As a business owner, you may be familiar with the concept of receipts. These small slips of paper serve as proof of purchase and are essential for tracking expenses and financial records. However, when it comes to non-profit organizations, the receipt process can be a bit different.

In this article, we will explore the world of non-profit organization receipts and how they can benefit both the organization and the business owner.

What is a Non-Profit Organization Receipt?

A non-profit organization receipt is a document provided by a non-profit organization to a donor or sponsor who makes a financial contribution. This receipt serves as proof of the donation and allows the donor to claim a tax deduction, as well as helps the non-profit organization keep track of their finances and maintain transparency.

Unlike regular receipts, non-profit organization receipts have specific requirements and guidelines set by the Internal Revenue Service (IRS). These guidelines ensure that the receipt is valid for tax purposes and that both the donor and the non-profit organization are protected.

Why Should Business Owners Care About Non-Profit Organization Receipts?

As a business owner, you may wonder why you should be concerned about non-profit organization receipts. After all, you are not the one donating, right? However, there are several reasons why business owners should pay attention to this aspect:

- Tax Deductions: Business owners often make donations to non-profit organizations as part of their corporate social responsibility initiatives. By ensuring that the organization provides a valid receipt, the business owner can claim a tax deduction for their donation.

- Financial Records: Keeping track of expenses and donations is essential for any business. Non-profit organization receipts provide a clear record of these transactions, allowing business owners to maintain accurate financial records.

- Transparency: Supporting non-profit organizations can enhance a business’s reputation and build trust with customers. By requesting and keeping non-profit organization receipts, business owners can demonstrate their commitment to transparency and accountability.

What Information Should Non-Profit Organization Receipts Include?

Non-profit organization receipts must contain specific information to be considered valid. The IRS requires that the following details be included:

- Name and Address: The name and address of the non-profit organization must be clearly stated on the receipt.

- Donor Information: The name and address of the donor or sponsor should also be included.

- Date and Description: The date of the donation and a brief description of the contribution should be provided on the receipt.

- Value and Fair Market Value: If the donation is not in cash, the receipt should state the value of the donated item or service, as well as its fair market value.

- Statement of No Goods or Services: If the donor did not receive any goods or services in return for the donation, the receipt should include a statement to that effect.

- Tax-Exempt Status: The non-profit organization’s tax-exempt status, including its Employer Identification Number (EIN), should be clearly stated on the receipt.

By including all the necessary information, non-profit organization receipts ensure that both the donor and the organization comply with IRS regulations.

How to Request a Non-Profit Organization Receipt?

If you are a business owner looking to request a non-profit organization receipt for a donation, the process is relatively straightforward:

- Contact the non-profit organization: Reach out to the non-profit organization’s finance or administration department to request a receipt. Provide them with the necessary details, such as the date and amount of the donation.

- Confirm receipt of the donation: Once the non-profit organization has processed your request, they will provide you with a receipt. Verify that all the required information is included and keep a copy for your records.

- Claim your tax deduction: When filing your taxes, include the non-profit organization receipt as supporting documentation for your donation. Consult with a tax professional for more information on how to claim your deduction.

Remember, it is essential to request and keep non-profit organization receipts for any donations made as a business owner. These receipts not only help you track your expenses but also provide the necessary documentation for tax purposes.

Examples of Non-Profit Organization Receipts

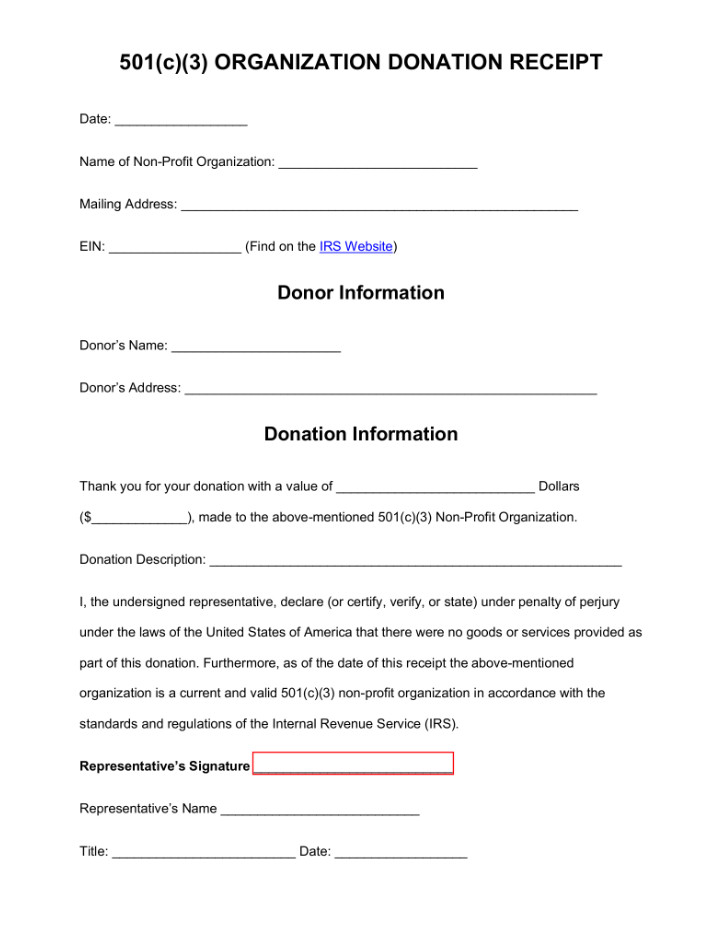

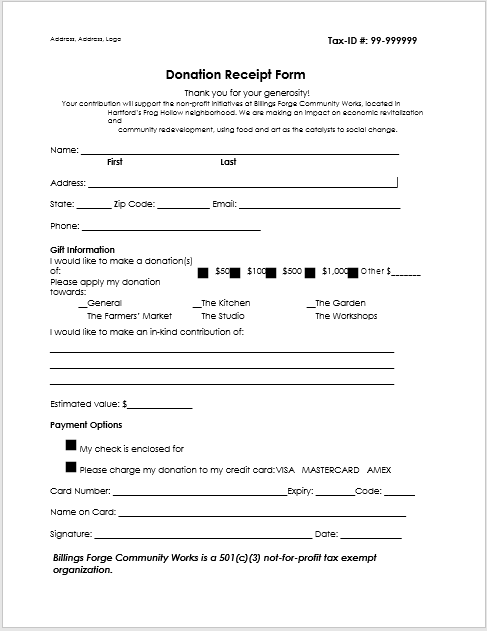

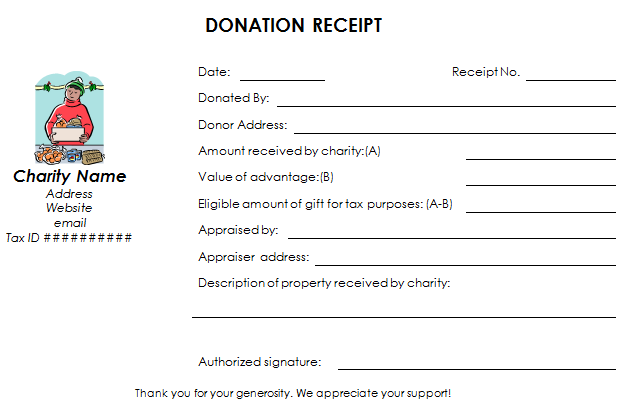

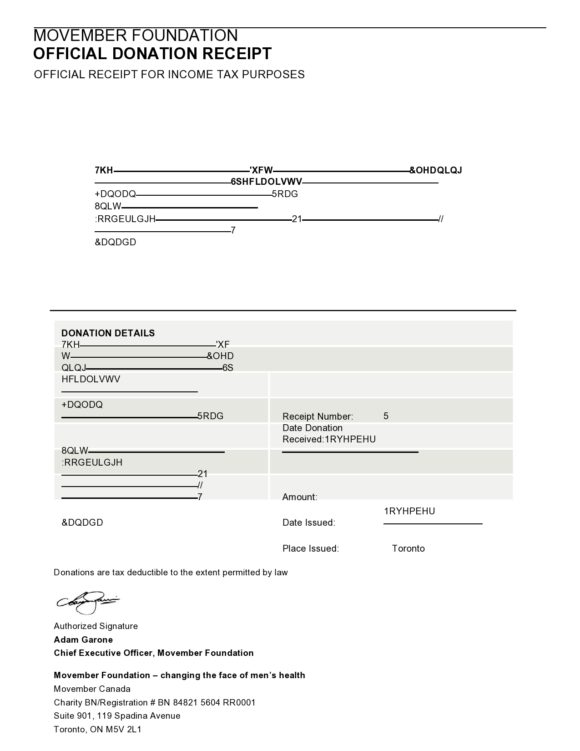

Non-profit organization receipts can vary in design and format, but they all contain the required information mentioned earlier. Here are a few examples:

- Example 1: A simple non-profit organization receipt may include the organization’s logo at the top, followed by the name and address. The donor’s information and details of the donation are then listed, along with a statement of no goods or services received.

- Example 2: Another type of non-profit organization receipt may have a more detailed format, including sections for the organization’s tax-exempt status, a breakdown of the donation by category, and a space for a signature from the organization’s representative.

- Example 3: Some non-profit organizations use electronic receipts, which can be sent via email or accessed through an online portal. These receipts often contain clickable links for easy access to additional information about the organization.

Regardless of the format, the key is to ensure that all the required information is present and that the receipt is easily accessible for future reference.

Conclusion

Understanding non-profit organization receipts as a business owner is crucial for maintaining accurate financial records, claiming tax deductions, and demonstrating transparency to customers and stakeholders. By familiarizing yourself with the requirements and requesting valid receipts, you can support non-profit organizations while also benefiting your own business.

Non-profit Organization Receipt Template Word – Download