A durable financial power of attorney is a legal document that grants someone the authority to make financial decisions on your behalf. This document is typically used in situations where an individual becomes incapacitated or unable to handle their financial affairs due to illness, injury, or other circumstances. By appointing a trusted individual as your agent through a durable power of attorney, you can ensure that your financial matters are managed effectively even if you are unable to do so yourself.

Why is a Durable Financial Power of Attorney Important?

Creating a durable financial power of attorney is an important step in estate planning and ensuring that your financial affairs are in order. Here are several reasons why having this document is crucial:

- Protection in case of incapacity: If you become incapacitated and unable to manage your finances, having a durable power of attorney in place ensures that someone you trust can step in and handle your affairs. This can help prevent financial hardship and ensure that your bills are paid, investments managed, and other financial matters are taken care of.

- Allows for decision-making authority: With a durable financial power of attorney, you can grant your agent the authority to make important financial decisions on your behalf. This can include managing bank accounts, paying bills, filing taxes, and making investment decisions.

- Peace of mind: Knowing that you have a trusted individual designated as your agent can provide peace of mind, knowing that your financial affairs are in capable hands if you ever become incapacitated.

How to Create a Durable Financial Power of Attorney

Creating a durable financial power of attorney is a relatively straightforward process. Here are the steps involved:

- Choose your agent: The first step is to choose someone you trust to act as your agent. This person should be responsible, trustworthy, and capable of managing your financial affairs.

- Discuss your wishes: Sit down with your chosen agent to discuss your wishes and the specific powers you want to grant them. This can include managing bank accounts, paying bills, selling property, and making investment decisions.

- Consult an attorney: It is recommended to consult with an attorney who specializes in estate planning to ensure that your durable financial power of attorney is legally valid and meets all the requirements.

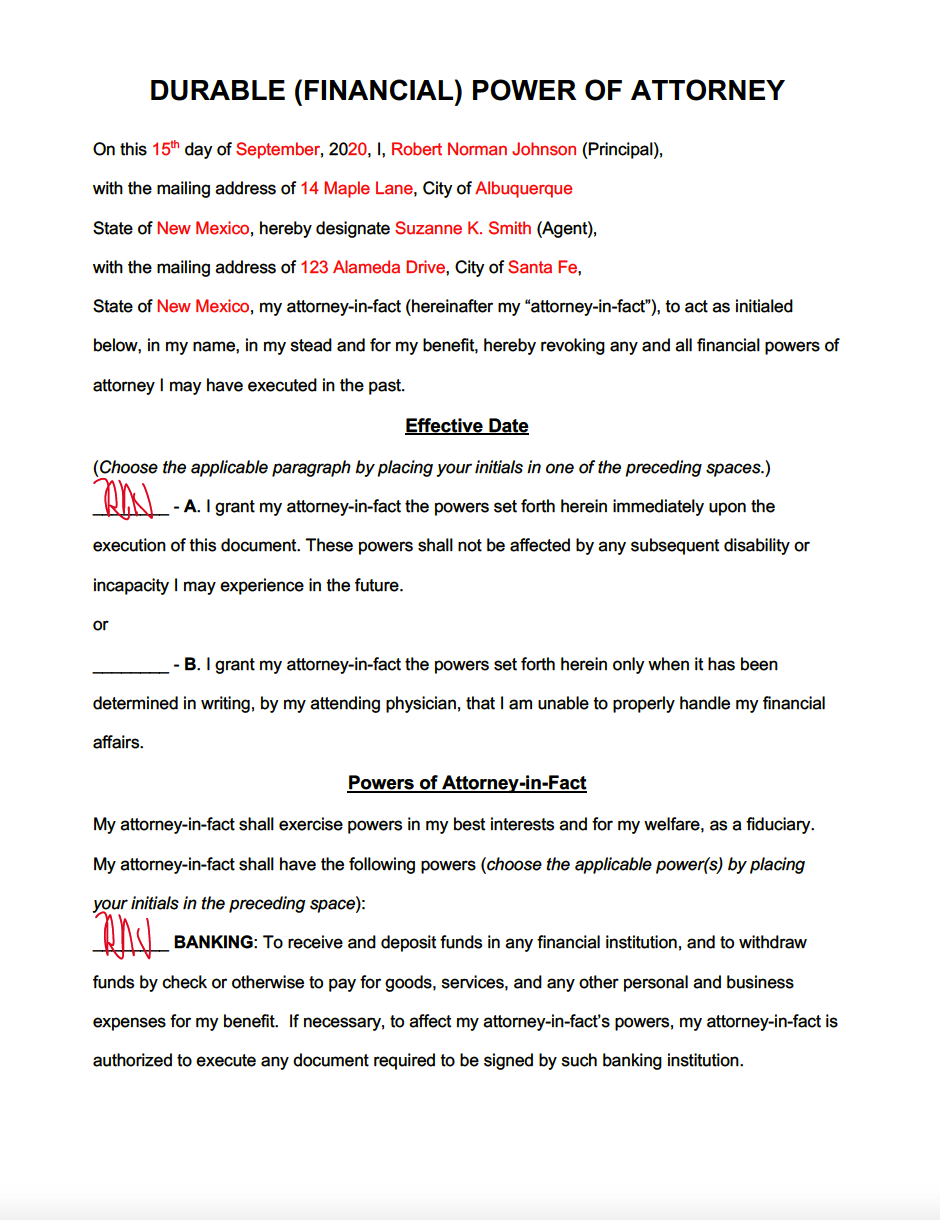

- Draft the document: With the help of your attorney, draft the durable financial power of attorney document. This document should clearly outline the powers granted to your agent and any limitations or restrictions you wish to include.

- Sign and notarize: Sign the document in the presence of a notary public to ensure its validity and enforceability. Notarizing the document adds an extra layer of assurance that it will be honored by financial institutions and other parties.

- Distribute copies: Provide copies of the durable financial power of attorney to your agent, your attorney, and any other relevant parties, such as banks, investment firms, and healthcare providers.

Who Should Have a Durable Financial Power of Attorney?

Creating a durable financial power of attorney is recommended for anyone who wants to ensure that their financial affairs are managed properly in case of incapacity. This includes:

- Individuals with chronic illnesses or medical conditions

- Seniors who may be at a higher risk of becoming incapacitated

- Individuals planning for the future and wanting to have their affairs in order

- Parents who want to appoint someone to manage their finances in case of emergency or incapacity

Where to Find a Durable Financial Power of Attorney Form

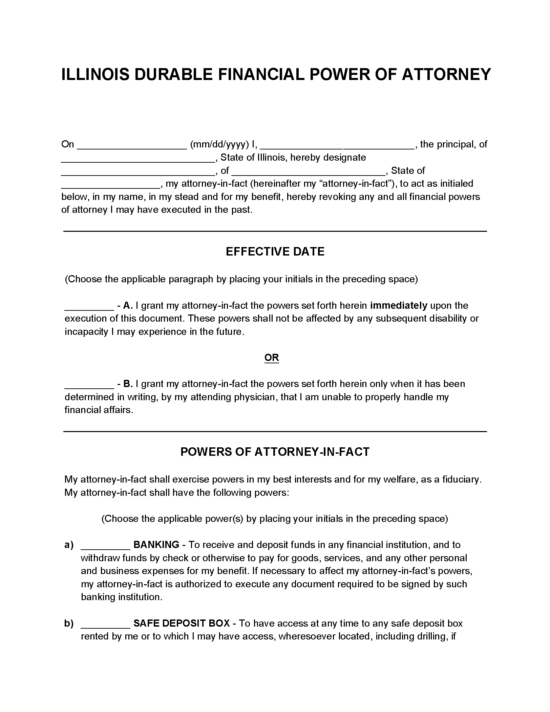

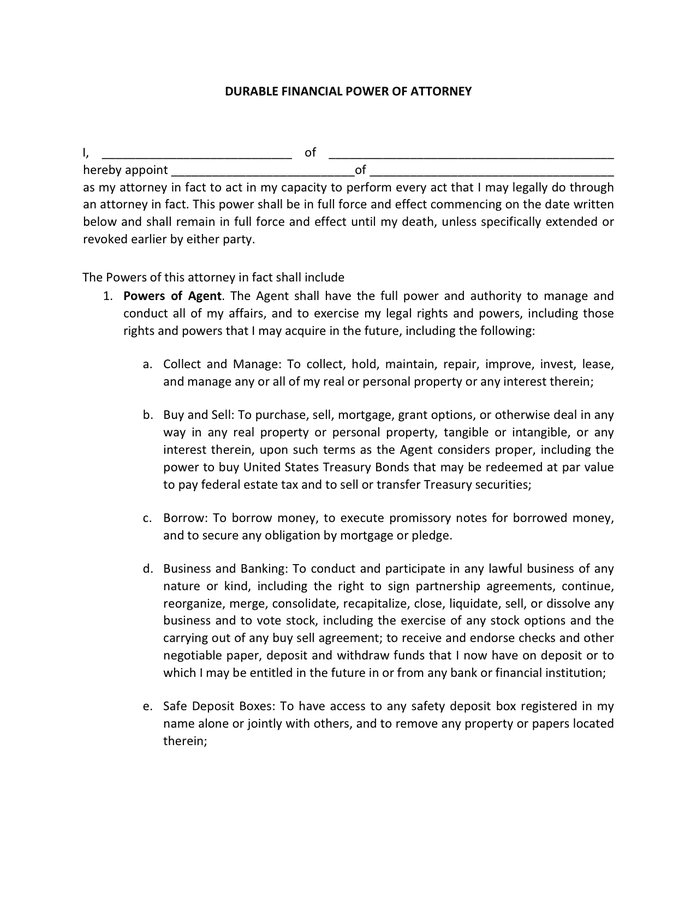

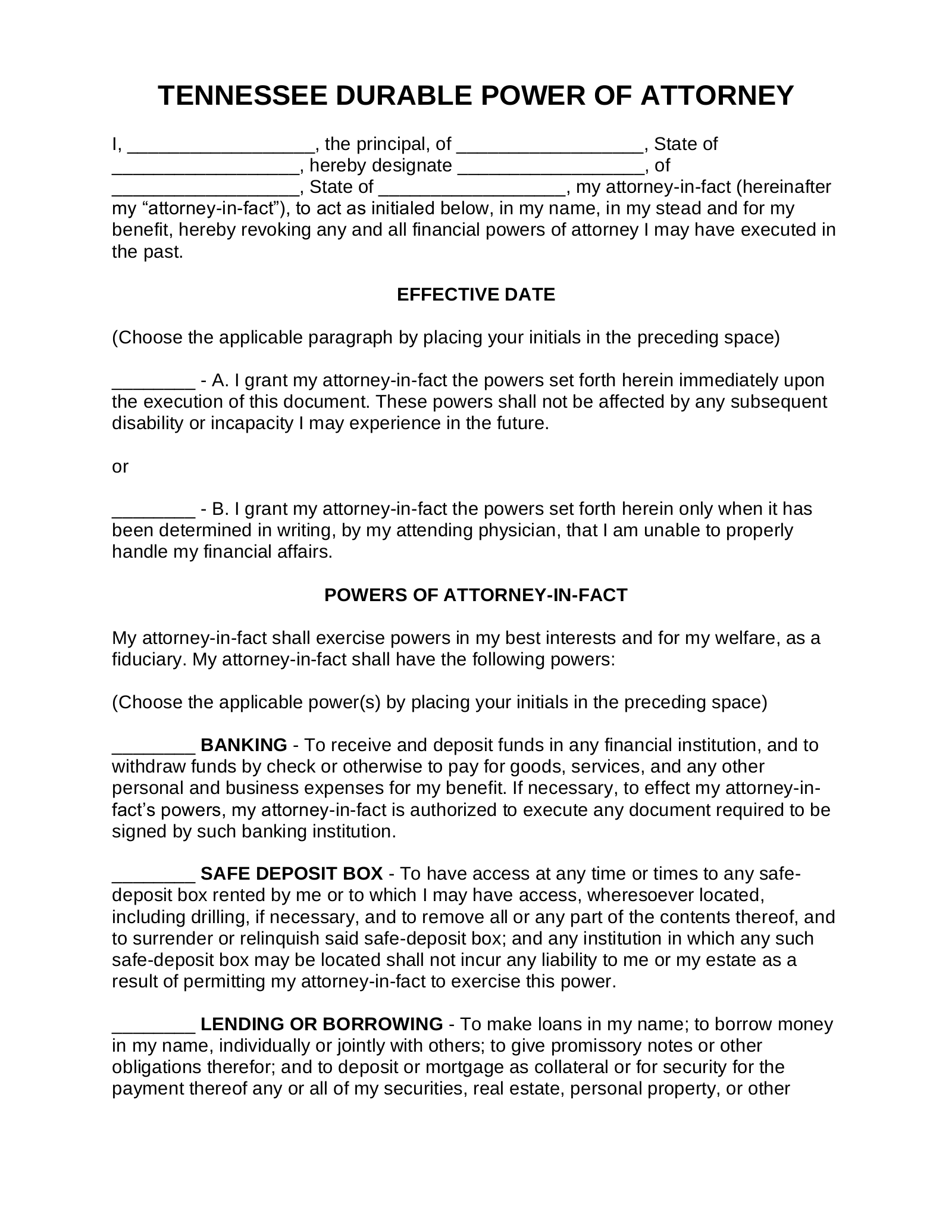

There are several resources available online where you can find durable financial power of attorney forms. It is important to ensure that the form you choose complies with the laws of your state and meets all the necessary legal requirements. Here are some reputable sources where you can find durable financial power of attorney forms:

- State government websites: Many state government websites provide free durable power of attorney forms that comply with state laws.

- Legal document services: Online legal document services often offer durable financial power of attorney forms that can be customized to meet your specific needs.

- Attorneys: Consulting with an attorney who specializes in estate planning is always recommended, as they can provide you with a customized durable financial power of attorney form that complies with state laws.

Benefits of Having a Durable Financial Power of Attorney

A durable financial power of attorney offers numerous benefits for individuals and their families. Here are the top 5 benefits:

- Financial protection: A durable power of attorney ensures that your financial affairs are managed properly, even if you are unable to do so yourself.

- Decision-making authority: By appointing an agent, you can grant them the authority to make important financial decisions on your behalf.

- Peace of mind: Knowing that you have a trusted individual designated to handle your finances can provide peace of mind.

- Prevents financial hardship: A durable power of attorney helps prevent financial hardship by ensuring that bills are paid, investments are managed, and other financial matters are taken care of.

- Estate planning: Creating a durable power of attorney is an essential part of estate planning, ensuring that your wishes are carried out and your assets are protected.

Conclusion

Creating a durable financial power of attorney is an important step in estate planning and ensuring that your financial affairs are properly managed. By appointing a trusted individual as your agent, you can have peace of mind knowing that your finances will be taken care of if you become incapacitated. Take the time to discuss your wishes with your chosen agent, consult with an attorney, and create a legally valid and enforceable document that meets all the requirements. By doing so, you can protect yourself, your assets, and your loved ones.

Durable Financial Power of Attorney Form – Download