Managing cash flow is crucial for any business, and a cash register plays a vital role in this process. A closing cash register is a useful tool that helps business owners organize and track their cash transactions.

In this article, we will explore the benefits of using a closing cash register, how it works, and provide some tips on effectively managing your cash flow.

Why Should You Use a Closing Cash Register?

A closing cash register offers several advantages for businesses of all sizes. Let’s take a closer look at why you should consider using one:

- Efficient Cash Management: By using a closing cash register, you can easily keep track of all your cash transactions, including sales, refunds, and petty cash expenses. This allows you to have an accurate record of your cash flow, helping you make informed financial decisions.

- Prevent Loss and Theft: A closing cash register helps deter theft and reduces the chances of errors or discrepancies in your cash drawer. By reconciling your cash register at the end of each shift or day, you can identify any discrepancies and take appropriate action.

- Organized Business Operations: With a closing cash register, you can maintain a systematic approach to handling cash transactions. This helps streamline your business operations and ensures that your cash is properly accounted for.

How to Use a Closing Cash Register

Using a closing cash register is relatively simple. Here are the basic steps:

- Open the Cash Register: Begin by opening the cash register and ensuring that it is empty and in working order. Make sure there is an adequate amount of change in the drawer.

- Record Sales: Throughout the day, record all sales transactions in the cash register, including the amount received and the change given to the customer.

- Track Petty Cash: If you have a petty cash fund, make sure to record any petty cash expenses in the register and replenish the fund as needed.

- Reconcile Cash Drawer: At the end of each shift or day, count the cash in the drawer and compare it to the recorded sales. Identify any discrepancies and investigate the cause.

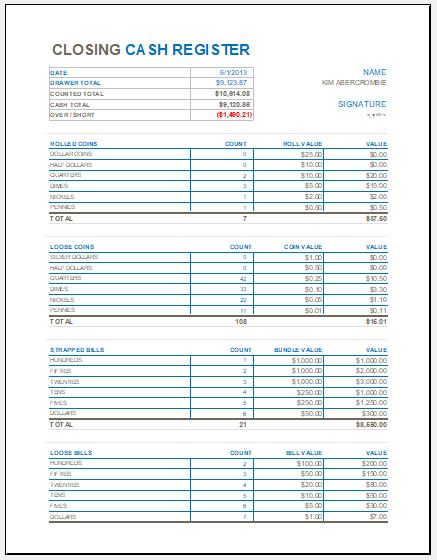

- Print Closing Report: Generate a closing report from your closing cash register. This report provides a summary of your cash transactions and can be used for accounting purposes.

- Secure Cash: Safely store the cash in a secure location, such as a safe or locked drawer, until it can be deposited in your bank account.

When to Use a Closing Cash Register?

A closing cash register is ideal for businesses that handle cash transactions regularly. Whether you run a retail store, restaurant, or any other cash-based business, using a closing cash register can help you maintain accurate records and ensure the integrity of your cash flow. It is especially important to use a cash register during peak sales periods or when multiple employees are handling cash.

What to Look for in a Closing Cash Register?

When choosing a closing cash register, consider the following factors:

- User-Friendly Interface: Look for a cash register with an intuitive interface that is easy to navigate. This will make it easier for your employees to learn and use the system.

- Reporting Capabilities: Ensure that the cash register can generate detailed reports, such as sales summaries, cash reconciliation reports, and transaction logs. These reports will help you analyze your cash flow and make informed business decisions.

- Integration with Other Systems: If you use other software or systems for inventory management or accounting, choose a cash register that can integrate seamlessly with these systems. This will help streamline your business processes and reduce manual data entry.

- Durable and Reliable: Invest in a cash register that is built to last and can withstand the demands of your business. Look for features such as a sturdy construction, a spill-resistant keyboard, and a reliable cash drawer mechanism.

Tips for Managing Your Cash Flow

Effective cash flow management is essential for the success of any business. Here are some tips to help you efficiently manage your cash flow:

- Create a Cash Flow Forecast: Develop a cash flow forecast to predict your future cash inflows and outflows. This will help you anticipate any potential cash shortages and plan accordingly.

- Monitor Your Cash Flow Regularly: Review your cash flow statement regularly to identify any trends or patterns. This will help you identify areas where you can improve cash flow and take proactive measures.

- Implement Cash Flow Controls: Establish internal controls to minimize the risk of theft or fraud. This can include segregating cash handling duties, implementing cash reconciliation procedures, and conducting regular audits.

- Negotiate Favorable Payment Terms: When working with suppliers or vendors, try to negotiate favorable payment terms, such as extended payment terms or discounts for early payment. This can help improve your cash flow and build stronger relationships with your suppliers.

- Offer Multiple Payment Options: Provide your customers with various payment options, such as cash, credit cards, or mobile payments. This will make it easier for customers to pay and can help speed up your cash flow.

- Control Your Expenses: Regularly review your expenses and identify areas where you can reduce costs. This will help free up cash for other business needs and improve your overall cash flow.

- Build a Cash Reserve: Set aside a portion of your profits as a cash reserve to cover unexpected expenses or emergencies. This will provide a buffer for your business and help you avoid cash flow issues.

Bottom Line

A closing cash register is a valuable tool for managing your cash flow efficiently. By using a cash register, you can maintain accurate records of your cash transactions, prevent loss and theft, and streamline your business operations.

Remember to choose a cash register that suits your business needs and implement effective cash flow management strategies to ensure the financial stability of your business.

Closing Cash Register Template Excel – Download