What Is a Service Invoice?

A service invoice is a vital document that serves as a formal request for payment from a client for services that have already been provided by a business. It acts as a detailed record of the transaction, outlining the services rendered, associated costs, payment terms, and due dates.

Service invoices are crucial for maintaining accurate financial records, facilitating clear communication with clients, establishing internal controls, and ensuring compliance with tax regulations.

How Does Service Invoicing Work?

Service invoicing is a systematic process that involves several steps from the completion of services to the receipt of payment. Understanding how service invoicing works can help businesses streamline their invoicing process and ensure timely payment for services rendered.

Step 1: Completion of Services

The first step in the service invoicing process is the completion of the services agreed upon with the client. Once the services have been provided in full accordance with the client’s requirements, the business is ready to create an invoice for the services rendered.

Step 2: Invoice Creation

After completing the services, the business creates a detailed invoice that outlines the services provided, the associated costs, any additional charges, and the payment terms. The invoice should include the business’s contact information, the client’s contact information, a breakdown of services and costs, payment terms, and due dates.

Step 3: Sending the Invoice

Once the invoice has been created, it is sent to the client for payment. Businesses can send invoices via email, mail, or through online invoicing platforms for convenience. It is essential to ensure that the invoice reaches the client promptly to expedite the payment process.

Step 4: Payment Processing

Upon receiving the invoice, the client reviews the details, makes the payment according to the specified terms, and sends confirmation of payment to the business. The business should track payments received, update its financial records accordingly, and follow up on any outstanding payments to maintain cash flow.

Step 5: Record Keeping

After the payment has been processed, the business should maintain accurate records of the invoice, payment received, and any communication related to the transaction. Keeping detailed records helps businesses track revenue, manage cash flow, and comply with financial reporting requirements.

The Role of Invoicing in Professional Services

Professional service industries, such as consulting, freelancing, and creative services, rely heavily on invoicing to facilitate payment for services rendered and maintain financial records. Understanding the role of invoicing in professional services can help businesses in these industries streamline their invoicing processes and improve their financial management.

Building Trust with Clients

In professional service industries, invoicing plays a significant role in building trust and credibility with clients. By providing detailed invoices that outline the services provided, costs incurred, and payment terms, businesses demonstrate transparency and professionalism in their client relationships. This transparency helps foster trust and long-term relationships with clients.

Streamlining Financial Processes

Invoicing is essential for streamlining financial processes in professional service industries. By creating detailed invoices that accurately reflect the services provided and costs incurred, businesses can track revenue, manage cash flow, and comply with financial reporting requirements. Invoicing also helps businesses identify areas for improvement in their service offerings and pricing strategies.

Establishing Payment Terms

Invoicing helps professional service providers establish clear payment terms with clients, ensuring that both parties are in agreement on the cost of services and the timing of payments. By specifying payment terms in the invoice, businesses can avoid misunderstandings or disputes with clients and maintain consistent cash flow to support their operations.

Enhancing Professionalism

Using professional, detailed invoices in professional service industries enhances the overall professionalism of the business. Clients view businesses that provide clear, transparent invoices as reliable and trustworthy partners. By consistently issuing accurate and timely invoices, businesses can reinforce their reputation for professionalism and reliability in the industry.

Improving Cash Flow Management

Invoicing plays a crucial role in improving cash flow management for professional service businesses. By promptly issuing invoices for services rendered and tracking payments received, businesses can ensure a steady flow of revenue to support their operations. Effective cash flow management enables businesses to invest in growth opportunities, manage expenses, and maintain financial stability.

Essential Components of a Service Invoice

When creating a service invoice, it is essential to include several key components to ensure clarity, accuracy, and compliance with financial regulations. Understanding the essential components of a service invoice can help businesses create professional invoices that facilitate timely payment and maintain accurate financial records.

Business Information

The service invoice should include the business’s name, address, phone number, and email address for contact purposes. Including this information ensures that the client can easily identify the business issuing the invoice and contact them with any questions or concerns.

Client Information

Include the client’s name, address, phone number, and email address on the service invoice to specify who the invoice is addressed to. This information helps avoid confusion and ensures that the client knows the invoice is intended for them.

Service Details

The service details section of the invoice should outline the services provided, including a description of each service, the quantity, rate, and total cost for each service. Providing a detailed breakdown of services helps the client understand what they are being billed for and helps the business justify the costs incurred.

Payment Terms

Specify the payment terms on the invoice, including the due date for payment, acceptable payment methods, and any late payment penalties or discounts. Clearly outlining the payment terms helps avoid misunderstandings and ensures that the client knows when and how to remit payment for the services provided.

Additional Charges

If there are any additional charges associated with the services provided, such as taxes, fees, or expenses, be sure to include them on the invoice. Clearly itemizing these additional charges helps the client understand the total cost of the services and ensures transparency in the billing process.

When Should You Send an Invoice?

Sending invoices promptly after completing services is crucial for maintaining a healthy cash flow and ensuring timely payment from clients. Understanding when to send an invoice can help businesses expedite the payment process and avoid delays in receiving payment for services rendered.

Immediately After Service Completion

As a best practice, businesses should send invoices immediately after completing the services agreed upon with the client. Sending invoices promptly demonstrates professionalism, ensures that the client has a clear understanding of the services provided and costs incurred, and expedites the payment process.

For Ongoing Services

For ongoing services that are provided regularly, businesses should send invoices at regular intervals according to the agreed-upon schedule. Sending invoices promptly for ongoing services helps maintain consistent cash flow, allows businesses to track revenue accurately, and ensures that clients are aware of their payment obligations.

Upon Project Milestones

For project-based work with specific milestones or deliverables, businesses should send invoices upon reaching each milestone or completing a deliverable. Sending invoices at project milestones helps businesses track progress, receive timely payments for completed work, and maintain transparency with clients regarding project costs and timelines.

Before Payment Due Dates

It is advisable to send reminders to clients for upcoming payment due dates to prompt timely payments and avoid any delays. Sending invoices before payment due dates allows clients to prepare for the payment and ensures that businesses receive payments on time, maintaining a healthy cash flow.

Regular Invoicing Schedule

Establishing a regular invoicing schedule, such as weekly, bi-weekly, or monthly, helps businesses maintain consistency in sending invoices and ensures that clients receive invoices promptly. A regular invoicing schedule also streamlines the payment process, reduces the risk of missed payments, and helps businesses track revenue accurately.

Upon Completion of Additional Services

If additional services are requested or provided beyond the scope of the initial agreement, businesses should promptly create and send invoices for these additional services. Sending invoices for additional services ensures that all services provided are accurately documented, costs are transparent to the client, and payments are received promptly.

Tips For Faster Payment And Effective Service Invoice Management

Managing service invoices efficiently is essential for businesses to ensure timely payment, maintain cash flow, and establish positive relationships with clients. Implementing best practices and tips for faster payment and effective invoice management can help businesses streamline their invoicing processes and improve financial management.

Set Clear Payment Terms

Clearly outline the payment terms on the invoice, including the due date for payment, acceptable payment methods, and any late payment penalties or discounts. Providing clear payment terms helps avoid misunderstandings and ensures that clients understand their payment obligations.

Follow Up on Overdue Invoices

Monitor payment statuses regularly and follow up promptly on overdue invoices to remind clients of outstanding payments. Sending reminders for overdue invoices can prompt clients to make payments promptly and avoid prolonged delays in receiving payment for services rendered.

Use Invoicing Software

Utilize invoicing software to streamline the invoicing process, track payments, and generate reports on invoicing activities. Invoicing software enables businesses to create professional invoices quickly, monitor payment statuses, and maintain accurate records of all invoicing transactions for financial reporting purposes.

Provide Detailed Descriptions

Include detailed descriptions of the services provided on the invoice to justify the costs and clarify the services rendered to the client. Providing detailed descriptions helps clients understand the value they are receiving, reduces the risk of disputes over charges, and fosters transparency in the invoicing process.

Keep Accurate Records

Maintain accurate records of all invoices issued, payments received, and communication related to invoicing transactions. Keeping detailed records helps businesses track revenue, manage cash flow, and comply with financial reporting requirements. Accurate record-keeping also facilitates efficient invoicing processes and supports internal controls.

Issue Invoices Promptly

Send invoices promptly after completing services to ensure that clients receive timely notification of their payment obligations. Issuing invoices promptly demonstrates professionalism, expedites the payment process, and helps businesses maintain a steady cash flow to support their operations.

Establish Payment Policies

Establish clear payment policies for clients, including expectations for payment terms, late fees, and payment methods. Communicating payment policies upfront helps set expectations with clients, reduces the risk of payment delays, and ensures that clients understand their obligations regarding payment for services rendered.

Offer Multiple Payment Options

Provide clients with multiple payment options, such as credit card, bank transfer, or online payment platforms, to accommodate their preferences and expedite the payment process. Offering various payment options increases convenience for clients, reduces payment barriers, and improves the likelihood of receiving payments promptly.

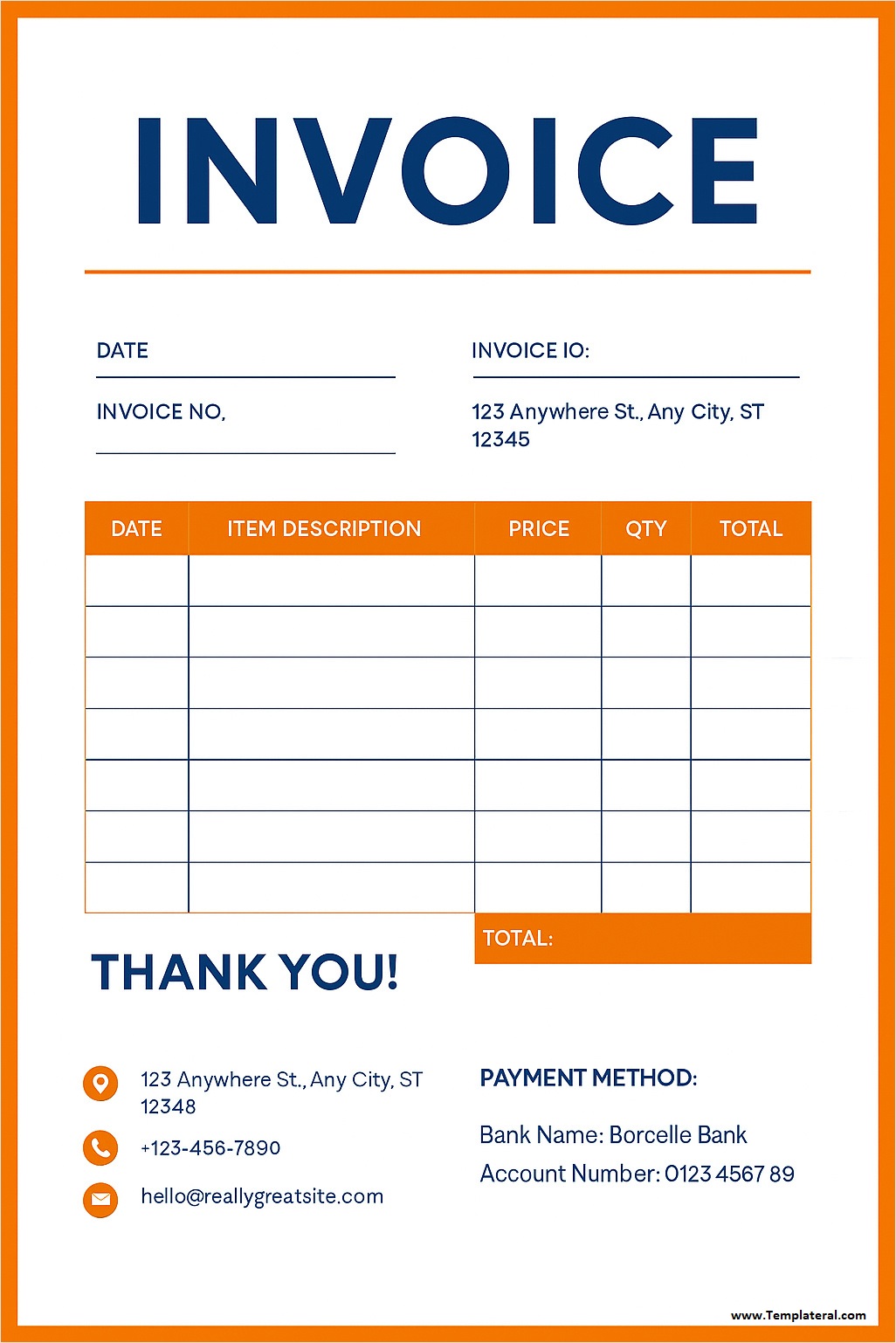

Service Invoice Template

A service invoice is a professional tool for billing clients by clearly listing services provided, hours worked, rates, and total payment due. It helps businesses maintain accurate records while ensuring transparency for clients.

To make invoicing simple and efficient, use our free service invoice template and create polished invoices with ease!

Service Invoice Template – Download