What is a Promissory Note?

A promissory note is a legally binding document that outlines the terms of a loan agreement between a borrower and a lender. It serves as a written promise by the borrower to repay a specific sum of money to the lender under defined conditions.

This document is crucial in formalizing the loan transaction and establishing clear repayment obligations for both parties.

A promissory note acts as evidence of a debt owed by the borrower to the lender. It specifies the amount borrowed, the interest rate, the repayment schedule, and any other terms agreed upon by the parties. By signing the promissory note, the borrower acknowledges their obligation to repay the loan according to the specified terms.

Why Use a Promissory Note?

There are several compelling reasons why using a promissory note is beneficial for both borrowers and lenders in a loan transaction:

Legal Protection

A promissory note provides legal protection for both parties by clearly documenting the terms of the loan agreement. In the event of a dispute or default, the promissory note serves as evidence of the borrower’s obligation to repay the loan and the lender’s right to seek repayment.

By outlining the specific terms of the debt, including the loan amount, interest rate, and repayment schedule, the promissory note helps prevent misunderstandings and disagreements between the parties. This legal clarity can be crucial in resolving any disputes that may arise during the course of the loan.

Enforceability

One of the key benefits of using a promissory note is its enforceability in a court of law. In the event that the borrower defaults on the loan, the lender can rely on the terms of the promissory note to seek repayment through legal means.

By signing the promissory note, the borrower acknowledges their debt and agrees to repay it according to the specified terms. This agreement is legally binding and can be used as evidence in court to compel the borrower to fulfill their repayment obligations.

Record Keeping

Another advantage of using a promissory note is that it serves as a formal record of the loan transaction. The document provides a written record of the loan terms, including the amount borrowed, the interest rate, and the repayment schedule.

Having a clear record of the loan agreement can be useful for both parties in tracking the progress of the loan and ensuring that payments are made on time. It also serves as a valuable reference in case there are any discrepancies or questions about the terms of the loan in the future.

Clarity and Transparency

By documenting the terms of the loan in writing, a promissory note helps ensure clarity and transparency in the loan agreement. Both parties have a clear understanding of their respective rights and obligations, which can help prevent misunderstandings or disagreements down the line.

Furthermore, the promissory note provides a roadmap for the repayment of the loan, outlining the schedule of payments and any other conditions that must be met. This clarity can be beneficial for both parties in managing their financial obligations and expectations throughout the loan term.

Types of Promissory Notes

Depending on the specific circumstances of the loan, different types of promissory notes may be used to formalize the agreement between the borrower and lender. Each type of promissory note serves a unique purpose and may have distinct features:

Secured Promissory Note

A secured promissory note is backed by collateral provided by the borrower to secure the loan. The collateral, which could be real estate, vehicles, or other valuable assets, acts as security for the lender in case the borrower defaults on the loan.

By including collateral in the promissory note, the lender reduces their risk of loss in the event of a default. If the borrower fails to repay the loan as agreed, the lender may have the right to seize and sell the collateral to recoup the outstanding debt.

Unsecured Promissory Note

An unsecured promissory note does not require any collateral to secure the loan. In this type of agreement, the borrower’s promise to repay the loan is based solely on their creditworthiness and ability to fulfill the repayment terms.

Because there is no collateral involved, unsecured promissory notes may carry a higher interest rate to compensate for the increased risk to the lender. Lenders may also impose stricter criteria for approving unsecured loans to minimize their exposure to potential losses.

Commercial Promissory Note

A commercial promissory note is used in business transactions to formalize loans between a company and a lender. These notes outline the terms of the loan agreement, including the loan amount, interest rate, and repayment schedule. Commercial promissory notes may include provisions specific to business transactions, such as clauses related to the use of funds, financial reporting requirements, and default remedies.

Real Estate Promissory Note

A real estate promissory note is tailored for transactions involving real property, such as mortgages or financing agreements for the purchase of a home or investment property. These notes may include additional provisions related to property insurance, taxes, and maintenance responsibilities.

Real estate promissory notes often specify the terms of the mortgage, including the loan amount, interest rate, repayment schedule, and any escrow requirements. These documents play a crucial role in formalizing the financing arrangements for real estate transactions.

Installment Promissory Note

An installment promissory note outlines a loan agreement in which the borrower repays the loan in periodic installments over a specified period. Each installment typically includes a portion of the principal amount borrowed and any accrued interest.

These notes are commonly used for personal loans, auto financing, and other consumer credit transactions. By setting out a predetermined repayment schedule, installment promissory notes help borrowers budget their payments and lenders track the progress of the loan.

Convertible Promissory Note

A convertible promissory note is a unique financing instrument that allows the lender to convert the outstanding debt into equity in the borrower’s company at a later date. This type of note is often used in startup and early-stage financing rounds.

Convertible promissory notes provide flexibility for both parties by offering the option to convert the debt into ownership shares in the event of a future equity financing round. This structure allows startups to secure funding without immediately determining the company’s valuation.

Key Elements of a Promissory Note

When drafting a promissory note, it is essential to include specific elements to ensure the document’s validity and enforceability. These key components help clarify the terms of the loan agreement and protect the interests of both the borrower and the lender:

Parties Involved

The promissory note should clearly identify the parties involved in the loan transaction, including the full legal names and contact information of the borrower and lender. This information helps establish the identities of the contracting parties and their roles in the agreement.

It is important to accurately spell out the names of the parties and include any relevant titles or affiliations to avoid confusion or ambiguity. By clearly identifying the parties, the promissory note can be easily enforced in case of a dispute or default.

Loan Amount

The promissory note should specify the total amount borrowed by the borrower from the lender. This amount represents the principal sum of the loan that the borrower is obligated to repay, along with any accrued interest and fees as outlined in the agreement.

It is crucial to clearly state the loan amount in the promissory note to avoid any misunderstandings regarding the total debt owed by the borrower. Including the specific dollar amount or currency ensures that both parties are aware of the financial terms of the loan.

Interest Rate

The promissory note should outline the interest rate that will apply to the loan amount borrowed by the borrower. The interest rate represents the cost of borrowing the money and is typically expressed as an annual percentage rate (APR).

By specifying the interest rate in the promissory note, both parties understand the additional cost associated with the loan and how it will impact the total repayment amount. Lenders may set fixed or variable interest rates based on market conditions and the creditworthiness of the borrower.

Repayment Terms

The promissory note must detail the repayment terms agreed upon by the borrower and lender, including the schedule for making payments. This includes the frequency of payments, such as monthly, quarterly, or annually, and the due dates for each installment.

It is essential to clearly outline the repayment schedule in the promissory note to ensure that both parties are aware of when payments are due. By setting specific repayment terms, the document helps prevent confusion and ensures that the borrower fulfills their obligations on time.

Collateral

If the loan is secured by collateral provided by the borrower, the promissory note should describe the property or assets that serve as security for the loan. Collateral acts as a form of protection for the lender in case the borrower defaults on the loan.

By including details of the collateral in the promissory note, the lender can legally claim the property or assets in the event of nonpayment by the borrower. This provision helps mitigate the lender’s risk and provides an additional layer of security for the loan.

Signatures

To formalize the loan agreement, both the borrower and the lender must sign the promissory note to indicate their acceptance of the terms. Signatures serve as evidence of the parties’ agreement to the conditions outlined in the document and their commitment to fulfilling their respective obligations.

Both parties need to sign the promissory note in the presence of witnesses or a notary public to validate the document’s authenticity. The signatures signify the parties’ consent to be bound by the terms of the agreement and their willingness to comply with its provisions.

How to Create a Promissory Note

Creating a promissory note involves several steps to ensure that the document accurately reflects the terms of the loan agreement and complies with legal requirements. By following these guidelines, parties can draft a comprehensive and enforceable promissory note:

Define the Terms

The first step in creating a promissory note is to define the terms of the loan agreement, including the loan amount, interest rate, and repayment schedule. Parties should agree on the specific details of the loan and document them clearly in the promissory note.

It is important to be thorough and precise when outlining the terms of the loan to avoid any ambiguity or confusion. Including specific provisions related to late payments, default remedies, and collateral can help protect the interests of both parties and clarify their rights and responsibilities.

Include Necessary Details

When drafting a promissory note, parties should include all necessary details to ensure the document’s completeness and accuracy. This includes specifying the names and contact information of the borrower and lender, as well as any witnesses or notaries present during the signing of the document.

Additionally, parties should clearly state the loan amount, interest rate, repayment terms, and any other conditions agreed upon in the promissory note. Providing detailed information helps avoid misunderstandings and ensures that both parties are fully informed about the loan agreement.

Consult Legal Counsel

Before finalizing a promissory note, parties may consider consulting legal counsel to review the document and ensure its compliance with applicable laws and regulations. An attorney can provide valuable guidance on drafting a legally sound promissory note that protects the parties’ interests and is enforceable in court.

Legal counsel can also offer advice on any specific provisions or clauses that parties may wish to include in the promissory note. By seeking professional assistance, parties can address any legal concerns or questions related to the loan agreement and ensure that their rights are protected.

Tips for Successful Promissory Notes

To create an effective and enforceable promissory note, parties may consider the following tips and best practices:

Be Specific

When drafting a promissory note, it is essential to be specific and detailed in outlining the terms of the loan agreement. Clearly define the loan amount, interest rate, repayment schedule, and any other conditions to avoid misunderstandings or disputes.

Including specific provisions for late payments, default remedies, and collateral can help protect the interests of both parties and clarify their obligations. By being specific in the promissory note, parties can minimize the risk of disagreements and ensure that the loan agreement is legally binding.

Keep Records

Parties should maintain accurate records of the promissory note and all related documents for their records. Keeping copies of the signed document, loan statements, payment receipts, and any correspondence related to the loan can help track the loan’s progress and resolve any issues that may arise.

By maintaining detailed records of the loan transaction, parties can refer back to the promissory note and other documentation to verify the terms of the agreement. This documentation can be valuable in case of disputes or discrepancies regarding the loan terms.

Seek Legal Advice

When in doubt about any aspect of the promissory note, parties may consider seeking legal advice from an attorney. Legal counsel can review the document, offer guidance on legal requirements, and ensure that the promissory note complies with applicable laws and regulations.

By consulting with a lawyer, parties can address any concerns or questions related to the loan agreement and make informed decisions about the terms of the promissory note. Legal advice can help parties protect their rights and interests, ensuring the document is enforceable in court.

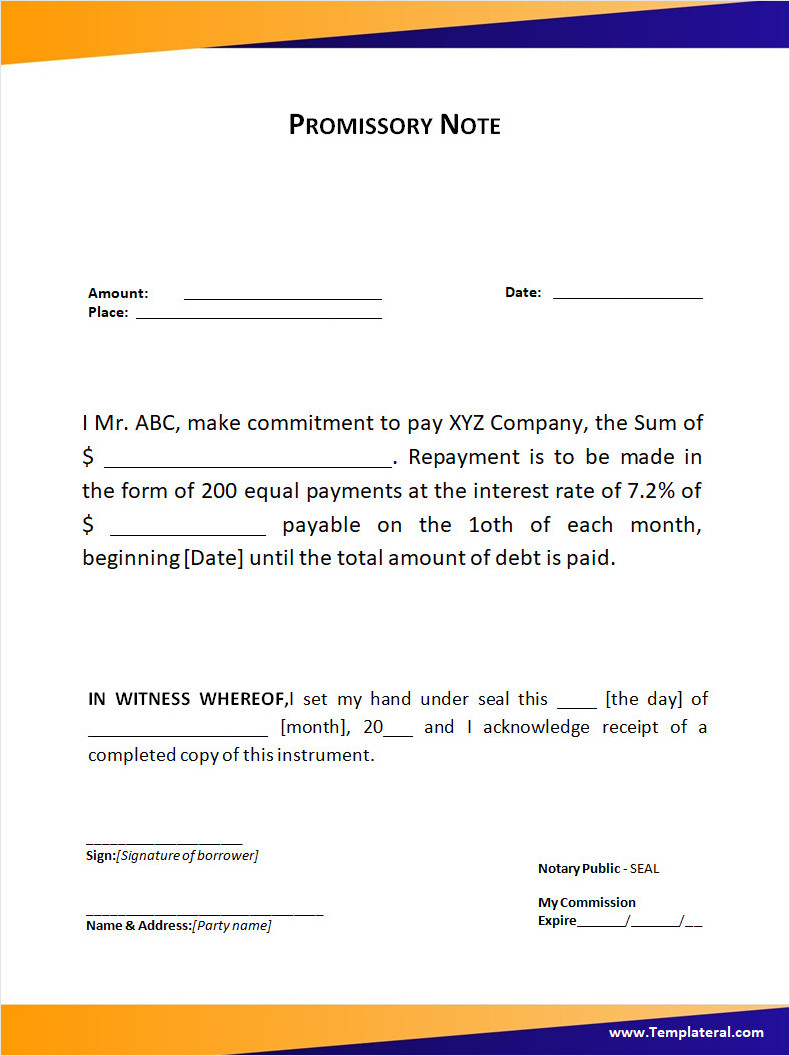

Promissory Note Template

By using a promissory note, you establish trust, clarity, and accountability in any lending arrangement. Whether for personal or business purposes, having a written agreement helps avoid misunderstandings in the future.

Get started now by accessing our free Promissory Note Template available on this website.

Promissory Note Template – Word