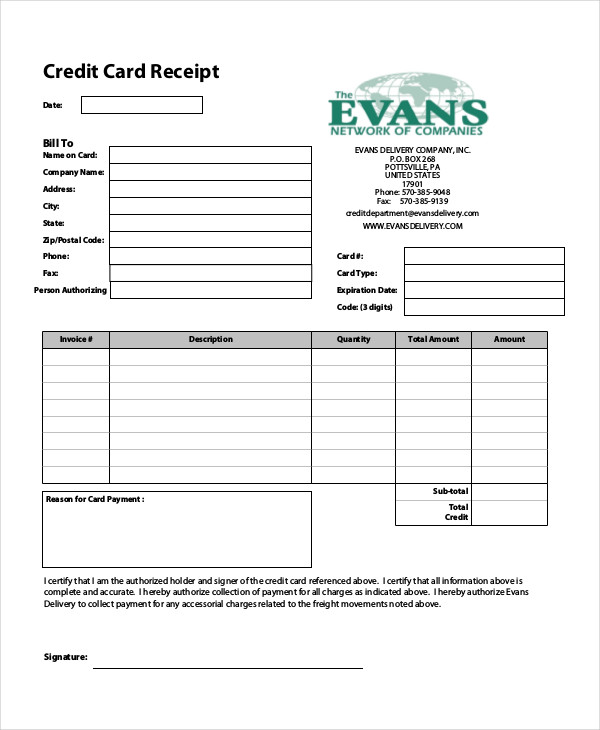

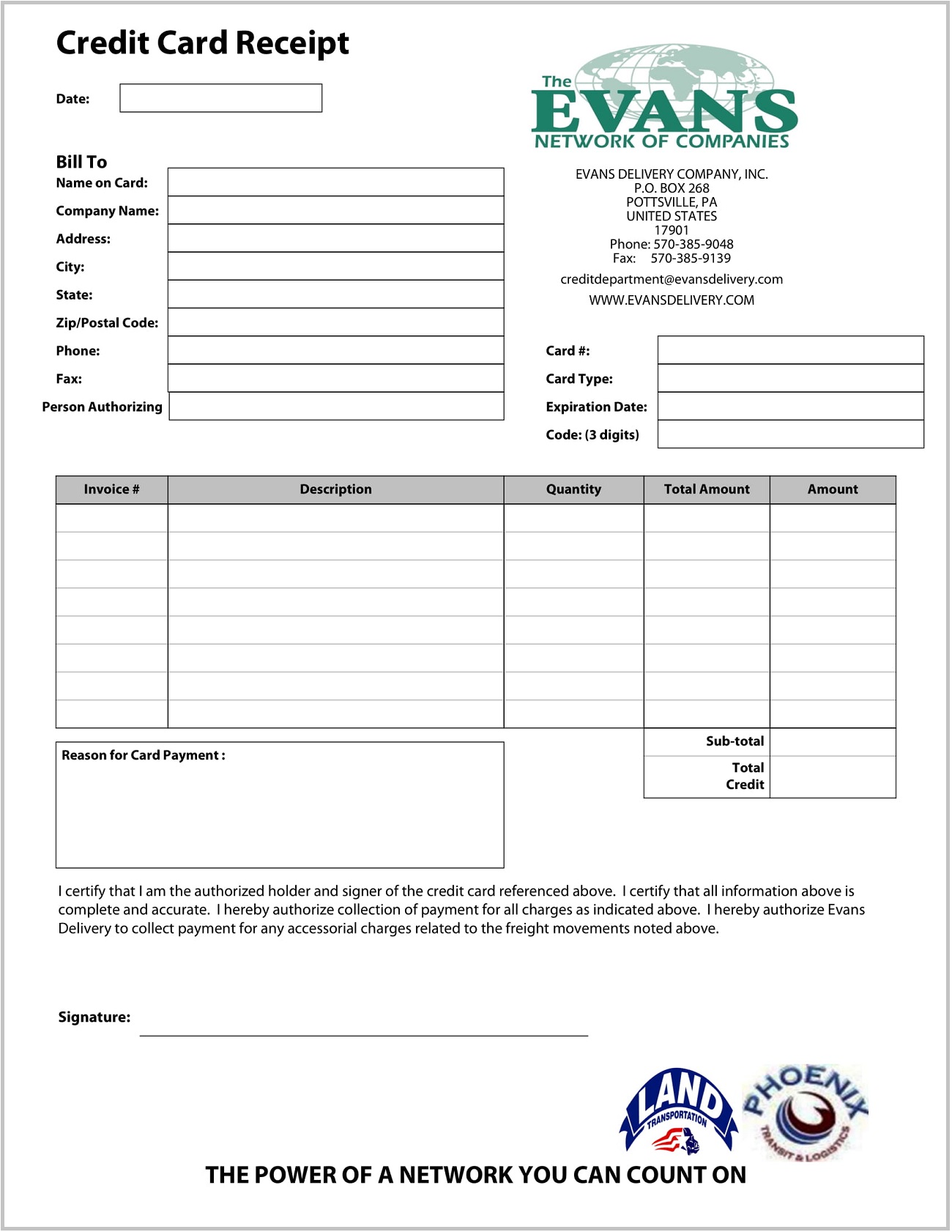

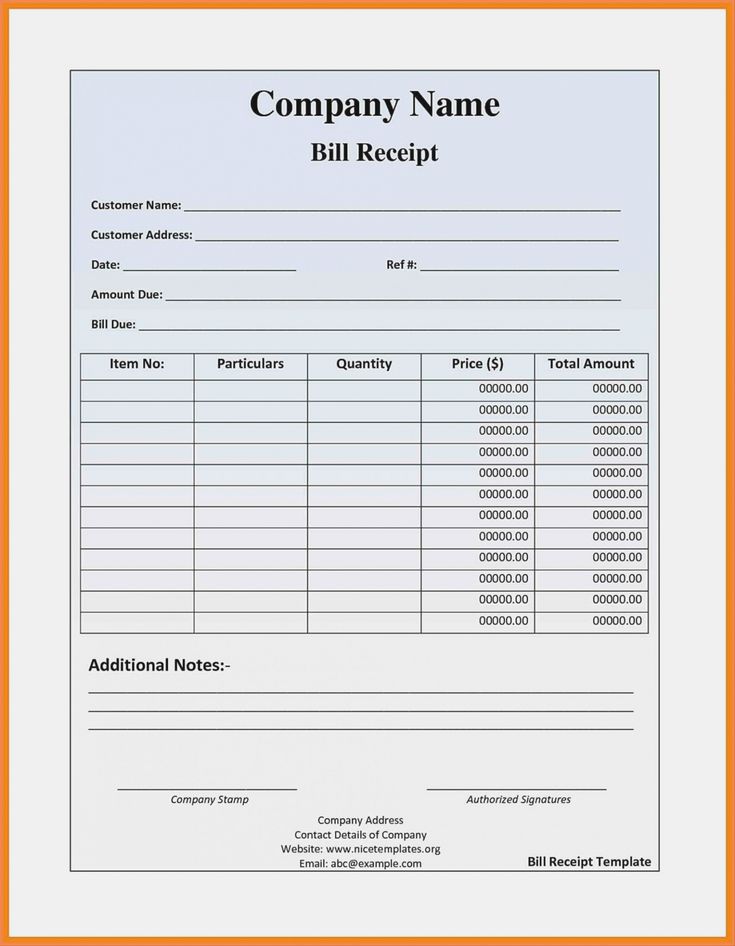

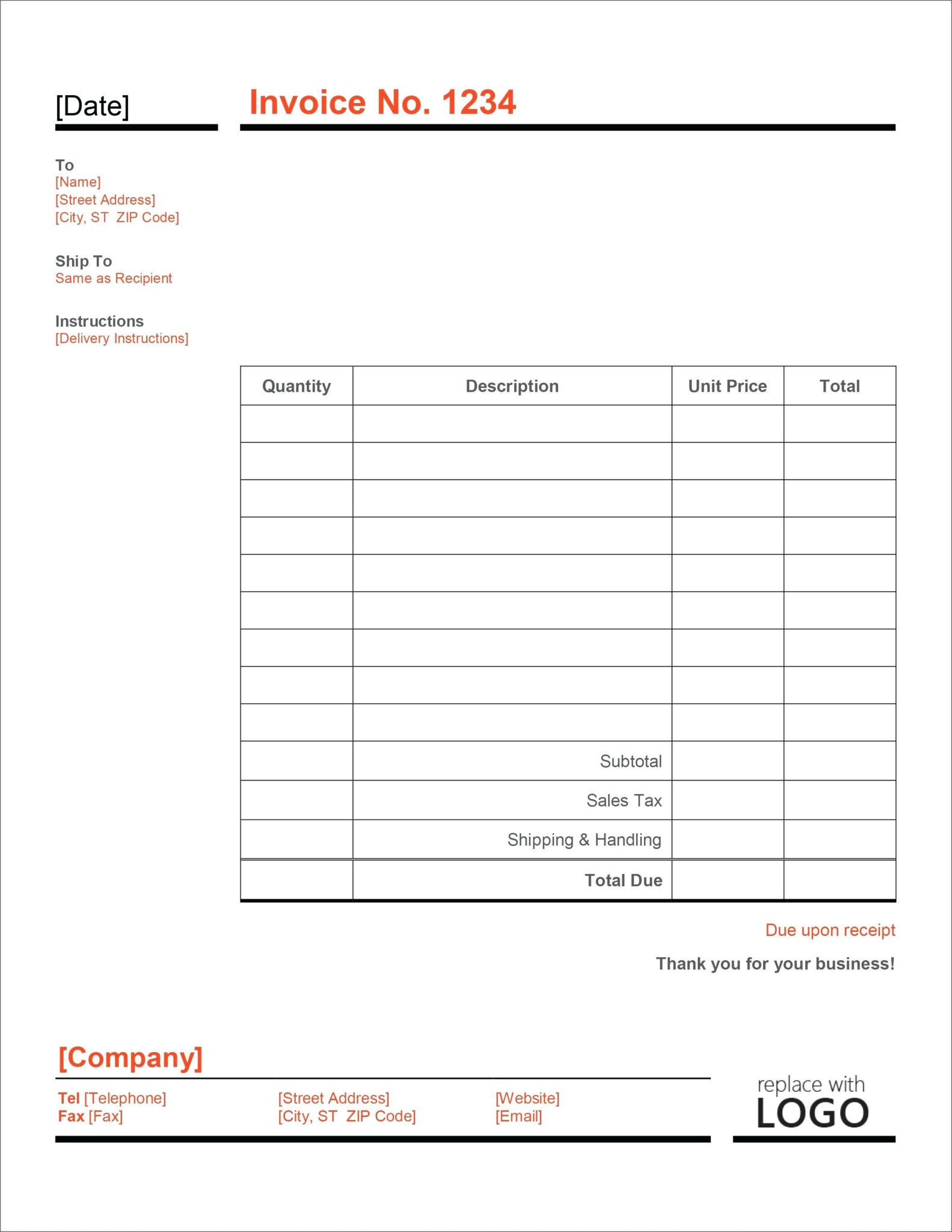

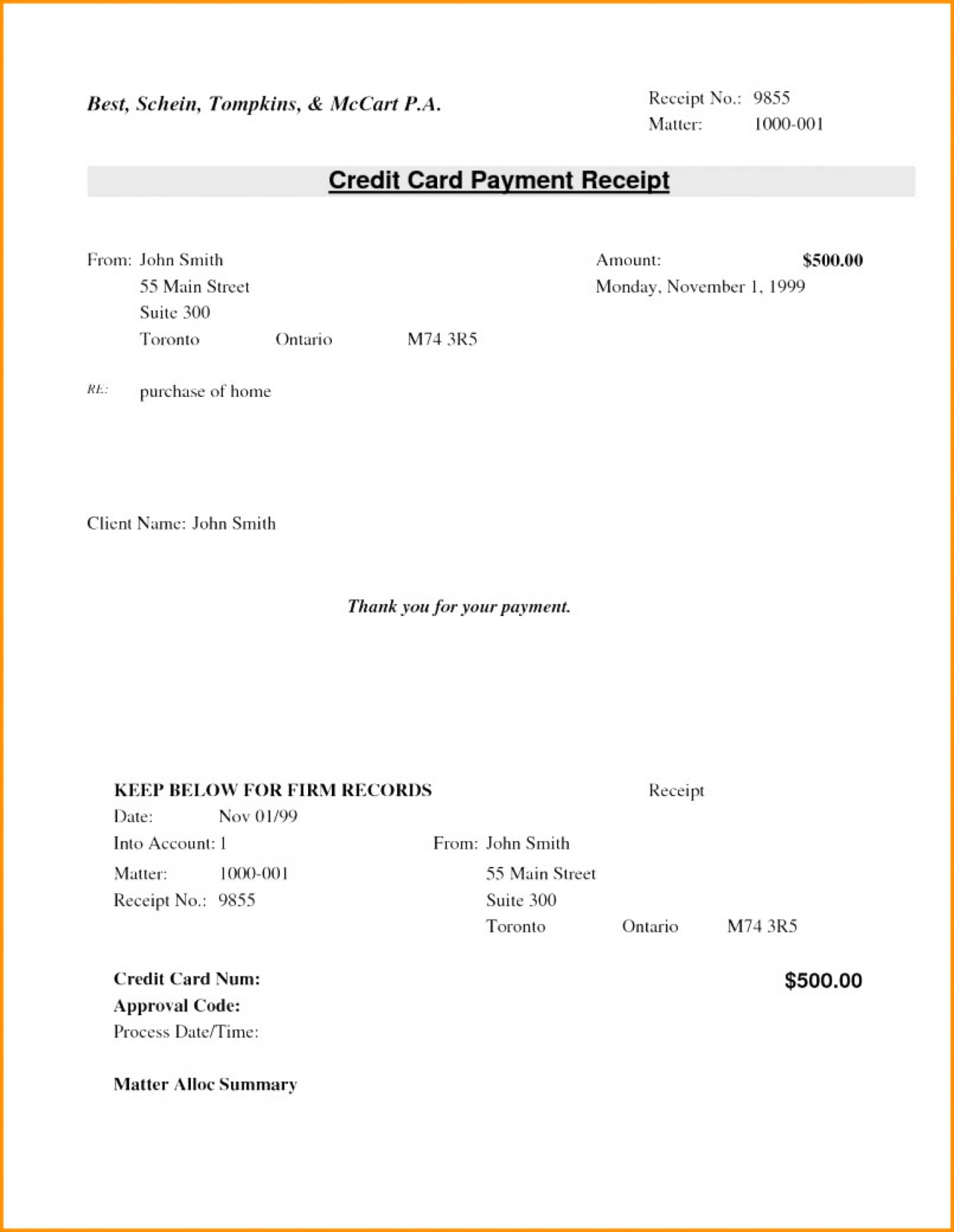

A credit card receipt is a document provided to customers as proof of payment when they make a purchase using a credit card. It contains important information such as the name of the business, the date and time of the transaction, the amount charged, and the last four digits of the credit card used. As a business owner, it is crucial to understand the importance of credit card receipts and how they can benefit your business.

Why Do Business Owners Need Credit Card Receipts?

There are several reasons why credit card receipts are essential for business owners:

- Recordkeeping: Credit card receipts serve as a record of all transactions made by customers. They provide a detailed account of the products or services purchased, the amount paid, and the payment method used. This information is valuable for accounting purposes and helps in tracking sales and expenses.

- Dispute Resolution: In case of any disputes or discrepancies regarding a transaction, credit card receipts can serve as evidence to resolve the issue. They provide clear documentation of the purchase, including the date, time, and amount charged. This can help protect the business from fraudulent claims or misunderstandings.

- Tax Purposes: Credit card receipts are important for tax purposes. They provide proof of sales and expenses, which are necessary for calculating accurate tax liabilities. By keeping track of credit card receipts, business owners can ensure they are claiming the correct deductions and complying with tax regulations.

- Customer Service: Credit card receipts can also be used to improve customer service. If a customer needs to return or exchange a product, having the original credit card receipt makes the process smoother and more efficient. It helps verify the purchase and ensures the customer receives the correct refund or replacement.

How to Properly Store Credit Card Receipts?

As a responsible business owner, it is crucial to establish a system for storing and organizing credit card receipts. Here are some best practices:

- Digital Storage: Consider using a digital system to store and organize credit card receipts. This can be done through accounting software or cloud-based services. Digital storage is convenient, saves physical space, and allows for easy retrieval and search.

- Physical Storage: If you prefer to keep physical copies of credit card receipts, create a filing system that is organized and easily accessible. Label folders or envelopes by date, month, or year to ensure proper organization.

- Backup and Security: Whether you choose digital or physical storage, it is important to have backup copies of all credit card receipts. This protects against loss or damage and ensures that the information is secure and accessible in case of emergencies.

- Retention Period: Check the legal requirements for how long credit card receipts should be retained. In some countries, businesses are required to keep credit card receipts for a certain period, typically for auditing or tax purposes. Make sure to comply with these regulations.

How to Handle Credit Card Receipt Disputes?

While credit card receipts help prevent disputes, they may still arise from time to time. Here’s how to handle them:

- Communication: Reach out to the customer and listen to their concerns. Understand the issue and gather as much information as possible to resolve it effectively.

- Review Documentation: Refer to the credit card receipt and any other relevant documents to verify the details of the transaction. Cross-check the information provided by the customer with your records.

- Offer Solutions: If there is an error or misunderstanding, apologize and offer appropriate solutions. This could include a refund, exchange, or store credit. Ensure that the customer feels heard and valued.

- Escalation: If the dispute cannot be resolved directly with the customer, consider involving the credit card company or seeking legal advice. They can guide how to proceed and protect your business’s interests.

Conclusion

Credit card receipts play a crucial role in the day-to-day operations of business owners. They provide a record of transactions, help resolve disputes, aid in tax compliance, and improve customer service. By implementing proper storage and organization practices, business owners can ensure they have easy access to credit card receipts when needed. Additionally, utilizing credit card receipt management tools can further streamline processes and enhance efficiency. Overall, credit card receipts are an essential tool that every business owner should prioritize and utilize effectively.

Credit Card Receipt Template – Download