When purchasing property or a business, traditional bank financing may not always be an option for every buyer. This is where seller financing agreements come into play, allowing the property seller to act as the lender and create an alternative financing option for the buyer.

This arrangement benefits both parties, providing the buyer with the opportunity to purchase the property or business they desire and the seller with potential advantages such as a wider buyer pool, a steady income stream, and possibly a higher sale price. In this article, we will explore the What, Why, What to Include, How to, and Tips for Successful Seller Financing Agreements in Real Estate Transactions.

What is a Seller Financing Agreement?

A seller financing agreement, also known as owner financing or seller carryback, is a real estate transaction in which the seller agrees to finance a portion of the purchase price for the buyer. In this arrangement, the buyer makes regular payments to the seller, typically with interest, until the full purchase price is paid off.

This allows buyers who may not qualify for a traditional bank loan to still purchase the property or business they desire.

Why Consider Seller Financing?

There are several reasons why both buyers and sellers may consider seller financing agreements in a real estate transaction. For buyers, seller financing can provide an alternative to traditional bank loans, especially for those who may have difficulty obtaining financing due to poor credit history or a lack of a substantial down payment. Seller financing can also offer flexibility in terms of payment schedules and interest rates, making it a more attractive option for some buyers.

For sellers, offering financing to buyers can help attract a wider pool of potential buyers who may not qualify for traditional bank loans. This can lead to a faster sale of the property or business and possibly a higher sale price. Additionally, sellers can benefit from a steady income stream in the form of monthly payments from the buyer, which can provide a source of passive income.

Enhanced Buying Power for Buyers

Buyers who may not have access to traditional financing options can benefit from seller financing by increasing their buying power. By offering flexible terms and conditions, sellers can help buyers overcome obstacles such as credit issues or limited funds for a down payment, allowing them to purchase a property they may not otherwise be able to afford.

Increased Marketability for Sellers

Sellers can improve the marketability of their property or business by offering seller financing. By providing an alternative financing option, sellers can attract a larger pool of potential buyers who may be interested in the property but are unable to secure traditional financing. This can result in a quicker sale and potentially a higher sale price for the seller.

Long-Term Income for Sellers

By acting as the lender in a seller financing agreement, sellers can create a long-term income stream. Instead of receiving a lump sum payment at the time of sale, sellers can collect monthly payments from the buyer, which can provide a steady source of income over time. This can be especially beneficial for sellers looking to supplement their retirement income or diversify their investment portfolio.

Flexibility in Negotiation

One of the key benefits of seller financing is the flexibility it offers in negotiation. Buyers and sellers can work together to establish the terms of the financing agreement, including the down payment amount, interest rate, and repayment schedule. This flexibility allows both parties to tailor the agreement to meet their individual needs and preferences.

Protection in a Volatile Market

In a volatile real estate market, seller financing can provide an added layer of protection for both buyers and sellers. By structuring the financing agreement with specific terms and conditions, both parties can mitigate risks and uncertainties associated with market fluctuations. Seller financing can offer stability and security in an unpredictable market environment.

What to Include in a Seller Financing Agreement?

When entering into a seller financing agreement, it is important to include specific terms and conditions to protect both parties involved. Some key elements to include in a seller financing agreement are:

Total Purchase Price

The seller financing agreement should clearly state the total purchase price of the property or business. This figure will include the amount financed by the seller, as well as any down payment provided by the buyer. Establishing the total purchase price upfront avoids confusion and ensures that both parties are in agreement on the value of the transaction.

Down Payment Requirements

Specify the amount of the down payment required from the buyer in the seller financing agreement. The down payment serves as a form of security for the seller and demonstrates the buyer’s commitment to the transaction. By outlining the down payment requirements in the agreement, both parties can establish clear expectations from the outset.

Interest Rate Terms

Determine the interest rate that will be applied to the seller financing portion of the purchase price. The interest rate should be competitive and reflective of current market conditions. By outlining the interest rate terms in the agreement, both parties can avoid misunderstandings and ensure that the financing arrangement is fair and equitable.

Payment Schedule Specifications

Define the frequency and amount of payments to be made by the buyer to the seller in the seller financing agreement. The payment schedule should outline when payments are due, how they will be made, and any penalties for late payments. By specifying the payment schedule upfront, both parties can stay organized and avoid potential conflicts over payment terms.

Default Provisions

Establish the consequences if the buyer fails to make payments or breaches the agreement in the seller financing agreement. Include provisions for default, such as late fees, interest rate adjustments, or even repossession of the property. By addressing default provisions in the agreement, both parties can protect their interests and have a plan in place for addressing potential issues.

Security Agreement Considerations

Consider including a security agreement in the seller financing agreement to protect the seller’s interests in case of default. A security agreement may involve collateralizing the property or business being purchased to provide additional security for the seller. By including a security agreement, sellers can mitigate risks and ensure that they have recourse in the event of non-payment by the buyer.

How to Set Up a Seller Financing Agreement?

Setting up a seller financing agreement involves several steps to ensure a smooth transaction for both parties. Here are some key steps to follow:

Negotiate Terms Collaboratively

Discuss and negotiate the terms of the seller financing agreement collaboratively with the buyer. Consider factors such as the purchase price, down payment amount, interest rate, and payment schedule. By working together to establish the terms of the agreement, both parties can reach a mutually beneficial arrangement.

Seek Legal Assistance

Work with a real estate attorney to draft a legally binding seller financing agreement that includes all the necessary terms and conditions. The attorney can ensure that the agreement complies with local laws and regulations and protects the interests of both parties. By seeking legal assistance, both buyers and sellers can have confidence in the validity of the agreement.

Close the Deal Officially

Sign the seller financing agreement and any related documents at the closing of the real estate transaction. Ensure that both parties fully understand their obligations under the agreement and are in agreement on the terms. By officially closing the deal, buyers and sellers can formalize their commitment to the transaction.

Initiate Regular Payments

The buyer will make regular payments to the seller according to the agreed-upon payment schedule. Ensure that payments are made on time and in full to

Ensure that the buyer is aware of the payment schedule and understands the consequences of missing payments. Sellers should keep accurate records of payments received and communicate regularly with the buyer to address any concerns or issues that may arise.

Monitor Compliance

Both parties should monitor the seller financing agreement to ensure that payments are made on time and in accordance with the terms of the agreement. Sellers should keep detailed records of payments received, including the amount, date, and any late fees incurred. By monitoring compliance, sellers can address any issues promptly and maintain the integrity of the agreement.

Transfer Ownership

Once the buyer has paid off the full purchase price, the seller will transfer ownership of the property or business to the buyer. This may involve signing a deed or other legal documents to officially transfer ownership. Ensure that all necessary paperwork is completed and filed properly to finalize the sale.

Consider Third-Party Servicing

Sellers may choose to enlist the services of a third-party servicing company to handle the collection of payments and administration of the seller financing agreement. A servicing company can help ensure that payments are processed correctly, track payment histories, and provide assistance with any issues that may arise during the term of the agreement.

Review and Update Agreement

Periodically review the seller financing agreement to ensure that it remains current and reflects the intentions of both parties. If circumstances change or new terms need to be added, consider updating the agreement with the help of a real estate attorney. By keeping the agreement up to date, both buyers and sellers can avoid misunderstandings and potential conflicts.

Tips for Successful Seller Financing Agreements

Here are some tips to help ensure a successful seller financing agreement:

Perform Due Diligence Thoroughly

Before entering into a seller financing agreement, perform thorough due diligence on the buyer to assess their creditworthiness and ability to make payments. Request financial documentation, such as bank statements and credit reports, to verify the buyer’s financial stability. By conducting due diligence, sellers can minimize the risk of non-payment and default.

Consult with Professionals

Work with a real estate attorney, accountant, or financial advisor to ensure that the seller financing agreement is structured properly and complies with legal requirements. These professionals can provide guidance on drafting the agreement, calculating interest rates, and addressing any tax implications. By seeking professional advice, sellers can navigate the complexities of seller financing with confidence.

Communicate Clearly and Consistently

Clearly communicate the terms and conditions of the seller financing agreement to the buyer to avoid misunderstandings or disputes later on. Provide written documentation of the agreement and review it with the buyer to ensure mutual understanding. Maintain open lines of communication throughout the term of the agreement to address any questions or concerns promptly.

Stay Flexible in Negotiations

Be open to negotiating terms with the buyer to reach a mutually beneficial agreement. Consider factors such as the down payment amount, interest rate, and payment schedule to find a balance that works for both parties. By staying flexible in negotiations, sellers can increase the likelihood of reaching a successful agreement that meets the needs of both parties.

Monitor Payments Regularly

Keep track of payments and monitor the buyer’s compliance with the agreement. Document all payments received, including the amount, date, and any applicable late fees. If any issues arise, address them promptly and seek a resolution to ensure that the agreement remains on track. By monitoring payments regularly, sellers can maintain the integrity of the agreement and address any issues proactively.

Seek Legal Assistance for Disputes

If any issues arise during the seller financing agreement, seek legal advice to protect your interests and resolve disputes. A real estate attorney can provide guidance on interpreting the terms of the agreement, enforcing payment obligations, and resolving conflicts between the buyer and seller. By seeking legal assistance, sellers can ensure that their rights are protected and that any disputes are handled effectively.

Build a Strong Relationship with the Buyer

Developing a strong relationship with the buyer can help foster trust and cooperation throughout the term of the seller financing agreement. Maintain open communication, respond to inquiries promptly, and address any concerns the buyer may have. By building a positive relationship, sellers can enhance the overall experience for both parties and increase the likelihood of a successful transaction.

Consider Refinancing Options

As the buyer’s financial situation improves, consider offering them the option to refinance the seller financing agreement with a traditional bank loan. Refinancing can help the buyer secure a lower interest rate, reduce monthly payments, or pay off the remaining balance sooner. By exploring refinancing options, sellers can provide flexibility for the buyer and potentially accelerate the payoff of the financing agreement.

Stay Informed on Market Trends

Monitor market trends and conditions that may impact the seller financing agreement. Stay informed about changes in interest rates, property values, and lending practices that could affect the terms of the agreement. By staying up to date on market trends, sellers can make informed decisions about the financing arrangement and adapt as needed to maximize the benefits of seller financing.

Evaluate Tax Implications

Consider the tax implications of a seller financing agreement for both buyers and sellers. Consult with a tax professional to understand how payments, interest income, and other financial aspects of the agreement may affect your tax liability. By evaluating tax implications in advance, both parties can plan accordingly and minimize any potential tax consequences associated with the seller financing arrangement.

Plan for the Future

Look ahead to the future and consider how the seller financing agreement fits into your long-term goals. Whether you are a buyer looking to build equity in a property or a seller seeking passive income, consider how the agreement aligns with your financial objectives. By planning for the future, both parties can make informed decisions that support their financial well-being and long-term success.

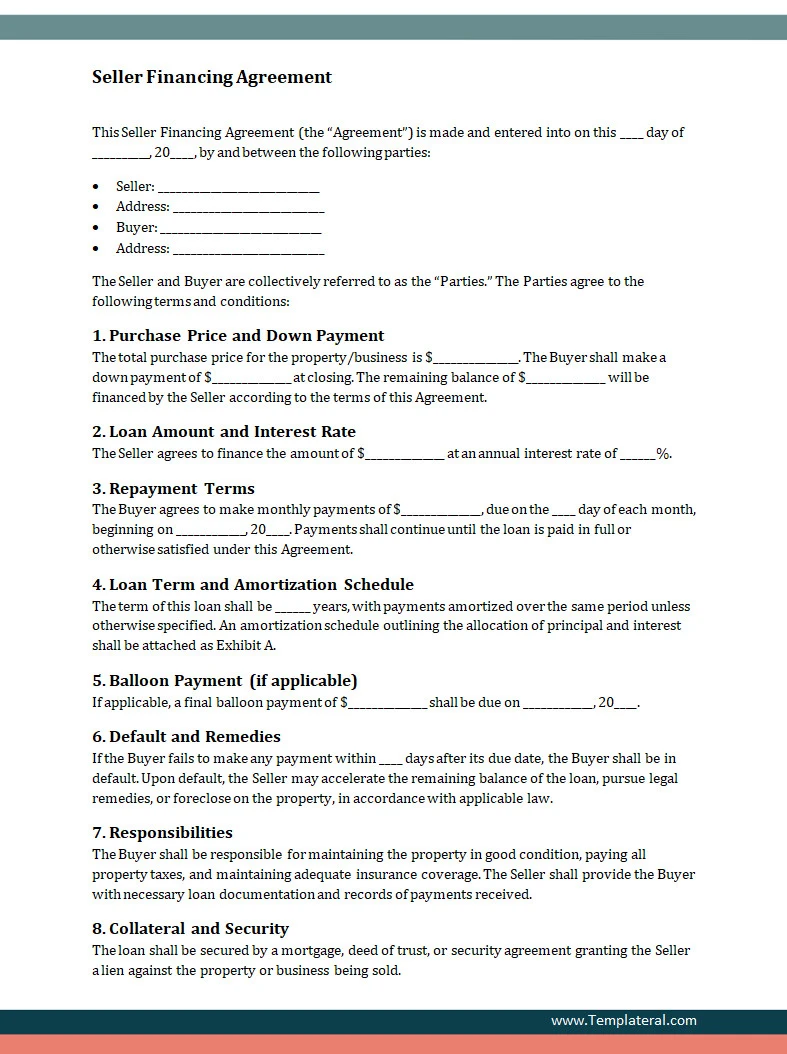

Seller Financing Agreement Template

A Seller Financing Agreement helps buyers and sellers outline clear terms when the seller provides financing instead of a traditional lender. It defines payment schedules, interest rates, responsibilities, and remedies, ensuring both parties are protected and fully aligned. With a well-structured agreement, the transaction becomes smoother, more flexible, and easier to manage from start to finish.

Download the Seller Financing Agreement Template today to create a clear, reliable document for your real estate transaction.

Seller Financing Agreement Template – DOWNLOAD