In the world of business financing, personal guarantees play a crucial role in helping businesses secure much-needed funding. Whether you’re a startup with limited collateral or an established business looking to expand, understanding the intricacies of personal guarantees is essential for making informed financial decisions.

Let’s delve deeper into what personal guarantees are, how they work, the different types available, their pros and cons, and key considerations before agreeing to one.

What Is a Personal Guarantee?

A personal guarantee is a legal commitment made by an individual, often a business owner or partner, to take on the responsibility for a debt if the primary borrower defaults.

This agreement provides lenders or creditors with an additional layer of security, as they can seek repayment from the guarantor’s personal assets if the business fails to meet its financial obligations.

How Personal Guarantees Work

The Process

When a lender or creditor requests a personal guarantee, the guarantor must sign a legally binding document that outlines their responsibilities in the event of default. This document typically specifies the amount of the guarantee, the duration of the guarantee’s validity, and the conditions under which the guarantor’s personal assets may be accessed for repayment.

Enforcement

If the primary borrower fails to meet their financial obligations and defaults on the debt, the lender has the right to pursue the guarantor for repayment. This may involve legal proceedings to seize and liquidate the guarantor’s personal assets, such as real estate, bank accounts, investments, or other valuable possessions, to recover the outstanding debt.

Risk Mitigation

From the lender’s perspective, requiring a personal guarantee serves as a risk mitigation strategy that provides an additional layer of security against potential losses. By holding the guarantor accountable for the debt, the lender can increase the likelihood of repayment, even in cases where the business faces financial difficulties or unforeseen challenges.

Impact on Relationships

It’s essential for both the borrower and the guarantor to understand the potential impact of a personal guarantee on their relationship. The guarantor may feel added pressure and responsibility for the business’s financial well-being, while the borrower must uphold their end of the agreement to protect the guarantor’s personal assets and financial stability.

Types of Personal Guarantees

Limited Guarantee

A limited guarantee restricts the guarantor’s liability to a specific amount or timeframe, providing some level of protection against unlimited financial exposure. This type of guarantee is often used in situations where the guarantor wishes to limit their risk while still supporting the borrower’s financial needs.

Joint and Several Guarantee

In a joint and several guarantee, the guarantor is jointly liable with the primary borrower for the full amount of the debt. This means that the lender can pursue either party for repayment, and the guarantor may be held responsible for the entire debt if the borrower is unable to fulfill their obligations.

Continuing Guarantee

A continuing guarantee remains in effect until it is formally revoked or released by the lender. This type of guarantee provides ongoing support for the borrower’s financial commitments and ensures that the lender has recourse to the guarantor’s personal assets for an extended period, if necessary.

Unlimited Guarantee

An unlimited guarantee holds the guarantor fully responsible for the entire debt amount, without any limitations on liability. While this type of guarantee offers maximum protection for the lender, it also exposes the guarantor to significant financial risk, as they may be required to repay the full debt if the borrower defaults.

Pros and Cons of Personal Guarantees

Pros

- Access to Financing. Personal guarantees can help businesses secure funding that may otherwise be unavailable due to credit constraints or lack of collateral.

- Build Trust. Providing a personal guarantee demonstrates the guarantor’s commitment to the business and can help build trust with lenders and creditors.

- Favorable Terms. Lenders may offer more favorable terms, such as higher loan amounts or lower interest rates, when a personal guarantee is provided.

- Growth Opportunities. Personal guarantees can enable businesses to pursue growth opportunities, expand operations, or invest in new projects that require additional funding.

- Flexibility. Personal guarantees can be tailored to suit the specific needs and circumstances of the borrower, offering a flexible financing solution.

- Shared Risk. By sharing the risk with the guarantor, lenders may be more willing to extend credit to businesses that would otherwise be considered too risky.

Cons

- Financial Risk. Guarantors are exposed to significant financial risk, as they may be required to repay the debt if the borrower defaults.

- Personal Liability. Personal guarantees put the guarantor’s personal assets, such as their home, savings, or investments, at risk of seizure in the event of default.

- Credit Impact. Defaulting on a personal guarantee can hurt the guarantor’s credit score and financial standing.

- Strained Relationships. Personal guarantees can strain relationships between business partners, family members, or friends who may be involved in the guarantee agreement.

- Limited Protection. Some types of personal guarantees offer limited protection for the guarantor, leaving them vulnerable to unforeseen financial challenges.

Things to Consider Before Agreeing to a Personal Guarantee

Financial Stability

Before agreeing to a personal guarantee, it’s essential to assess your financial stability and ability to repay the debt if the borrower defaults. Consider your current income, assets, liabilities, and overall financial health to determine whether you can afford to take on the financial risk.

Legal Advice

Seeking legal advice before signing a personal guarantee is crucial to fully understand the terms of the agreement and your rights and responsibilities as a guarantor. A legal expert can help you navigate the complexities of the guarantee agreement and protect your interests.

Alternative Options

Explore alternative financing options that do not require a personal guarantee, such as secured loans, grants, crowdfunding, or equity financing. Evaluate the pros and cons of each option to find the best fit for your business’s financial needs and risk tolerance.

Communication

Maintain open communication with the primary borrower and lender throughout the duration of the guarantee agreement. Stay informed about the status of the debt, any changes in repayment terms, and potential risks that may impact your financial responsibilities as a guarantor.

Risk Assessment

Conduct a thorough risk assessment to evaluate the potential implications of entering into a personal guarantee. Consider worst-case scenarios, such as business failure, economic downturns, or unexpected financial challenges, and develop a contingency plan to mitigate risks and protect your personal assets.

Exit Strategy

Develop an exit strategy in case you need to revoke or release the personal guarantee in the future. Consider potential triggers for releasing the guarantee, such as reaching certain financial milestones, repaying a portion of the debt, or transferring the guarantee to another party.

Financial Planning

Incorporate the personal guarantee into your overall financial planning strategy to ensure that it aligns with your short-term and long-term financial goals. Consider how the guarantee may impact your personal finances, creditworthiness, and ability to access future financing options.

Documentation

Keep detailed records of all documentation related to the personal guarantee, including the guarantee agreement, repayment schedules, correspondence with the lender, and any changes to the terms of the agreement. Maintain organized records to protect your legal rights and track your financial obligations.

Review Periodically

Periodically review the terms and conditions of the personal guarantee to ensure that they align with your current financial situation and risk tolerance. Consider renegotiating the terms of the agreement if your circumstances change or if you need to adjust the guarantee to protect your interests.

Legal Recourse

Understand your legal rights and recourse as a guarantor in the event of default or non-payment by the borrower. Familiarize yourself with the legal process for enforcing a personal guarantee, including potential litigation, asset seizure, and debt collection actions that may be necessary to recover the outstanding debt.

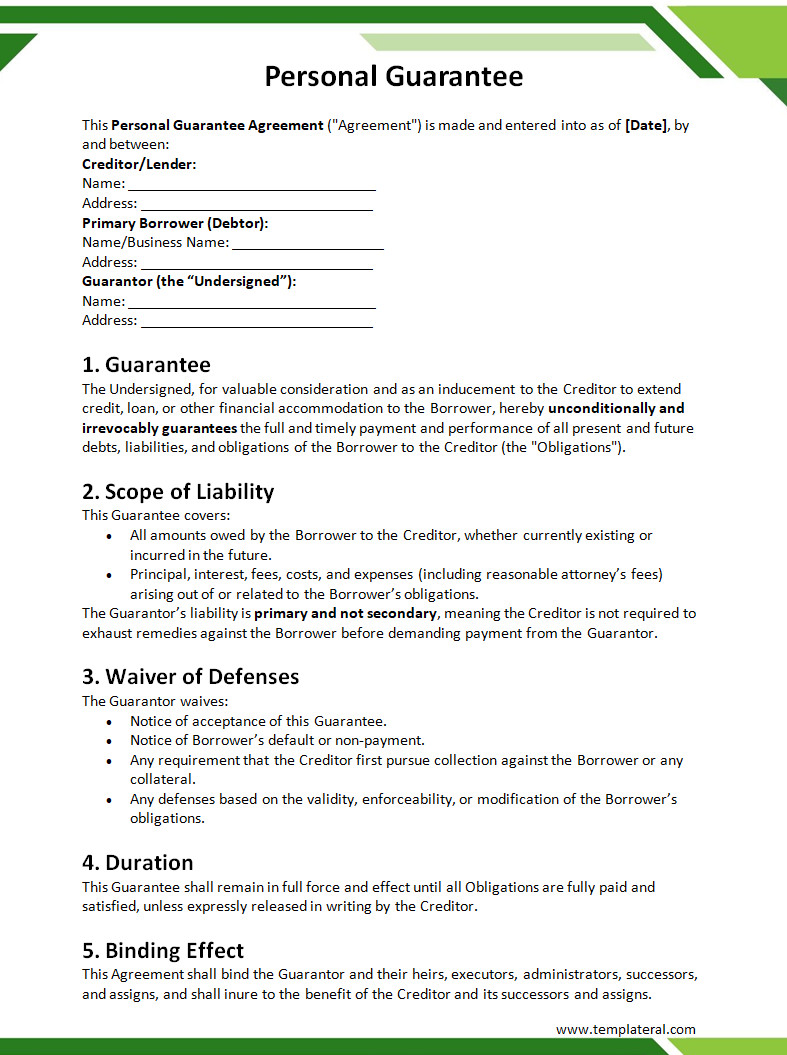

Personal Guarantee Template

A personal guarantee is a crucial document that outlines an individual’s promise to assume responsibility for a debt or obligation if the primary party fails to fulfill their commitments. It assures lenders or creditors while ensuring clarity and legal protection.

To make your agreements straightforward and professional, use our free personal guarantee template and secure your commitments with confidence!

Personal Guarantee Template – Word