Managing your finances can be a daunting task, but implementing a bi-weekly budget can help you align your spending and saving with your every two-week paycheck. This method provides a more accurate financial picture than a monthly budget, preventing cash flow gaps and helping you manage irregular expenses by spreading costs.

Additionally, it allows you to leverage those extra paychecks each year for debt or savings goals, giving you better control over your finances. By linking specific expenses to specific paydays, a bi-weekly budget reduces financial stress and makes it easier to meet obligations and save consistently.

What is a Bi-Weekly Budget?

A bi-weekly budget is a financial planning tool that aligns your spending and saving with your bi-weekly paychecks, instead of budgeting monthly, where income and expenses may not always align.

A bi-weekly budget breaks down your financial responsibilities into two-week increments. This method enables you to allocate your funds more effectively, ensuring you have sufficient funds to cover expenses throughout the entire month.

Why Use a Bi-Weekly Budget?

There are several benefits to using a bi-weekly budget to manage your finances:

- Accurate Financial Picture. By budgeting every two weeks, you can see exactly how much money you have coming in and going out, providing a clearer understanding of your financial situation.

- Preventing Cash Flow Gaps. With a bi-weekly budget, you can ensure that you have enough money to cover expenses between paychecks, reducing the risk of running out of funds.

- Managing Irregular Expenses. By spreading costs over two weeks, you can better plan for irregular expenses such as semi-annual bills or unexpected emergencies.

- Leveraging Extra Paychecks. Since there are usually two extra paychecks in a year for bi-weekly earners, you can use this additional income for debt repayment or savings goals.

- Reducing Financial Stress. By linking expenses to specific paydays, a bi-weekly budget can help you feel more in control of your finances, reducing stress and anxiety about money.

- Meeting Obligations. A bi-weekly budget makes it easier to meet financial obligations consistently, ensuring that you have enough money set aside for bills, savings, and other expenses.

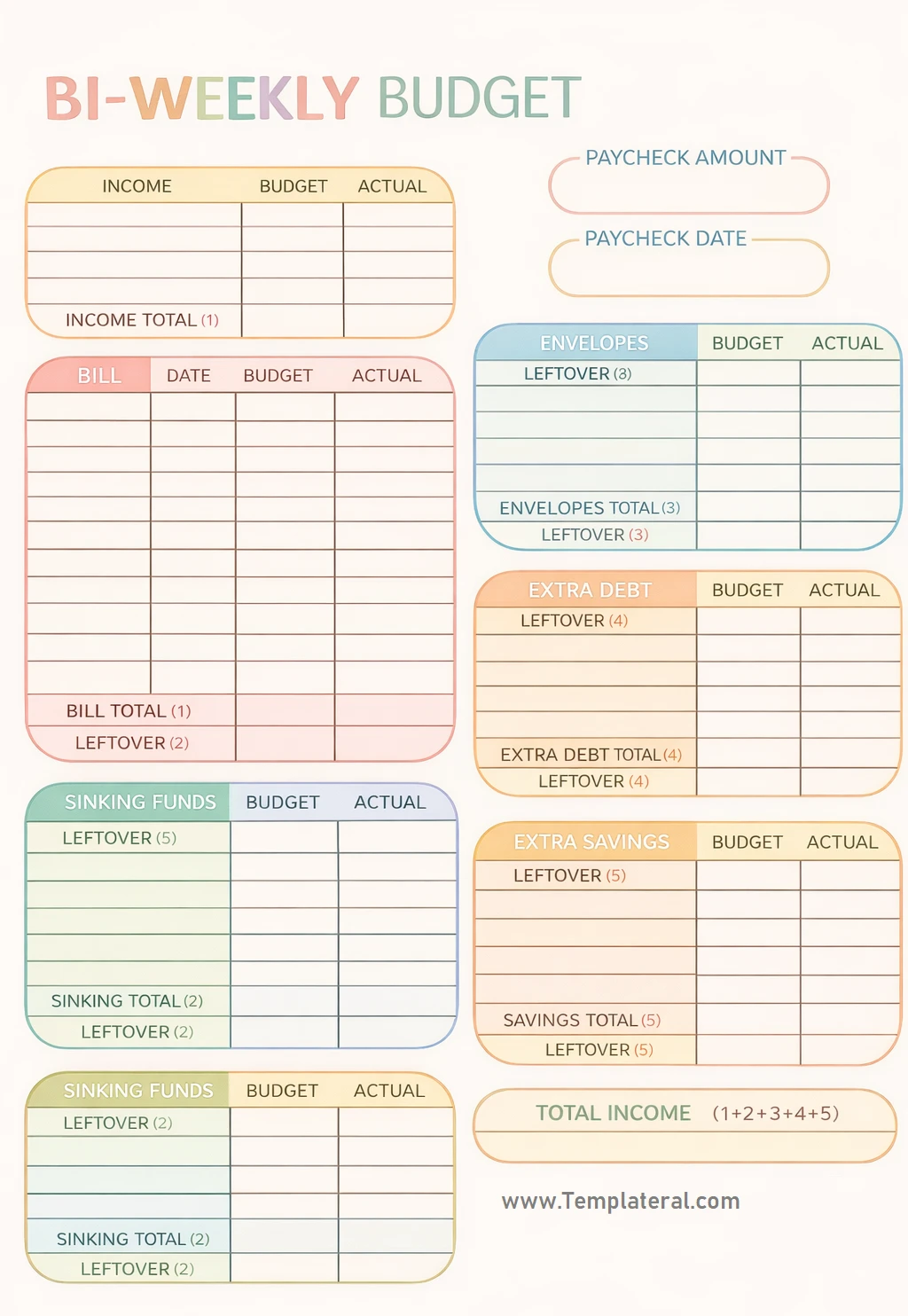

What to Include in a Bi-Weekly Budget

When creating a bi-weekly budget, there are several key elements to include:

- Income. List all sources of income, including your bi-weekly paychecks and any additional income such as bonuses or side gigs.

- Expenses. Break down your expenses into categories such as housing, transportation, groceries, utilities, debt payments, savings, and discretionary spending.

- Savings Goals. Identify specific savings goals such as an emergency fund, retirement savings, or a down payment for a house.

- Debt Repayment. Include any debt repayment obligations such as credit card payments, student loans, or personal loans.

- Irregular Expenses. Factor in irregular expenses that may not occur monthly, such as car maintenance, medical bills, or annual subscriptions.

- Emergency Fund. Allocate a portion of your income to an emergency fund to cover unexpected expenses or financial emergencies.

How to Create a Bi-Weekly Budget

Creating a bi-weekly budget is a straightforward process that involves the following steps:

1. Calculate Your Income

Determine your total income for each pay period, including any additional sources of income.

2. List Your Expenses

Make a detailed list of all your expenses, categorizing them into fixed expenses (e.g., rent, utilities) and variable expenses (e.g., groceries, entertainment).

3. Set Savings Goals

Establish specific savings goals and allocate a portion of your income towards achieving them.

4. Allocate Funds for Debt Repayment

If you have any outstanding debts, prioritize debt repayment by setting aside a portion of your income for this purpose.

5. Factor in Irregular Expenses

Account for irregular expenses by setting aside a portion of your income each pay period to cover these costs when they arise.

6. Build an Emergency Fund

Allocate a portion of your income to an emergency fund to provide a financial safety net in case of unexpected expenses.

7. Review and Adjust Regularly

Regularly review your bi-weekly budget to track your progress towards your financial goals and make adjustments as needed.

8. Use Tools and Apps

Utilize budgeting tools and apps to help you track your income, expenses, and savings goals more effectively.

9. Stay Disciplined

Stick to your bi-weekly budget by staying disciplined and avoiding unnecessary expenses that may derail your financial progress.

10. Seek Professional Help

If you’re struggling to manage your finances, consider seeking the help of a financial advisor or counselor to provide guidance and support.

Tips for Mastering Your Bi-Weekly Budget

Here are some additional tips to help you make the most of your bi-weekly budget:

- Automate Your Savings. Set up automatic transfers to your savings account to ensure you consistently save a portion of your income.

- Avoid Lifestyle Inflation. Resist the temptation to increase your spending whenever you receive a raise or bonus, and instead prioritize saving and debt repayment.

- Track Your Expenses. Keep a record of your expenses to identify areas where you can cut back and save more money.

- Plan for the Unexpected. Build flexibility into your budget to accommodate unexpected expenses or changes in your financial situation.

- Celebrate Milestones. Recognize and celebrate your financial milestones, whether it’s paying off debt, reaching a savings goal, or sticking to your budget consistently.

- Stay Motivated. Stay motivated by reminding yourself of your financial goals and the benefits of sticking to your budget in the long run.

- Review and Reflect. Regularly review your budget and reflect on your progress to identify areas for improvement and celebrate your successes.

By implementing a bi-weekly budget and following these tips, you can take control of your finances, reduce stress, and work towards achieving your financial goals with confidence.

Bi-weekly Budget Template – DOWNLOAD