Running a business involves a multitude of expenses, from office supplies to marketing campaigns, travel costs, and employee salaries. Keeping track of all these expenditures can quickly become overwhelming, which is why a business expense spreadsheet is a crucial tool for any company seeking to stay on top of its finances.

In this guide, we’ll explore what a business expense spreadsheet is, the benefits it offers, how to create one, and the best practices for effectively keeping track of your business expenses.

What is a Business Expense Spreadsheet?

A business expense spreadsheet is a digital document that serves as a centralized tool for meticulously tracking, categorizing, and analyzing a company’s expenditures. It acts as a virtual ledger where all expenses are recorded, organized, and stored for future reference. This spreadsheet typically includes columns for date, description, category, amount, and any other relevant information that can help businesses gain insights into their financial activities.

Business expense spreadsheets are designed to provide a comprehensive overview of where a company’s money is being spent. By inputting all expenses into the spreadsheet, businesses can easily track their spending habits, identify trends, and make data-driven decisions to optimize their financial health. This tool is crucial for budget planning, forecasting, and ensuring that businesses stay within their financial limits.

Benefits of a Business Expense Spreadsheet

1. Organization and Clarity

One of the primary benefits of using a business expense spreadsheet is the organization and clarity it provides. By inputting all expenses into a centralized document, businesses can easily track where their money is going, identify any discrepancies, and ensure that all financial information is well-documented and easily accessible.

2. Financial Insight and Decision-Making

Analyzing expense data can provide valuable insights into a company’s financial health and performance. By categorizing and tracking expenses in a spreadsheet, businesses can make informed decisions about budgeting, resource allocation, and investments. This financial insight is essential for strategic planning and ensuring the long-term sustainability of a company.

3. Optimized Spending and Cost Reduction

By using a business expense spreadsheet to track and categorize expenses, businesses can identify areas of overspending and take steps to optimize their spending. Whether it’s renegotiating contracts with vendors, implementing cost-saving measures, or eliminating unnecessary expenses, the insights gained from the spreadsheet can help businesses reduce costs and improve profitability.

4. Tax Preparation and Compliance

Preparing for tax season can be a daunting task for many businesses. However, with a well-maintained business expense spreadsheet, the process becomes much smoother. By keeping all expenses neatly organized and categorized, businesses can easily generate the necessary reports and documentation needed for tax filing. This not only saves time but also ensures compliance with tax regulations.

How to Create a Business Expenses Spreadsheet

1. Setting Up Your Spreadsheet

Creating a business expense spreadsheet starts with setting up the basic structure of the document. Begin by opening a new spreadsheet in software like Microsoft Excel or Google Sheets and creating columns for date, description, category, amount, and any additional fields you want to track.

2. Customizing Your Categories

One of the key aspects of creating a business expense spreadsheet is customizing the categories to align with your business’s specific needs. Consider creating categories for different types of expenses, such as office supplies, travel, utilities, marketing, and employee salaries, to provide a comprehensive overview of your spending.

3. Inputting Expenses

Once you have set up your spreadsheet and defined your categories, start inputting all your business expenses into the document. Be sure to include details such as the date of the expense, a brief description of the expenditure, the category it belongs to, and the amount spent. This meticulous recording ensures that all expenses are accurately tracked.

4. Creating Formulas and Calculations

To streamline the process of tracking expenses, consider using formulas and calculations in your spreadsheet. Utilize functions such as sum, average, and count to automatically calculate totals, track spending by category, and generate reports that provide valuable insights into your financial activities.

5. Utilizing Templates and Tools

If you’re new to creating business expense spreadsheets or want to save time, consider using templates and tools available online. Many websites offer pre-designed spreadsheet templates specifically for tracking business expenses, which can serve as a convenient starting point for customizing your document.

The Best Way To Keep Track of Business Expenses

1. Consistent Categorization

To ensure the accuracy and reliability of your expense tracking, make sure to categorize expenses consistently. Establish clear guidelines for assigning expenses to specific categories and adhere to them diligently. Consistent categorization not only simplifies the tracking process but also facilitates more accurate analysis of your spending habits.

2. Save and Organize Receipts

Keeping receipts and invoices organized is essential for maintaining a comprehensive record of your expenses. Designate a specific location or folder for storing physical receipts and consider digitizing them for easy access. By saving and organizing receipts, you have a reliable source of documentation in case of audits or financial reviews.

3. Regular Review and Analysis

Set aside time each week or month to review and analyze your expense data. Look for patterns, trends, or anomalies in your spending habits and identify areas where costs can be optimized. Regularly reviewing your expenses allows you to make timely adjustments, stay within budget, and make informed financial decisions for your business.

4. Cloud Storage and Backup

Consider storing your business expense spreadsheet in the cloud to ensure it’s accessible from anywhere and backed up regularly. Cloud storage provides added security for your financial data and protects against the risk of losing important information due to hardware malfunctions or data corruption. Additionally, cloud-based solutions often offer collaboration features that allow multiple users to access and update the spreadsheet simultaneously.

5. Utilize Mobile Apps for Expense Tracking

In today’s digital age, there are numerous mobile apps available for tracking business expenses on the go. Consider using expense tracking apps that sync with your business expense spreadsheet, allowing you to record expenses in real-time, capture receipts using your phone’s camera, and categorize expenditures effortlessly. Mobile apps provide convenience and efficiency in managing your business expenses.

5. Training and Education for Employees

If you have employees who incur business expenses on behalf of the company, provide training and education on proper expense tracking practices. Establish clear guidelines and procedures for submitting expenses, saving receipts, and categorizing expenditures. By ensuring that all employees are aligned with the expense tracking process, you can maintain consistency and accuracy in your financial records.

5. Consult with Financial Professionals

For complex financial matters or if you require additional guidance on managing your business expenses, consider consulting with financial professionals such as accountants or financial advisors. These experts can provide insights, recommendations, and best practices for optimizing your expense tracking process, ensuring compliance with regulations, and maximizing your financial efficiency.

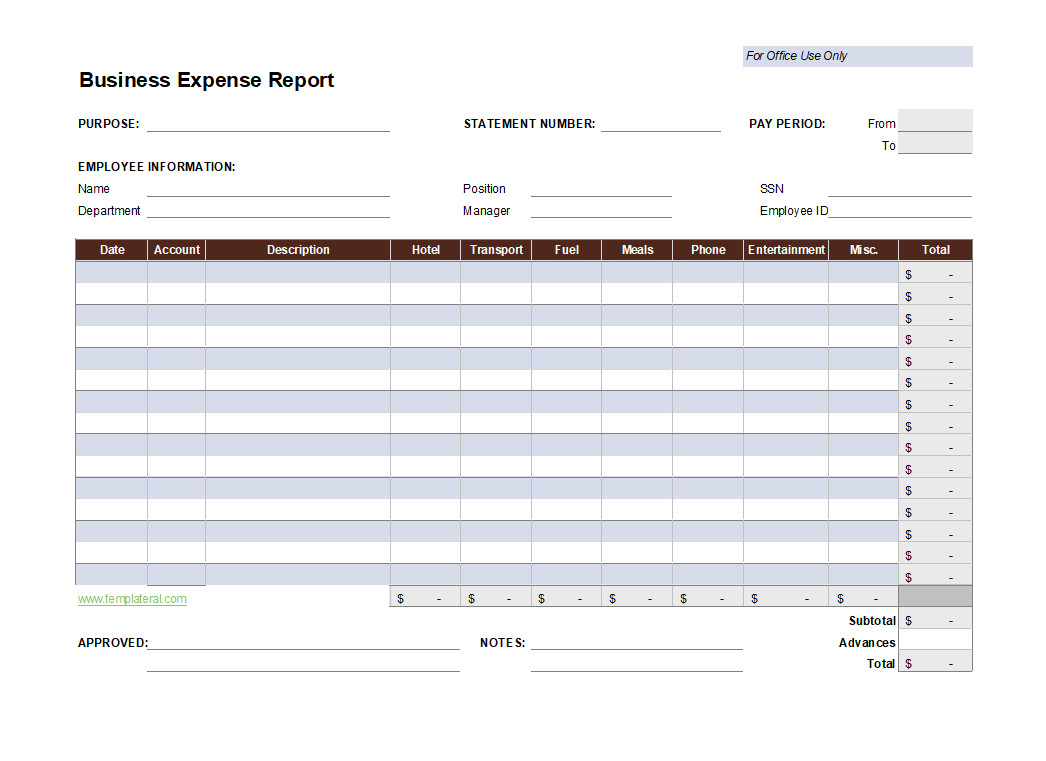

Business Expense Spreadsheet Template

Start using our free business expense spreadsheet template today to track spending accurately, manage your budget effectively, and keep your financial records organized.

Business Expense Spreadsheet Template – Excel