In today’s financial landscape, the demand for proof of income letters has become increasingly significant. These documents play a crucial role in verifying an individual’s employment status and income.

Whether you’re applying for a rental property, a loan, or a line of credit, having a solid proof of income letter can make all the difference in demonstrating your financial stability and reliability.

What Is a Proof of Income Letter?

A proof of income letter is an official document issued by an employer to verify an individual’s income and employment status. It typically includes key details such as the employee’s job title, salary, start date, and any other relevant financial information that demonstrates their earning capacity.

This letter assures third parties—such as landlords, lenders, or financial institutions—about the individual’s financial stability. It helps these entities assess creditworthiness and make informed decisions regarding lease approvals, loan applications, or other financial commitments. In short, a proof of income letter acts as a reliable validation of someone’s income source and financial reliability.

Why Proof of Income is Essential for Financial Institutions?

1. Evaluating Creditworthiness

When individuals apply for loans or credit, financial institutions use proof of income to evaluate their creditworthiness. By verifying the individual’s income, lenders can determine the individual’s ability to repay borrowed funds. A stable income is a key factor in determining the individual’s credit risk and likelihood of default. Proof of income helps lenders assess the individual’s financial situation and make informed lending decisions.

2. Mitigating Financial Risk

Financial institutions use proof of income to mitigate financial risk and protect their interests. By verifying an individual’s income source, lenders can reduce the likelihood of default on loans or credit. This helps maintain a healthy lending portfolio and ensures that financial institutions can continue to provide financial services to individuals and businesses. Proof of income is a valuable tool in managing financial risk and safeguarding the stability of financial institutions.

Accepted Documents for Income Verification

1. Pay Stubs

Pay stubs are one of the most common documents accepted for income verification. These documents provide detailed information about an individual’s earnings, deductions, and pay period. Pay stubs offer a snapshot of the individual’s income and help verify their financial stability. Lenders and landlords often request pay stubs as proof of income when assessing an individual’s creditworthiness and rental affordability.

2. Employment Verification Letter

An employment verification letter is a formal document provided by an employer that confirms an individual’s job title, salary, and employment status. This letter serves as official validation of the individual’s income source and helps verify their financial stability. Lenders and landlords rely on employment verification letters to assess an individual’s ability to meet their financial obligations and make informed decisions regarding loans, credit, or rentals.

3. Tax Returns

Tax returns are another valuable document accepted for income verification. Copies of tax returns provide a comprehensive overview of an individual’s income over a specific period, including sources of income, deductions, and tax liabilities. Tax returns offer detailed insights into an individual’s financial situation and help lenders and landlords assess their creditworthiness and rental affordability. Individuals can provide tax returns as proof of income when applying for loans, credit, or rentals.

4. Bank Statements

Bank statements are commonly used to verify an individual’s income source and track financial transactions. These documents show regular income deposits, expenses, and other financial activities, providing a detailed record of the individual’s financial situation. Lenders and landlords may request bank statements as proof of income to assess an individual’s financial stability and credibility. Bank statements help verify an individual’s ability to meet their financial obligations and make timely payments on loans, credit, or rent.

5. Profit and Loss Statements

For self-employed individuals, profit and loss statements are essential for demonstrating their business income and financial stability. These documents show the individual’s revenue, expenses, and net income over a specific period, providing insights into their financial situation. Lenders and landlords may request profit and loss statements as proof of income to assess the individual’s creditworthiness and rental affordability. Profit and loss statements help self-employed individuals establish their income source and financial stability when applying for loans, credit, or rentals.

6. Social Security Award Letter

Individuals receiving social security benefits can provide a social security award letter as proof of income. This official document confirms the individual’s eligibility for social security benefits and the amount they receive each month. Lenders and landlords may accept social security award letters as proof of income to assess the individual’s financial stability and credibility. Social security award letters help verify an individual’s income source and demonstrate their ability to meet their financial obligations when applying for loans, credit, or rentals.

7. Rental Agreements

Landlords may accept rental agreements as proof of rental income for individuals who own rental properties. These agreements outline the terms and conditions of the rental property, including the monthly rent amount, lease duration, and other relevant details. Rental agreements help landlords assess the individual’s rental income and verify their ability to meet their financial obligations. Individuals who own rental properties can provide rental agreements as proof of income when applying for loans, credit, or other financial transactions.

8. Alimony or Child Support Documents

Individuals receiving alimony or child support payments can provide documentation to confirm their additional income. These documents show the amount of alimony or child support received each month, providing evidence of the individual’s financial situation. Lenders and landlords may accept alimony or child support documents as proof of income to assess the individual’s overall financial stability and credibility. Alimony or child support documents help verify an individual’s income source and demonstrate their ability to meet their financial obligations when applying for loans, credit, or rentals.

How to Write a Proof of Income Letter

Crafting a compelling proof of income letter requires attention to detail and clarity. This document serves as a formal confirmation of an individual’s income and employment status, so it’s essential to include specific information that accurately reflects the individual’s financial situation. Here are some tips for writing an effective proof of income letter:

1. Include Detailed Information

When drafting a proof of income letter, be sure to include detailed information about the individual’s income and employment. Specify the individual’s full name, job title, salary, and the frequency of payment. Include any additional income sources such as bonuses or commissions, as well as the duration of the employment relationship. Providing specific details helps verify the individual’s financial stability and credibility.

2. Use Official Letterhead

Write the proof of income letter on the company’s official letterhead to add credibility to the document. Using official letterhead conveys professionalism and authenticity, making the letter more compelling to recipients. Including the company logo, contact information, and other branding elements can further enhance the document

3. Be Clear and Concise

When writing a proof of income letter, it’s important to be clear and concise in your communication. Clearly state the purpose of the letter and include all necessary information straightforwardly. Avoid using jargon or technical language that may confuse the recipient. Present the information in a logical sequence to make it easy for the reader to understand and verify the individual’s income and employment status.

4. Provide Contact Information

Include contact information for the employer in the proof of income letter. This allows the recipient to verify the authenticity of the letter and contact the employer if necessary. Providing accurate contact information, such as the employer’s phone number or email address, adds credibility to the document and helps establish trust with the recipient. Be sure to double-check the contact details to ensure accuracy and accessibility.

5. Sign and Date the Letter

Ensure that the proof of income letter is signed and dated by an authorized representative of the company. This adds validity to the document and confirms that the information provided is accurate and current. The signature and date also serve as a form of authentication, indicating that the letter has been reviewed and approved by the employer. Including a signature and date enhances the document’s credibility and reliability.

6. Customize the Letter

Tailor the proof of income letter to the specific requirements of the recipient. Customize the content to address the recipient’s needs and provide relevant information that supports the individual’s income and employment status. Personalizing the letter shows attention to detail and demonstrates the individual’s commitment to meeting the recipient’s expectations. By customizing the letter, individuals can increase the likelihood of success in their financial transactions.

7. Proofread and Edit

Before finalizing the proof of income letter, make sure to proofread and edit the document for accuracy and clarity. Check for spelling and grammar errors, as well as any inconsistencies or inaccuracies in the information provided. Review the letter from the recipient’s perspective to ensure that it effectively conveys the individual’s income and employment status. Taking the time to proofread and edit the letter can help avoid misunderstandings and present a polished and professional document.

8. Seek Professional Assistance

If you’re unsure about how to craft a compelling proof of income letter, consider seeking professional assistance. Consult with human resources or legal professionals who can guide on drafting an effective letter. They can offer valuable insights and ensure that the letter meets the requirements for verification of income and employment status. Seeking professional assistance can help individuals create a strong and persuasive proof of income letter that enhances their credibility and financial stability.

9. Follow Up

After submitting the proof of income letter, it’s important to follow up with the recipient to ensure that they have received and reviewed the document. Follow up on time to confirm that the letter has met their requirements and address any additional questions or concerns they may have. Maintaining open communication with the recipient demonstrates professionalism and a commitment to meeting their needs. By following up, individuals can ensure that the proof of income letter has served its intended purpose and provided the necessary verification of income and employment status.

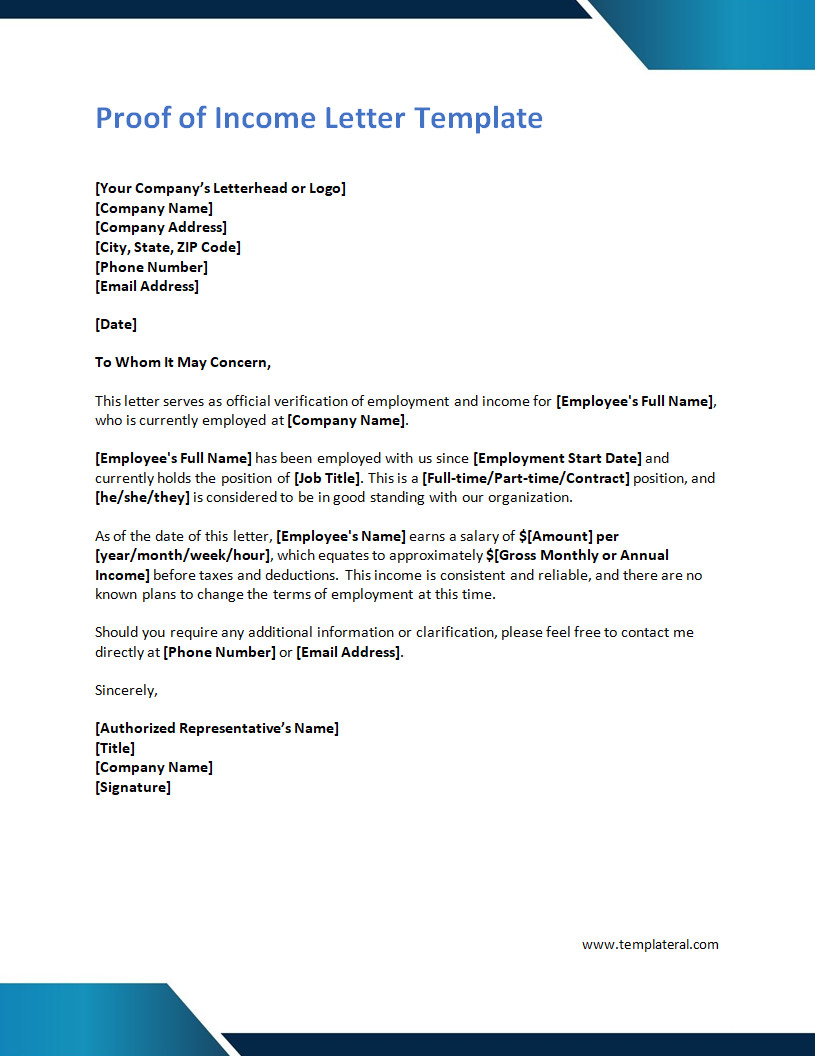

Proof of Income Letter Template

A proof of income letter is a vital document when applying for loans, renting a home, or verifying employment. It clearly outlines your income source, amount, and consistency, offering credibility and reassurance to landlords, lenders, or agencies.

Download our free proof of income letter template today to simplify the verification process. Professional, customizable, and suitable for employees, freelancers, and business owners—ready to print or send digitally.

Proof of Income Letter Template – Download