Sales invoices are a crucial aspect of any business transaction, serving as a formal request for payment from the customer for goods or services rendered. They play a vital role in maintaining accurate financial records, tracking sales, and ensuring timely payment from customers.

Let’s explore the significance of sales invoices in more detail.

What is a Sales Invoice?

A sales invoice is a document provided by a seller to a buyer that outlines the details of a transaction. It includes information such as the products or services purchased, quantity, price, and terms of the sale.

The invoice serves as proof of the agreement between the buyer and seller, acting as a legal document that establishes the buyer’s obligation to pay for the goods or services received.

Why are Sales Invoices Important?

Sales invoices serve multiple purposes in a business transaction and are essential for maintaining financial health and transparency.

Legal Obligation for Payment

One of the primary reasons sales invoices are important is that they create a legal obligation for the buyer to pay for the goods or services received. By providing a formal document that outlines the terms of the sale, including the price and quantity of the products or services, the seller can hold the buyer accountable for fulfilling their payment obligations.

Financial Record-Keeping

Sales invoices are essential for maintaining accurate financial records and tracking revenue and expenses. They provide a detailed account of each transaction, including the date of the sale, products or services sold, and the total amount due. This information is crucial for bookkeeping, budgeting, and financial reporting, helping businesses make informed decisions and manage their finances effectively.

Proof of Transaction for Audits

In addition to serving as a legal document, sales invoices act as proof of the transaction for audits and compliance purposes. In the event of an audit by tax authorities or regulatory bodies, businesses must be able to provide documentation to support their financial transactions. Sales invoices help establish a clear paper trail of sales and purchases, ensuring transparency and accountability.

Establishing Accounts Receivable

Sales invoices are instrumental in establishing accounts receivable, which represent the money owed to a business by its customers for goods or services provided on credit. By issuing sales invoices, businesses can track outstanding payments, monitor cash flow, and follow up with customers to ensure timely payment. Accounts receivable are a key component of a business’s financial health and cash flow management.

Managing Disputes and Resolving Issues

Sales invoices also play a critical role in managing disputes and resolving issues that may arise between the buyer and seller. In the event of discrepancies or disagreements regarding the transaction, the sales invoice serves as a detailed record that can be used to clarify the terms of the sale, reconcile any misunderstandings, and reach a resolution. Having a clear and accurate sales invoice can help prevent disputes and protect both parties’ interests.

What to Include in a Sales Invoice?

When creating a sales invoice, it is essential to include all the necessary information to ensure clarity and accuracy.

Invoice Number and Date

The invoice number and date are essential for identifying and tracking each invoice. The invoice number should be unique to each invoice and can be alphanumeric to differentiate between multiple invoices. Including the date of issuance helps both parties reference the timeline of the transaction and ensures that payments are made promptly.

Customer Information and Contact Details

Accurate customer information is crucial for ensuring that the invoice reaches the correct recipient and that communication channels remain open. Include the customer’s name, address, phone number, and email address to facilitate easy communication and follow-ups. Having up-to-date contact details also allows for quick resolution of any issues that may arise during the payment process.

Product or Service Details

Provide a detailed description of the products or services sold on the invoice, including quantity, price per unit, and total amount due. Clearly outlining the items purchased helps the customer understand the charges and ensures transparency in the transaction. Including specific details also makes it easier to reconcile the invoice with the goods or services received.

Payment Terms and Due Date

Specify the payment terms on the invoice, including the due date for payment, accepted payment methods, and any late payment penalties or discounts. Clearly communicating the payment terms helps set expectations with the customer and reduces the likelihood of payment delays or disputes. Including a due date encourages prompt payment and helps businesses maintain a healthy cash flow.

Terms and Conditions of Sale

Include any additional terms and conditions of the sale on the invoice to clarify the rights and responsibilities of both parties. This may include warranty information, return policies, or any other relevant terms that apply to the transaction. By outlining these terms upfront, businesses can prevent misunderstandings and ensure a smooth and transparent transaction process.

Itemized Breakdown of Charges

Provide an itemized breakdown of charges on the invoice to detail the cost of each product or service purchased. This helps the customer understand the total amount due and verifies the accuracy of the charges. Including an itemized breakdown also makes it easier to reconcile the invoice with any purchase orders or agreements that were made before the sale.

Additional Notes or Messages

Include any additional notes or messages on the invoice to communicate important information to the customer. This could include thank you messages, promotional offers, or any other relevant details that enhance the customer experience. Adding a personal touch to the invoice can help build customer loyalty and foster positive relationships with clients.

How to Create an Effective Sales Invoice

Creating an effective sales invoice is essential for ensuring smooth transactions, timely payments, and accurate record-keeping. By following best practices and incorporating key elements into the invoice, businesses can streamline their invoicing process and maintain strong financial management practices.

Use a Professional Invoice Template

Utilize a professional invoice template or invoicing software to create a polished and organized invoice. A well-designed template ensures consistency in branding, layout, and formatting, making it easier for customers to read and understand the invoice. Many invoicing software options offer customizable templates that can be tailored to suit the specific needs of the business.

Include All Necessary Information

Ensure that all essential information is included on the invoice, such as the invoice number, date, customer information, product details, and payment terms. Omitting any critical details can lead to confusion or delays in payment. Double-check the accuracy of the information before sending the invoice to ensure that all details are correct and up-to-date.

Be Clear and Concise

Use clear and concise language on the invoice to ensure that the information is easy to understand for the customer. Avoid using technical jargon or industry-specific terms that may be confusing to non-experts. Clearly communicate the terms of the sale, payment due date, and any other important details in a straightforward manner to prevent misunderstandings.

Double-Check for Accuracy

Review the invoice carefully before sending it to the customer to ensure that all information is accurate and up-to-date. Check for any spelling or typographical errors, inaccuracies in pricing or quantities, and inconsistencies in the information provided. A thorough review helps maintain professionalism and accuracy in the invoicing process.

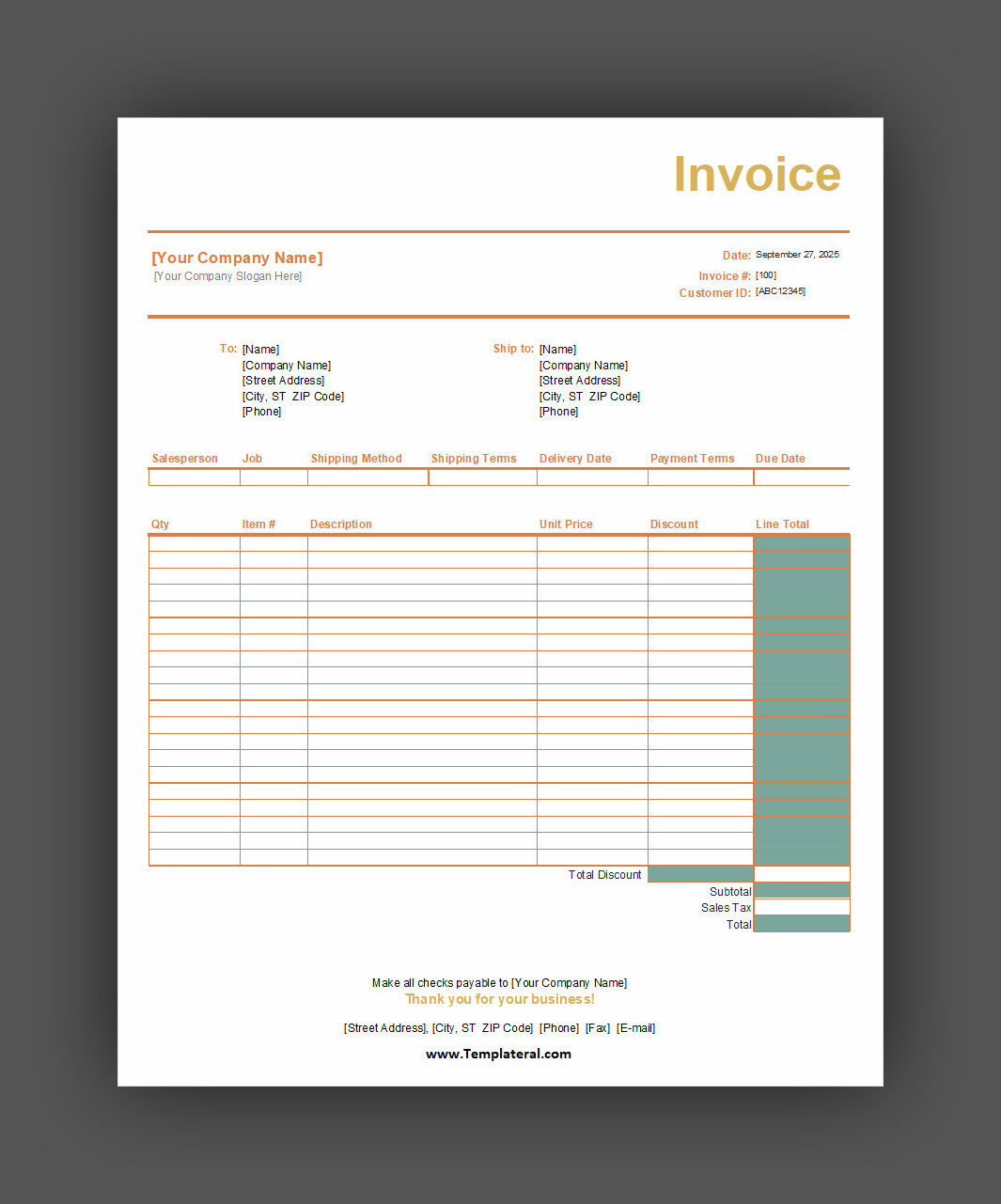

Sales Invoice Template

A sales invoice is essential for recording transactions, maintaining professionalism, and ensuring smooth payment processes. It provides clarity for both businesses and customers while keeping financial records organized.

Download our free Sales Invoice Template today and start creating professional invoices with ease.

Sales Invoice Template – Excel