What is a Profit and Loss Statement?

A profit and loss statement is a financial report that summarizes a company’s revenue, costs, and expenses during a specific period, typically a quarter or a year. It provides a detailed breakdown of the company’s financial performance, showing whether it has generated a profit or incurred a loss.

The statement begins with the company’s total revenue and subtracts the costs of goods sold and operating expenses to arrive at the net income or loss for the period.

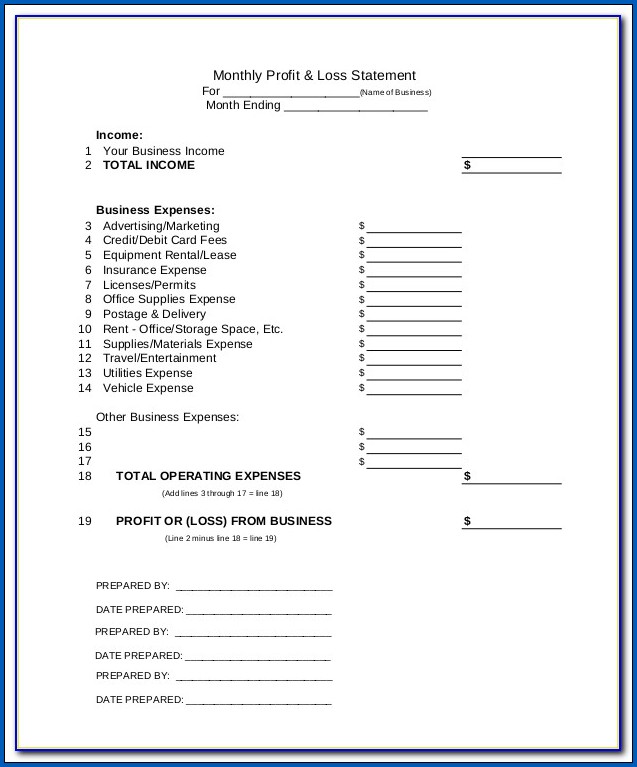

Samples of Profit And Loss Statement:

Why are Profit and Loss Statements Important?

Profit and loss statements play a crucial role in financial analysis for several reasons.

Operational Efficiency

By analyzing the revenue and expenses outlined in the profit and loss statement, companies can identify inefficiencies in their operations and take corrective actions to improve profitability.

Strategic Decision-Making

The insights provided by the profit and loss statement can help companies make informed decisions about pricing strategies, cost-cutting measures, and resource allocation.

Trend Analysis

Comparing profit and loss statements from different periods can reveal trends in a company’s financial performance, enabling stakeholders to forecast future performance and plan accordingly.

External Stakeholder Assessment

Investors, lenders, and other external parties use profit and loss statements to evaluate a company’s financial stability, growth potential, and overall attractiveness as an investment or lending opportunity.

What to Include in a Profit and Loss Statement?

A comprehensive profit and loss statement should include all relevant revenue streams and expenses to provide a clear picture of a company’s financial performance.

Detailed Revenue Breakdown

It is essential to include a detailed breakdown of all sources of revenue, including sales, services, and any other income streams the company may have.

Thorough Expense Analysis

Operating expenses should be categorized and detailed to provide transparency into where the company is spending its money and identify areas for potential cost savings.

Accurate Calculation of Net Income

The net income figure should accurately reflect the company’s financial performance by deducting all expenses, including operating expenses, taxes, and any other costs incurred during the period.

How to Analyze a Profit and Loss Statement?

Analyzing a profit and loss statement involves comparing key metrics and identifying trends to assess a company’s financial health.

Calculating Profit Margins

Profit margins can be calculated by dividing net income by total revenue to determine how efficiently a company is generating profits.

Comparing Periods

Comparing profit and loss statements from different periods can reveal trends in revenue and expenses, providing insights into the company’s financial performance over time.

Identifying Cost Drivers

By analyzing operating expenses, companies can identify cost drivers and prioritize cost-cutting measures to improve profitability.

Tips for Creating an Effective Profit and Loss Statement

Creating an effective profit and loss statement requires attention to detail and accuracy to provide a comprehensive view of a company’s financial performance.

Include all Revenue Streams

Make sure to account for all sources of revenue, including sales, services, and any other income streams the company may have to ensure an accurate representation of total income.

Detailed Operating Expenses

Break down operating expenses into categories to provide a clear overview of where the company is spending its money and identify areas for potential cost savings.

Use Accrual Accounting

Accrual accounting provides a more accurate representation of a company’s financial performance by matching revenues and expenses in the period they occur, giving a true picture of the company’s profitability.

Review Regularly

Regularly reviewing and updating the profit and loss statement can help identify trends and make timely adjustments to improve profitability and financial health in the long run.

Profit And Loss Statement Template

A profit and loss statement is a valuable financial tool that helps you track your business’s income, expenses, and overall profitability over a specific period. It provides a clear picture of your company’s financial performance, making it easier to identify trends, control costs, and make informed business decisions. Perfect for startups, small businesses, and freelancers, this template simplifies financial reporting.

Download and use our profit and loss statement template today to monitor your earnings, manage expenses, and keep your business financially healthy.

Profit And Loss Statement PDF – download