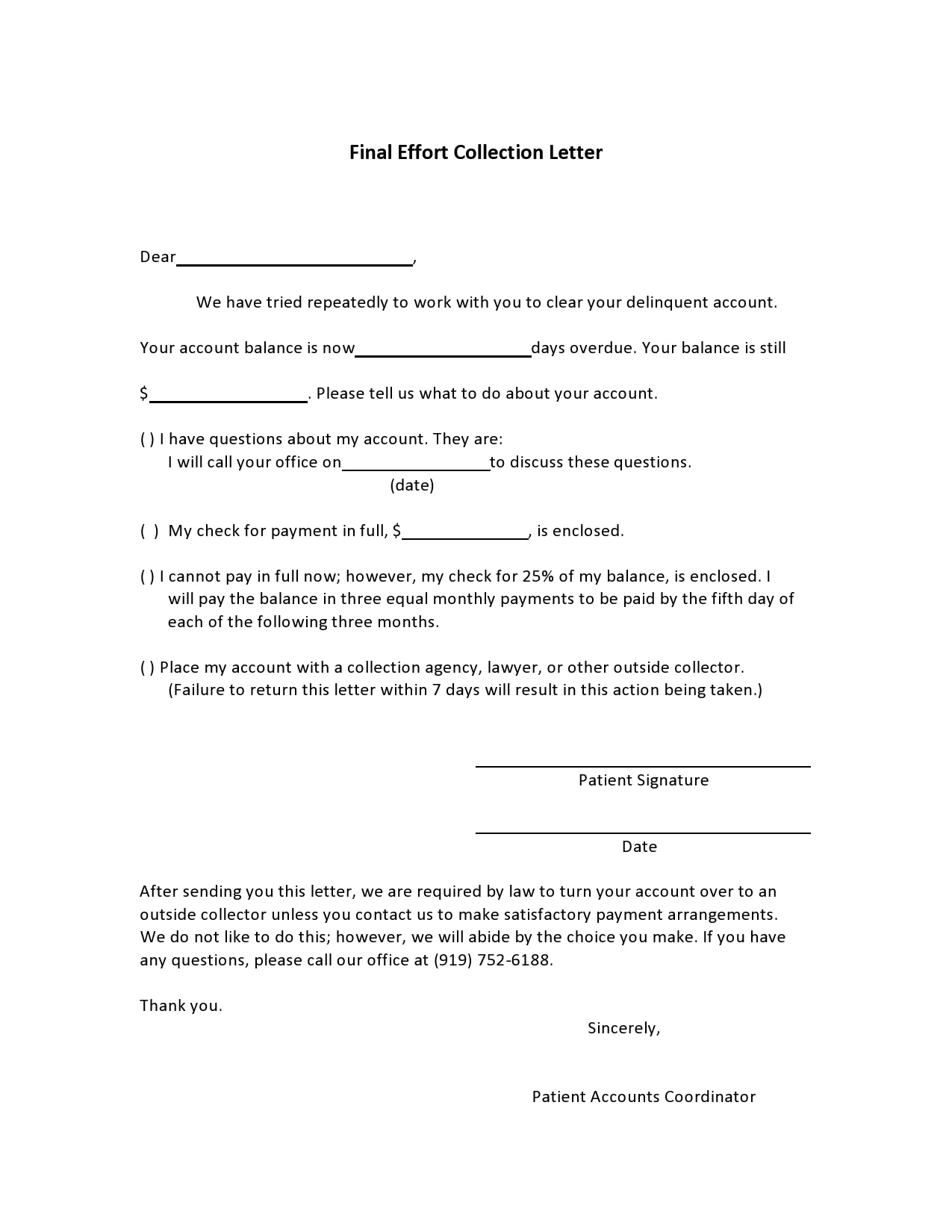

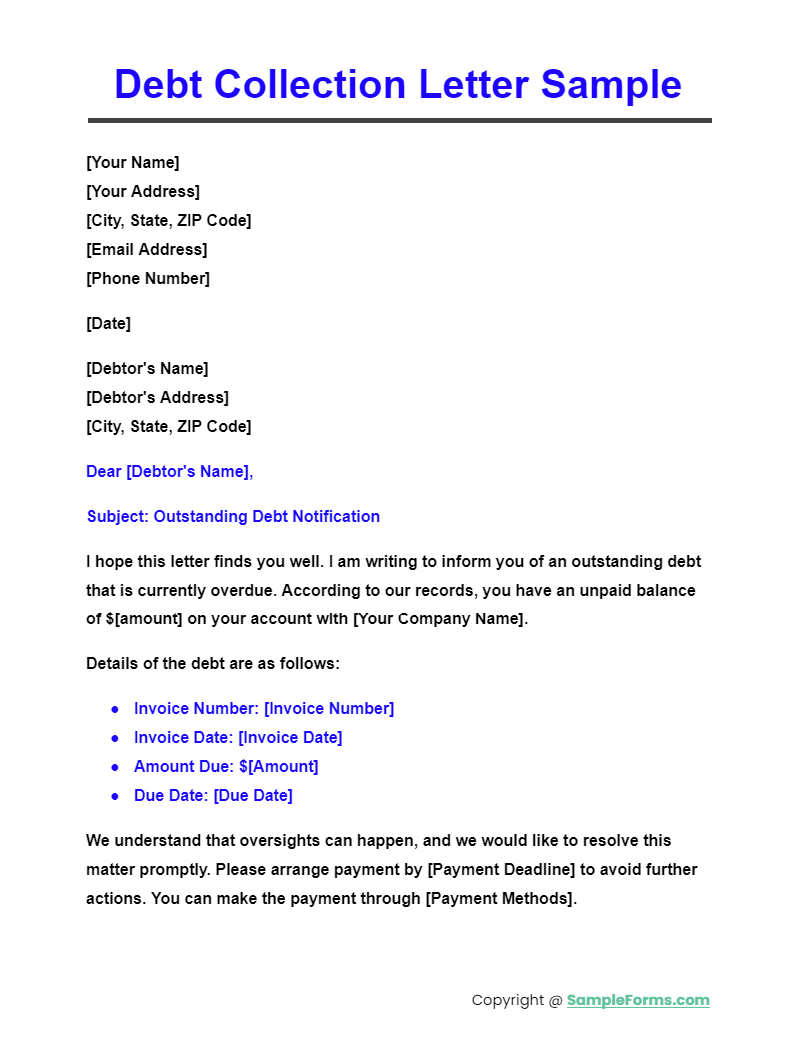

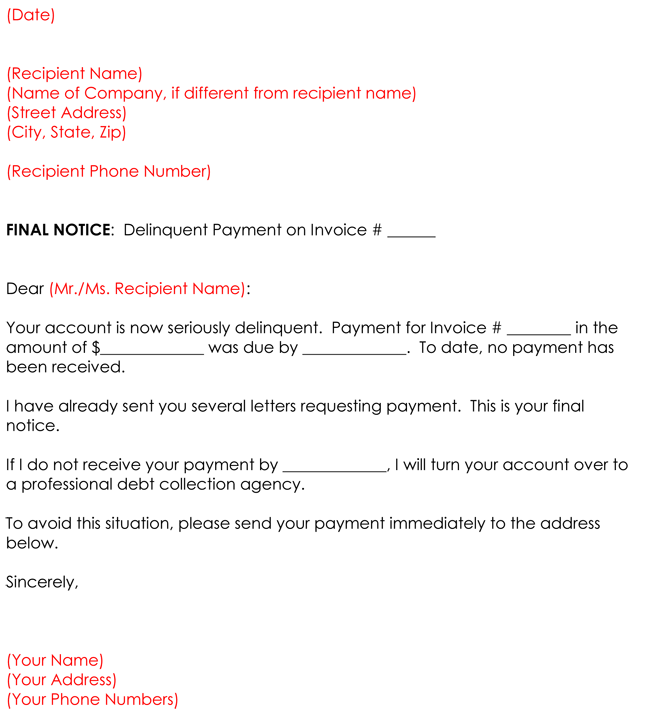

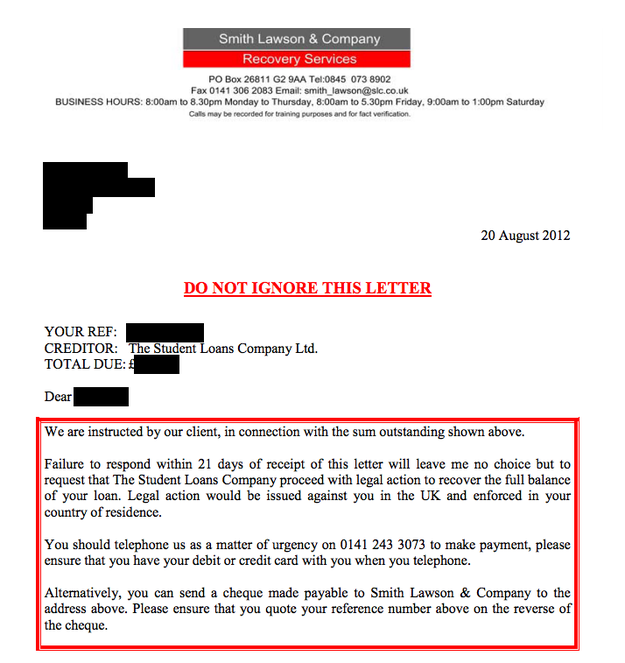

To give you a better idea of what a debt collection letter template looks like, here are some examples:

1. Initial Reminder Letter: This letter serves as an initial reminder to the debtor of the outstanding debt and provides instructions on how to make payment.

2. Second Reminder Letter: If the debtor does not respond to the initial reminder, a second letter may be sent with a firmer tone and consequences for non-payment.

3. Final Demand Letter: The final demand letter is the last attempt to collect the debt before legal action is taken. It typically includes a deadline for payment and consequences for non-compliance.

These examples demonstrate the progression of debt collection letters and the increasing urgency in tone as the debt collection process continues.

Tips for Successful Debt Collection

Successfully collecting debts can be a challenging process, but with the right strategies, it can be more manageable. Here are some tips for successful debt collection:

1. Communicate Clearly: Ensure that your debt collection letters are clear, concise, and professional to effectively communicate your expectations to debtors.

2. Follow Up: If debtors do not respond to your initial letter, be sure to follow up with additional reminders to increase the chances of payment.

3. Be Persistent: Debt collection can take time, so be persistent in your efforts to collect the debt and do not give up easily.

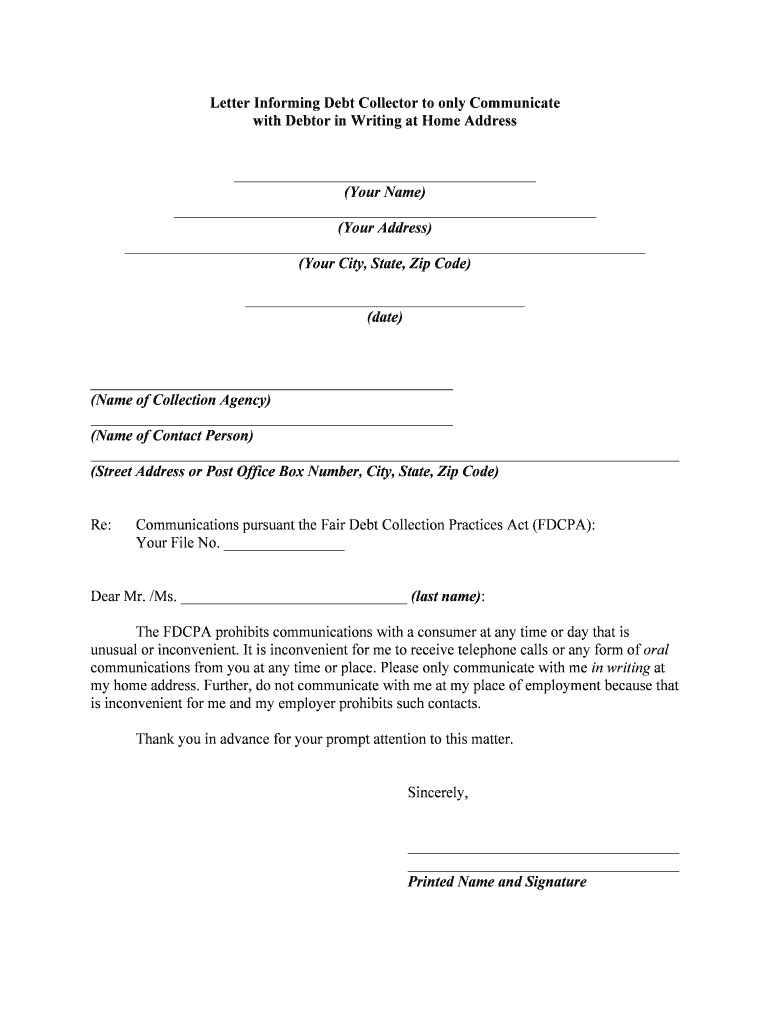

4. Stay Compliant: Familiarize yourself with debt collection laws and regulations to ensure that your collection practices are legal and ethical.

5. Consider Hiring a Professional: If you are struggling to collect a debt, consider hiring a debt collection agency or lawyer to assist you in the process.

6. Document Everything: Keep detailed records of all communications with debtors, including letters, phone calls, and emails, to protect yourself in case of disputes.

7. Offer Payment Plans: Consider offering debtors a payment plan to help them repay the debt in manageable installments.

By following these tips, you can improve your chances of successfully collecting debts and maintaining positive relationships with debtors.

In conclusion, debt collection letter templates are essential tools for creditors to communicate with debtors and collect outstanding debts. By creating a clear and professional template, following best practices, and staying compliant with laws and regulations, creditors can effectively navigate the debt collection process and achieve successful outcomes.

Debt Collection Letter Template – Download