Managing your finances can be a daunting task, especially when it comes to understanding your monthly billing statement. Whether you’re dealing with credit card bills, utility bills, or any other type of recurring payment, it’s important to have a clear understanding of what you’re being charged for and how to make sense of it all.

In this article, we will guide you through the ins and outs of a monthly billing statement, providing you with the knowledge to navigate your financial obligations with ease.

What is a Monthly Billing Statement?

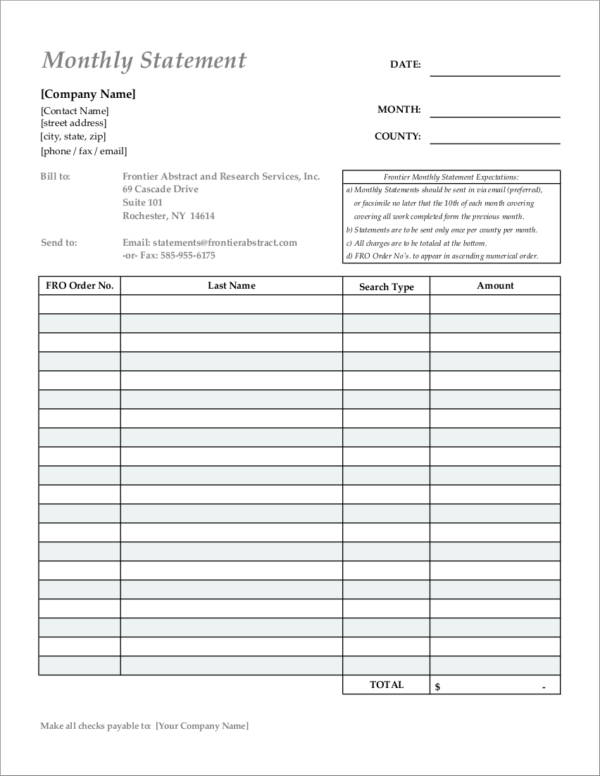

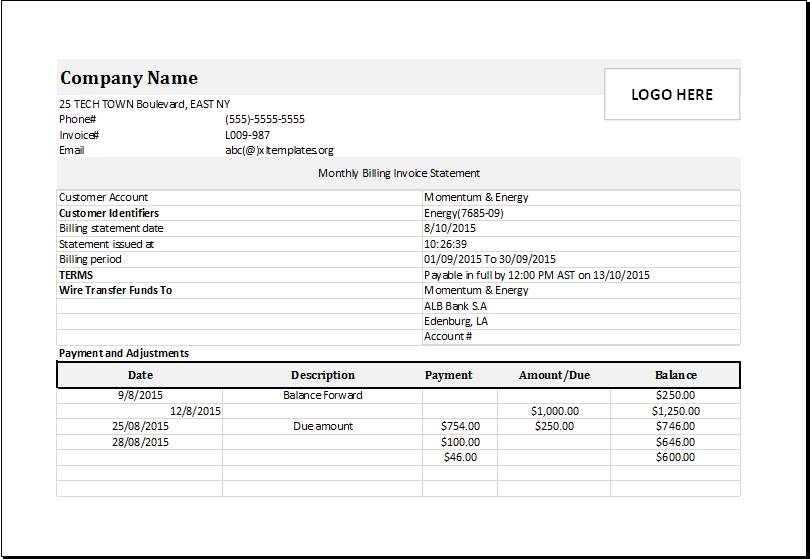

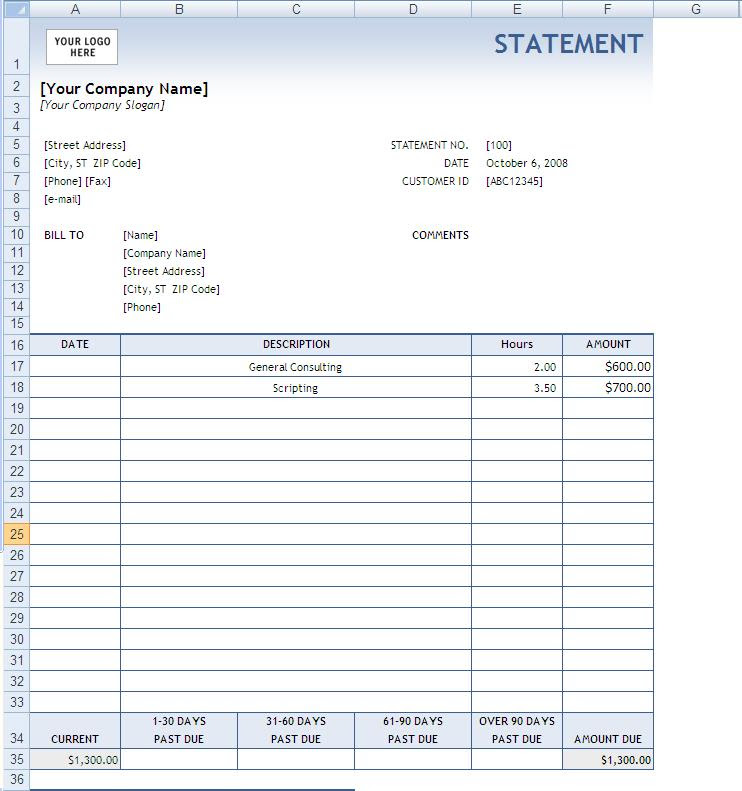

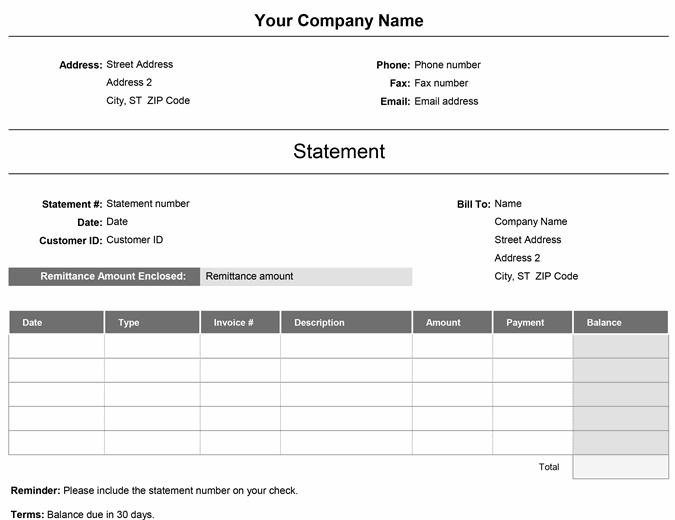

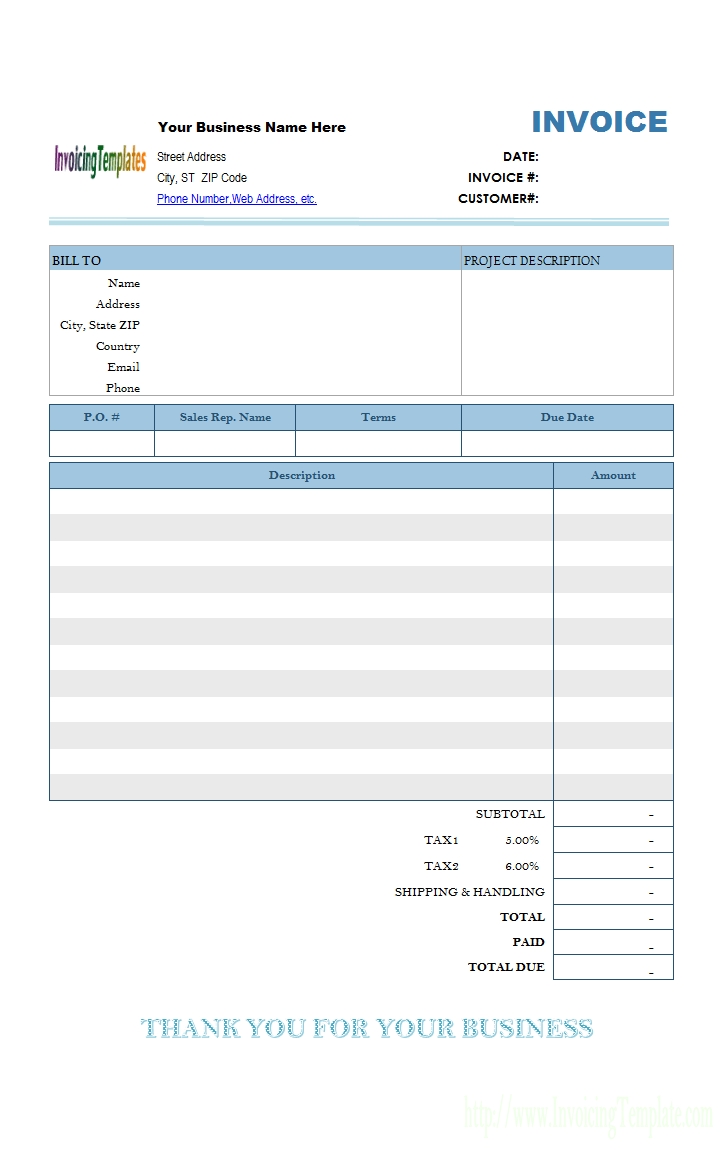

A monthly billing statement is a document that outlines the charges, payments, and other financial activities related to your account over a specific billing period. It provides a summary of your financial transactions, allowing you to keep track of your expenses and monitor your account’s activity. Monthly billing statements are typically sent by service providers, such as credit card companies or utility companies, to their customers.

These statements are crucial for maintaining financial control as they provide a detailed breakdown of all the charges and payments made during the billing period. By reviewing your monthly billing statement, you can identify any discrepancies, track your spending habits, and ensure that your payments are up to date.

Understanding the Components of a Monthly Billing Statement

A monthly billing statement consists of several key components that you need to understand to make sense of the information provided. Let’s take a closer look at each of these components:

1. Account Summary

The account summary is usually located at the top of your monthly billing statement and provides an overview of your account’s details. It includes your account number, billing period, and the total amount due for the current billing cycle. This section also shows any past-due amounts from previous billing periods.

2. Transaction Details

The transaction details section is where you’ll find a comprehensive list of all the charges, credits, and payments made during the billing period. This includes purchases, fees, interest charges, and any other financial activities related to your account. Each transaction is typically accompanied by a description, date, and amount.

3. Payment Information

Payment information provides details on how and when to make your payment. It includes the due date, minimum payment amount, and various payment options available to you. This section may also provide information on late payment fees and the consequences of not making your payment on time.

4. Interest and Fees

If you have a credit card or any other type of loan, the interest and fees section will outline the interest charges and any additional fees associated with your account. This information is crucial for understanding the cost of borrowing money and managing your debt effectively.

5. Rewards and Discounts

If you have a rewards program or qualify for any discounts, this section will outline the rewards earned or discounts applied to your account. It’s important to review this section to ensure that you are taking full advantage of any benefits offered by your service provider.

6. Contact Information

The contact information section provides the necessary details to get in touch with your service provider’s customer support. This can be helpful if you have any questions or concerns about your billing statement or need assistance with your account.

Why is it Important to Understand Your Monthly Billing Statement?

Understanding your monthly billing statement is crucial for several reasons:

- Financial Control: By reviewing your statement, you can track your expenses, identify any unauthorized charges, and ensure that your payments are accurate and up to date.

- Budgeting: Your monthly billing statement provides valuable insights into your spending habits, allowing you to make more informed decisions and adjust your budget accordingly.

- Dispute Resolution: If you notice any discrepancies or errors on your statement, understanding the components of your billing statement will help you effectively communicate and resolve any issues with your service provider.

- Building Credit: For those with credit cards or loans, reviewing your monthly billing statement helps you monitor your credit utilization, payment history, and overall creditworthiness, which can impact your credit score.

Tips for Reviewing Your Monthly Billing Statement

Here are some tips to help you effectively review your monthly billing statement:

- Check for Accuracy: Ensure that all the charges, payments, and other financial activities listed on your statement are accurate. If you notice any discrepancies, contact your service provider immediately.

- Monitor Due Dates: Pay close attention to the due date and make sure you make your payment on time to avoid late fees or penalties.

- Review Interest Rates and Fees: If you have a credit card or loan, review the interest rates and fees charged to your account. If they seem high or unreasonable, consider contacting your service provider to negotiate a better rate.

- Keep a Record: It’s a good practice to keep copies of your monthly billing statements for future reference. This can be helpful for tax purposes, dispute resolution, or any other financial needs.

Conclusion

Understanding your monthly billing statement is essential for maintaining control over your financial obligations. By familiarizing yourself with the components of your statement and reviewing it regularly, you can effectively manage your expenses, track your payments, and ensure that your financial transactions are accurate and up to date. Remember to always keep an eye on your statement, monitor your spending habits, and reach out to your service provider if you have any questions or concerns.

Monthly Billing Statement Template Excel – Download