Keeping track of your monthly expenses, due dates, and payment statuses can be a daunting task. Late fees, missed payments, and financial stress can all be avoided with the help of a bill tracker.

This financial management tool is designed to organize and monitor your bills, ensuring they are paid on time, helping you budget effectively, and ultimately, maintaining financial stability.

What is a Bill Tracker?

A bill tracker is a tool that allows you to monitor and manage your monthly expenses, due dates, and payment statuses in one convenient location. It provides an overview of your cash flow, helping you identify spending patterns, manage debt, and stay on top of your financial obligations.

Why Use a Bill Tracker?

There are numerous benefits to using a bill tracker to manage your finances:

- Prevent Late Fees: By keeping track of due dates and payment statuses, you can ensure bills are paid on time, avoiding costly late fees.

- Aid in Budgeting: A bill tracker offers a comprehensive view of your expenses, enabling you to budget effectively and plan for future financial goals.

- Identify Spending Patterns: By tracking your expenses, you can identify areas where you may be overspending and make adjustments to improve your financial habits.

- Manage Debt: A bill tracker can help you keep track of your debt payments and work towards reducing your overall debt load.

Key Elements of a Bill Tracker

When choosing a bill tracker tool, there are several key elements to consider:

- User-Friendly Interface: Look for a tool that is easy to navigate and understand, making it simple to input and track your bills.

- Customizable Categories: Choose a bill tracker that allows you to customize categories based on your specific expenses, making it easier to organize and track your bills.

- Reminder Notifications: Opt for a tool that offers reminder notifications for upcoming due dates, ensuring you never miss a payment.

- Reporting Features: Look for a bill tracker that provides reporting features, allowing you to analyze your spending habits and make informed financial decisions.

How to Use a Bill Tracker

Using a bill tracker is simple and straightforward. Here are some tips to help you get started:

- Input Your Bills: Begin by inputting all of your monthly bills into the tracker, including due dates and payment amounts.

- Set Reminders: Utilize the reminder feature to set notifications for upcoming due dates, ensuring you never miss a payment.

- Monitor Your Spending: Regularly review your expenses in the tracker to identify areas where you may be overspending or where adjustments can be made.

- Adjust Your Budget: Use the insights from the tracker to adjust your budget as needed, reallocating funds to meet your financial goals.

Tips for Successful Bill Tracking

To make the most of your bill tracker, consider the following tips:

- Consistent Updates: Make it a habit to update your bill tracker regularly to ensure all information is accurate and up-to-date.

- Stay Organized: Keep all of your bills and financial documents in one central location to make it easier to input information into the tracker.

- Review Regularly: Take time each week to review your expenses and payment statuses in the tracker to stay on top of your financial obligations.

In Conclusion

A bill tracker is a valuable tool for managing your finances and ensuring bills are paid on time. By utilizing a bill tracker, you can prevent late fees, budget effectively, and work towards achieving your financial goals. Remember to choose a tool that meets your specific needs, input all of your bills accurately, and regularly review your expenses to stay on top of your financial obligations.

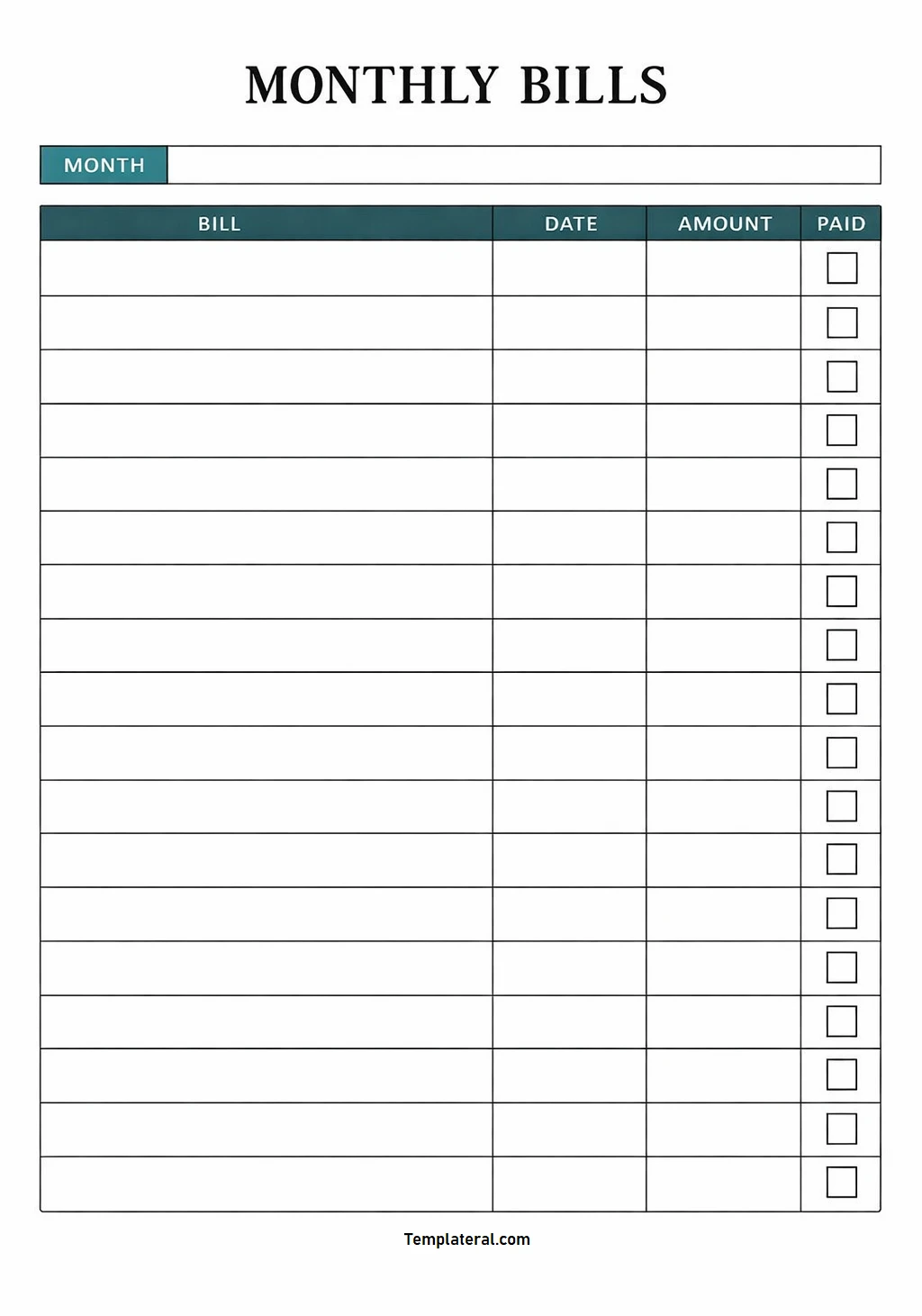

Bill Tracker Template – DOWNLOAD