In the realm of business acquisitions, navigating the intricacies of asset purchase agreements is crucial for both buyers and sellers.

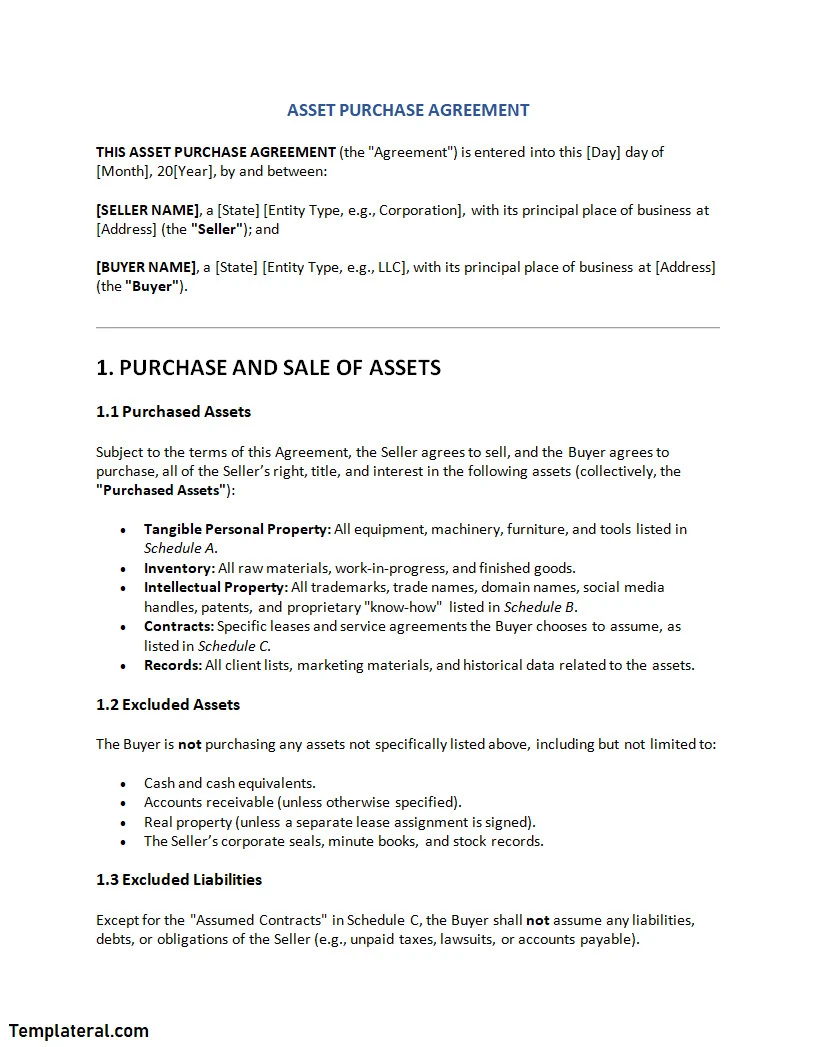

An asset purchase agreement is a legally binding contract that outlines the sale of specific business assets from a seller to a buyer. This agreement allows the buyer to cherry-pick desired assets while avoiding unwanted liabilities, thereby structuring a customized acquisition with clear terms for price, assets, responsibilities, and risk mitigation for both parties. It provides a framework to specify what’s included, how much it costs, and protects interests by defining obligations, ensuring legal compliance, and allocating tax impacts.

What is an Asset Purchase Agreement?

An asset purchase agreement is a key document in a business acquisition process that details the sale of specific assets from one party to another. Unlike a stock purchase agreement, where the buyer acquires the entire company, an asset purchase agreement allows for a more tailored approach, enabling the buyer to select specific assets and liabilities they wish to acquire.

This type of agreement typically includes a detailed list of assets being transferred, purchase price, payment terms, representations and warranties, indemnification provisions, and other terms and conditions agreed upon by both parties.

Why Are Asset Purchase Agreements Important?

Asset purchase agreements play a crucial role in structuring a business acquisition deal that meets the needs and objectives of both parties involved. By clearly outlining the assets being acquired and the liabilities being assumed, these agreements help mitigate risks and protect the interests of both the buyer and the seller.

Key Elements of an Asset Purchase Agreement

1. Asset Description: The agreement should clearly define the assets being transferred, including equipment, intellectual property, inventory, real estate, etc.

2. Purchase Price: Outline the total purchase price and any payment terms agreed upon by both parties.

3. Representations and Warranties: Include statements made by the seller regarding the assets being sold, ensuring their accuracy and legality.

4. Indemnification Provisions: Specify how liabilities and risks will be handled post-acquisition, including any indemnification obligations.

5. Closing Conditions: Detail the conditions that must be met for the transaction to close successfully.

6. Governing Law: Specify the jurisdiction and laws that will govern the agreement in case of disputes.

7. Confidentiality: Include provisions to protect sensitive information disclosed during the negotiation process.

8. Termination Clause: Outline the circumstances under which the agreement can be terminated by either party.

How to Draft an Asset Purchase Agreement

Drafting a comprehensive asset purchase agreement requires careful consideration of the specifics of the transaction and the needs of both parties involved. Here are some key steps to follow:

1. Identify the Assets: Clearly list all assets being transferred in the agreement, including a detailed description of each asset.

2. Negotiate Purchase Price: Agree on a fair purchase price for the assets, taking into account their market value and condition.

3. Define Responsibilities: Clearly outline the responsibilities of both the buyer and the seller post-acquisition, including any transition services or support.

4. Seek Legal Counsel: Consult with legal experts to ensure the agreement complies with relevant laws and regulations.

5. Review and Revise: Carefully review the agreement to ensure all terms are accurately reflected and make any necessary revisions before finalizing.

Tips for Negotiating an Asset Purchase Agreement

Negotiating an asset purchase agreement can be a complex process, but with the right approach, both parties can reach a mutually beneficial deal. Here are some tips to keep in mind:

- Understand Your Objectives: Clearly define your goals and objectives for the acquisition to guide the negotiation process.

- Conduct Due Diligence: Thoroughly assess the assets being acquired and the financial health of the selling company before finalizing the agreement.

- Seek Professional Advice: Engage legal and financial experts to provide guidance and ensure the agreement protects your interests.

- Be Flexible: Approach negotiations with an open mind and be willing to compromise on certain terms to reach a mutually agreeable deal.

- Document Everything: Keep detailed records of all negotiations and agreements reached to avoid any misunderstandings or disputes in the future.

- Review Regularly: Periodically review the agreement to ensure it remains current and reflects any changes in the business or market conditions.

- Communicate Effectively: Maintain open and transparent communication with the other party throughout the negotiation process to build trust and facilitate a successful deal.

Conclusion

In conclusion, asset purchase agreements are essential documents that play a crucial role in structuring successful business acquisitions. By clearly outlining the terms of the transaction, including assets, liabilities, price, and responsibilities, these agreements help mitigate risks and protect the interests of both buyers and sellers. By following the key elements, drafting tips, and negotiation strategies outlined in this guide, parties can navigate the complexities of asset purchase agreements with confidence and achieve a mutually beneficial outcome.

Asset Purchase Agreement Template – Word