As businesses continue to evolve and adapt to the digital age, traditional methods of payment are being replaced by more efficient and streamlined processes. One such method is the use of printable check vouchers, which offer a convenient and secure solution for businesses to manage their financial transactions.

In this article, we will explore the benefits of printable check vouchers, how they work, and why businesses should consider utilizing them.

What are Check Vouchers?

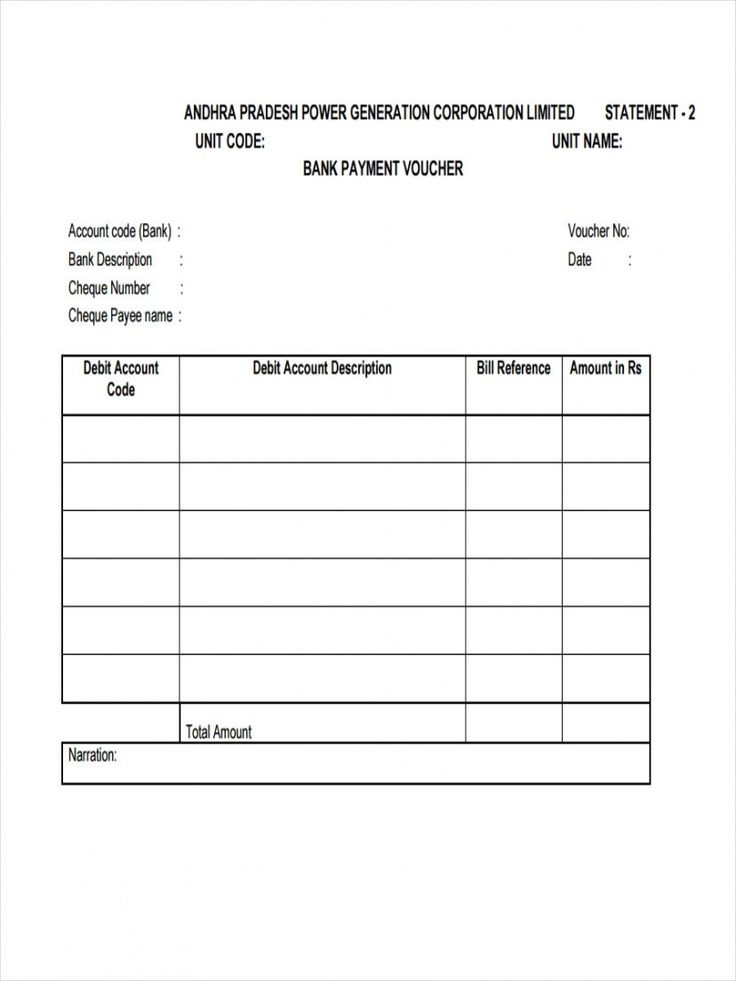

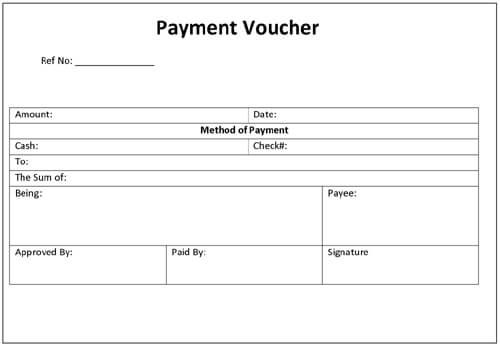

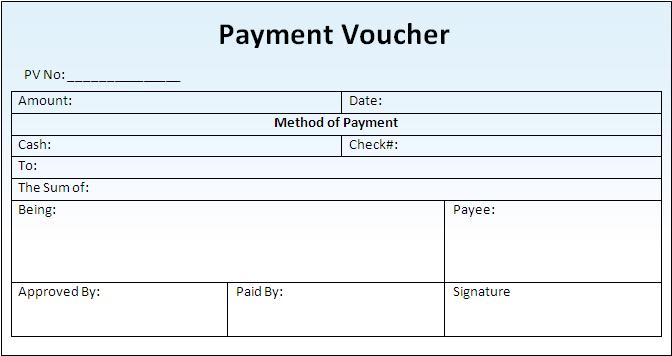

Printable check vouchers are essentially digital versions of traditional paper checks. They are designed to be printed on regular printer paper and can be used to make payments to vendors, employees, or any other recipients. These vouchers contain all the necessary information typically found on a paper check, including the amount, payee, and issuer’s details.

Businesses can create printable check vouchers using specialized software or online platforms that offer customizable templates. Once created, these vouchers can be printed and used just like a regular check. They provide a convenient alternative to traditional paper checks, eliminating the need for physical checkbooks and reducing the risk of manual errors.

How Do Check Vouchers Work?

Creating and using printable check vouchers is a straightforward process. Here’s a step-by-step guide:

- Create a template: Use software or an online platform to create a customized printable check voucher template. Include your business logo, contact information, and any other relevant details.

- Fill in the details: Enter the recipient’s name, payment amount, and any other required information into the template.

- Print the voucher: Once all the details are filled in, print the voucher on regular printer paper.

- Sign the voucher: Sign the voucher using a pen to make it valid.

- Distribute the voucher: Give the printed voucher to the recipient or send it electronically if applicable.

- Record the transaction: Keep a record of the voucher and the associated transaction in your accounting system for future reference.

Using printable check vouchers simplifies the payment process and reduces the time and effort required to issue payments. It also provides a digital record of the transaction, making it easier to track and reconcile payments.

Why Should Businesses Use Check Vouchers?

There are several compelling reasons why businesses should consider using printable check vouchers:

- Convenience: Printable check vouchers offer a convenient solution for businesses to make payments without the need for physical checks. They can be created and printed on-demand, saving time and reducing the risk of running out of pre-printed checks.

- Cost savings: By eliminating the need for pre-printed checks, businesses can save money on check printing costs. Printable check vouchers can be printed on regular printer paper, which is significantly cheaper than purchasing pre-printed check stock.

- Security: Printable check vouchers can incorporate security features such as watermarks and unique serial numbers to prevent fraud. They also reduce the risk of check tampering or loss during mail delivery.

- Accuracy: With printable check vouchers, businesses can ensure accuracy in payment details. The templates can be pre-filled with commonly used information, reducing the chances of manual errors.

- Efficiency: The process of creating and issuing printable check vouchers is quick and efficient. It eliminates the need for manual check writing and reduces administrative tasks associated with traditional paper checks.

Overall, printable check vouchers offer businesses a flexible and efficient solution for managing their payment processes.

When Should Businesses Use Check Vouchers?

Printable check vouchers can be used in various scenarios, depending on the specific needs of the business. Here are some situations where businesses can benefit from using printable check vouchers:

- Vendor payments: Businesses can use printable check vouchers to make payments to vendors for goods or services rendered. The vouchers provide a clear record of the transaction and facilitate efficient payment processing.

- Employee reimbursements: Printable check vouchers can be used to reimburse employees for business-related expenses. They allow businesses to track and record reimbursements accurately.

- Contractor payments: Businesses that work with contractors or freelancers can use printable check vouchers to issue payments for services rendered. The vouchers provide a secure and professional way to handle contractor payments.

- Supplier payments: When making payments to suppliers, printable check vouchers can serve as a reliable method for ensuring timely and accurate payments.

Ultimately, the decision to use printable check vouchers will depend on the specific requirements and preferences of the business. However, they offer a versatile solution that can be adapted to various payment scenarios.

How to Create Check Vouchers

To create printable check vouchers, businesses can follow these steps:

- Select a software or online platform: Choose a software or online platform that offers customizable check voucher templates. There are various options available, ranging from simple software programs to comprehensive accounting systems.

- Customize the template: Customize the template with your business logo, contact information, and any other relevant details. Some platforms allow for further customization, such as adding watermarks or security features.

- Enter payment details: Enter the payment details, including the recipient’s name, payment amount, and any other required information.

- Preview and print: Preview the check voucher to ensure all the details are correct. Once verified, print the voucher on regular printer paper.

- Sign the voucher: Sign the voucher using a pen to make it valid.

By following these steps, businesses can create professional and customized printable check vouchers that meet their specific needs.

Summary

Printable check vouchers offer businesses a convenient and efficient solution for managing their payment processes. They eliminate the need for physical checks, reduce costs, and provide a secure and customizable payment method. By leveraging printable check vouchers, businesses can streamline their financial operations and ensure accuracy in their payment transactions.

Check Voucher Template – Excel