What Is A Payment Plan?

A payment plan is a structured arrangement that allows individuals and businesses to divide a larger debt or purchase into more manageable installments. This method enables debtors to pay off their financial obligations over time, rather than in one lump sum.

Payment plans are commonly used in various financial scenarios, such as paying off credit card debt, medical bills, student loans, or financing a big-ticket purchase like a car or home appliance.

Why You Should Offer A Payment Plan To Your Customers?

Boost Sales and Increase Revenue

Offering payment plans to customers can significantly boost sales and increase revenue for businesses. By providing customers with the option to pay in installments, businesses can attract a broader customer base who may not have the immediate financial means to make a full purchase upfront. This accessibility can lead to higher sales volumes and improved cash flow for businesses, ultimately driving growth and profitability.

Enhance Customer Satisfaction

Providing payment plans to customers can enhance overall customer satisfaction and loyalty. Customers appreciate the flexibility and convenience of being able to spread out payments over time, making larger purchases more accessible and manageable. By offering payment plans, businesses demonstrate a commitment to meeting their customers’ needs and building positive relationships, which can result in repeat business and referrals.

Competitive Advantage

In today’s competitive market, offering payment plans can give businesses a competitive edge by differentiating themselves from competitors. Customers are more likely to choose a business that provides flexible payment options, as it gives them greater control over their finances and purchasing decisions. By incorporating payment plans into their offerings, businesses can stand out in the market and attract customers who value financial flexibility and convenience.

Improve Cash Flow

Payment plans can also help businesses improve their cash flow by generating consistent revenue over time. Rather than relying on sporadic one-time purchases, businesses with payment plans in place can forecast their cash inflows more accurately and plan their expenses accordingly. This steady stream of income can provide stability and financial security for businesses, especially during economic downturns or seasonal fluctuations.

Reduce Financial Risk

By offering payment plans, businesses can mitigate financial risk and exposure to non-payment from customers. Payment plans allow businesses to secure a portion of the total sale upfront and receive the remaining payments over time, reducing the impact of potential defaults or delinquencies. This risk mitigation strategy can safeguard businesses against cash flow disruptions and minimize losses associated with unpaid invoices or debts.

Who Can Enter Into A Payment Plan?

Individuals Facing Financial Hardship

Individuals who are facing financial hardship or struggling to make ends meet may benefit from entering into a payment plan to manage their debts effectively. Whether dealing with credit card debt, medical bills, or personal loans, a payment plan can provide relief by allowing them to pay off their debts gradually and avoid more severe financial consequences.

Businesses Seeking to Improve Cash Flow

Businesses that are looking to improve their cash flow and increase sales can enter into payment plans with their customers to facilitate larger purchases and recurring revenue streams. By offering payment plans for products or services, businesses can attract more customers, retain existing ones, and build long-term relationships that lead to sustained growth and profitability.

Debtors Willing to Commit to Repayment

Individuals and businesses entering into payment plans must be willing to commit to the repayment terms outlined in the agreement. By making regular payments and adhering to the agreed-upon schedule, debtors demonstrate their intention to fulfill their financial obligations and work towards becoming debt-free. This commitment is essential for the success of the payment plan and the debtor’s financial well-being.

Creditors and Sellers Offering Flexibility

Creditors and sellers who are open to providing flexible payment options to debtors can benefit from entering into payment plans. By accommodating the diverse financial situations of their customers or clients, creditors and sellers can increase their chances of securing payments, reducing the likelihood of defaults or delinquencies, and fostering trust and loyalty among their customer base.

Collaborative Approach to Financial Management

Entering into a payment plan requires a collaborative approach to financial management between debtors and creditors. By working together to establish fair and reasonable terms, both parties can achieve their financial objectives and maintain a positive relationship built on trust, transparency, and mutual respect. Effective communication and cooperation are essential for the successful implementation of a payment plan.

What To Do Before Setting Up A Payment Plan?

Assess Your Financial Situation

Before setting up a payment plan, it’s crucial to assess your financial situation thoroughly. Take stock of your income, expenses, debts, and savings to determine how much you can afford to allocate towards payments each month. Understanding your financial capabilities will help you create a realistic budget and avoid overextending yourself with unmanageable payment obligations.

Communicate with Creditors

Open and honest communication with creditors or sellers is essential when setting up a payment plan. Clearly explain your financial challenges and limitations, and discuss potential payment arrangements that work for both parties. Creditors may be willing to negotiate terms, such as reducing interest rates, waiving fees, or extending the repayment period, to help you meet your financial obligations more effectively.

Read the Agreement Carefully

Before finalizing a payment plan, carefully review the terms and conditions outlined in the agreement. Pay close attention to details such as the total amount owed, the repayment schedule, any interest rates or fees, and consequences for missed payments. Make sure you understand all aspects of the agreement and seek clarification on any unclear terms before signing to avoid misunderstandings or disputes in the future.

Stick to Your Budget

Once you have set up a payment plan, it’s essential to stick to your budget and make timely payments as agreed. Monitor your expenses, adjust your budget as needed, and prioritize your payment obligations to ensure you can meet your financial commitments without falling behind. Staying disciplined with your finances will help you stay on track with the payment plan and work towards becoming debt-free.

Monitor Your Progress

Regularly monitor your progress towards paying off your debt through the payment plan. Keep track of your payments, review your remaining balance, and periodically assess your financial situation to ensure steady progress toward your goal. If necessary, adjust your budget, seek additional income opportunities, or explore debt management strategies to accelerate your debt repayment and achieve financial freedom sooner.

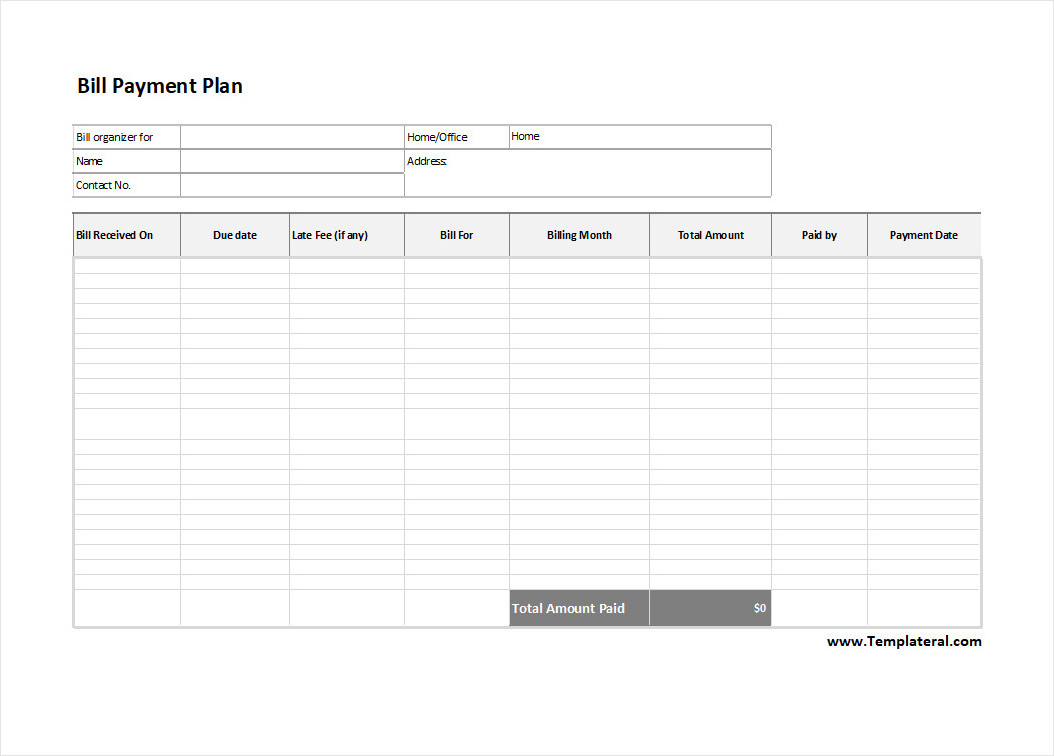

Payment Plan Template

A payment plan is a practical tool for outlining how a debt or purchase will be repaid over a specified period. It clearly defines payment amounts, due dates, and terms, helping both parties stay organized and avoid misunderstandings.

To make repayment simple and structured, use our free payment plan template and set clear terms with confidence!

Payment Plan Template – Excel