When it comes to managing expenses and keeping track of financial transactions, an itemized billing statement is an essential tool. Whether you are a business owner, a freelancer, or an individual managing personal finances, understanding the details of your expenses is crucial for financial planning and decision-making.

In this comprehensive guide, we will explore the significance of an itemized billing statement, how to interpret it, and why it is essential for both businesses and individuals.

What is an Itemized Billing Statement?

An itemized billing statement is a document that provides a detailed breakdown of expenses and charges incurred during a specific period. It includes a list of individual items or services purchased, along with their corresponding costs. This statement serves as a record of transactions, allowing individuals and businesses to review and verify their expenditures.

Itemized billing statements are commonly used in various industries, including retail, healthcare, telecommunications, and professional services. They provide transparency and accountability, ensuring that customers or clients have a clear understanding of the charges they are being billed for.

Why is an Itemized Billing Statement Important?

An itemized billing statement offers several benefits and plays a crucial role in financial management. Here are some key reasons why it is important:

1. Transparency and Accuracy:

An itemized billing statement provides a transparent breakdown of expenses, allowing individuals or businesses to see exactly what they are paying for. This level of detail promotes accuracy and helps identify any discrepancies or errors in the charges.

By reviewing the statement, you can ensure that you are not being overcharged or billed for services you did not receive. It allows you to question or dispute any incorrect charges, leading to fair and accurate billing.

2. Expense Tracking and Budgeting:

One of the primary purposes of an itemized billing statement is to help individuals and businesses track their expenses and manage their budgets effectively. By having a clear breakdown of costs, you can categorize and analyze your spending patterns.

With this information, you can identify areas where you may be overspending or where cost-cutting measures can be implemented. It allows you to make informed financial decisions and adjust your budget accordingly.

3. Verification and Auditing:

For businesses, itemized billing statements are crucial for verifying and auditing expenses. They provide a detailed record that can be cross-referenced with other financial documents to ensure accuracy and compliance.

In addition, itemized billing statements are useful during tax audits or financial reviews. They serve as evidence of expenses and can help support deductions or claims made during these processes.

4. Dispute Resolution:

If you have concerns about the charges on your bill, an itemized billing statement can be instrumental in resolving disputes. It provides a clear breakdown of the services or items you were billed for, making it easier to address any discrepancies.

By referring to the statement and communicating with the billing party, you can resolve issues promptly and avoid unnecessary conflicts or misunderstandings.

How to Interpret an Itemized Billing Statement

Interpreting an itemized billing statement may seem daunting at first, but with a little practice, it becomes easier to understand. Here are some key steps to help you interpret your statement:

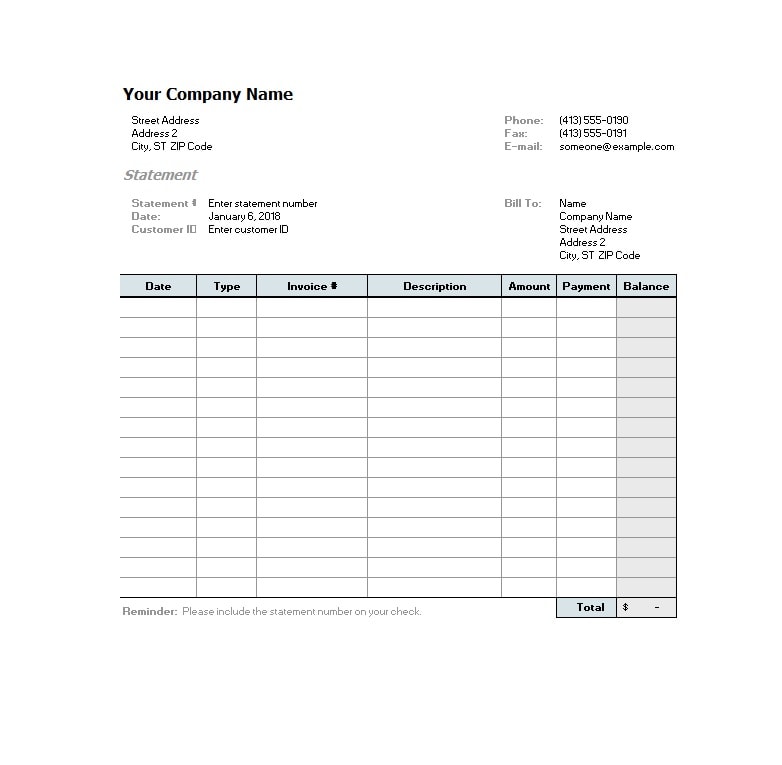

1. Review the Header Information:

The header of the billing statement typically includes important details such as the billing period, account number, and contact information for the billing party. Make sure to verify that this information is accurate, as it ensures that you are reviewing the correct statement.

2. Identify the Items or Services:

Scan through the statement and identify the individual items or services listed. They are usually accompanied by a description and a corresponding code or reference number. Take note of any unfamiliar items or services that may require further clarification.

3. Note the Quantity or Usage:

For certain items or services, the statement may include the quantity or usage details. This is especially common in utility bills or telecommunications statements, where you are billed based on usage. Make sure to review these quantities and verify that they align with your actual usage.

4. Check the Unit Cost and Total:

Each item or service listed will have a unit cost and a total cost. The unit cost represents the price per unit or the rate for a specific service, while the total cost is the cumulative amount for the quantity used or purchased. Ensure that these costs are accurate and match your expectations.

5. Look for Taxes, Fees, and Discounts:

In addition to the item or service costs, there may be additional charges such as taxes, fees, or discounts applied to the statement. These charges should be clearly outlined and explained. Verify that they are calculated correctly and that any applicable discounts are accurately reflected.

6. Calculate the Subtotal and Grand Total:

The statement will typically include a subtotal, which is the sum of all itemized costs before additional charges or taxes. The grand total is the final amount you are required to pay, including all charges. Double-check these totals to ensure they match your calculations.

7. Review Payment Terms and Due Dates:

Finally, make sure to review the payment terms and due dates specified on the statement. This information will outline how and when you need to make the payment. Adhering to these terms will help you avoid late fees or penalties.

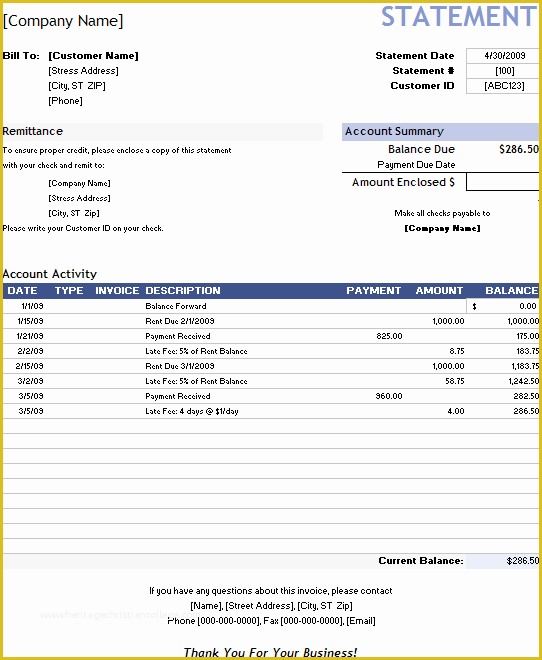

Sample Itemized Billing Statement

Here is an example of an itemized billing statement for a telecommunications service provider:

- Account Number: 123456789

- Billing Period: January 1, 2022 – January 31, 2022

- Contact Information: Telecom Company, 123 Main Street, Anytown, USA

| Item/Service | Description | Quantity | Unit Cost | Total |

|---|---|---|---|---|

| Phone Service | Basic Phone Plan | 1 | $50.00 | $50.00 |

| Internet Service | High-Speed Internet | 1 | $70.00 | $70.00 |

| Additional Data | 100GB Data Pack | 1 | $20.00 | $20.00 |

| Subtotal | $140.00 | |||

| Taxes | Sales Tax (7.5%) | $10.50 | ||

| Grand Total | $150.50 | |||

Conclusion

An itemized billing statement is an invaluable tool for financial management and expense tracking. Whether you are a business owner or an individual, understanding the details of your expenses is essential for making informed decisions and ensuring accuracy in billing. By reviewing and interpreting your itemized billing statement, you can maintain control over your finances, resolve disputes, and plan for the future with confidence.

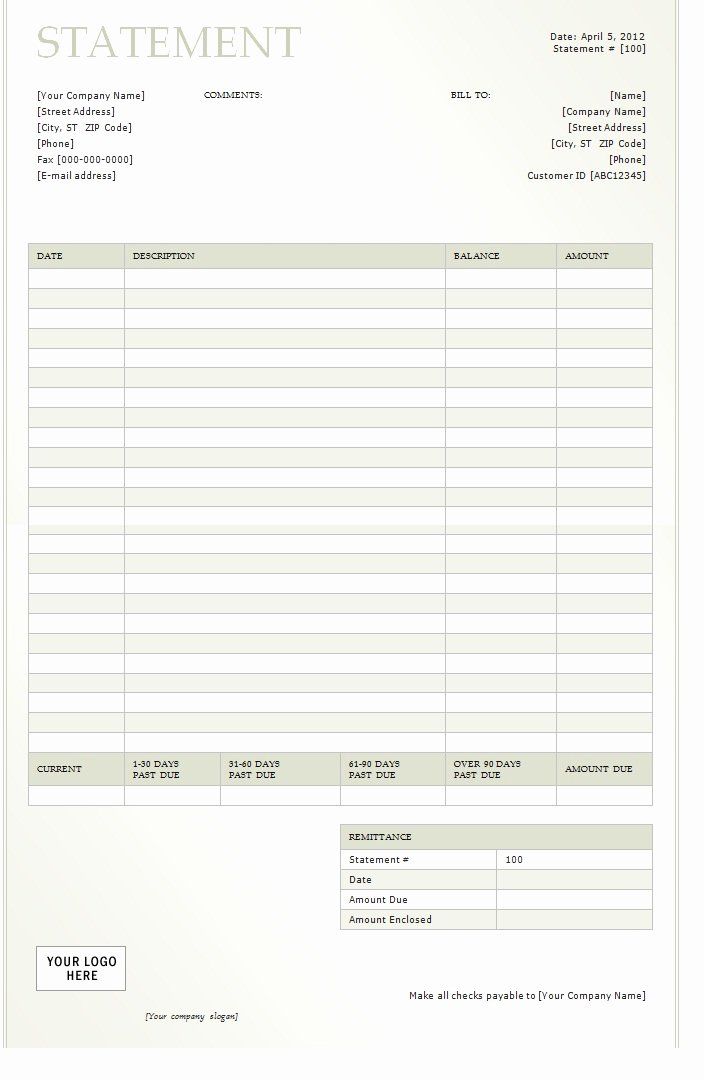

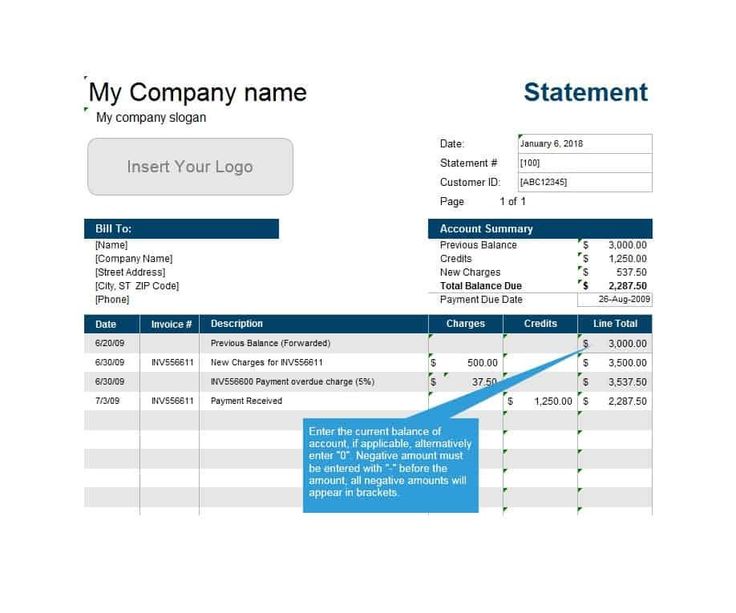

Itemized Billing Statement Template Excel – Download