What Is a Letter of Intent?

A Letter of Intent (LOI) is a non-binding document that outlines the key terms and conditions of a potential business transaction. It serves as a preliminary agreement between the buyer and the seller, setting the stage for more detailed negotiations and the drafting of a formal contract.

The LOI is a crucial tool in the acquisition process, providing a roadmap for both parties as they navigate the complexities of buying and selling a business.

Purpose of a Letter of Intent

Establishing a Framework for Negotiations

One of the primary purposes of a Letter of Intent is to establish a framework for negotiations between the buyer and the seller. By outlining the key terms of the potential transaction, the LOI helps to define the scope of the deal and create a starting point for further discussions. This framework can help to streamline the negotiation process, making it easier for both parties to reach a mutually agreeable agreement.

Clarifying Intentions and Expectations

Another important purpose of a Letter of Intent is to clarify the intentions and expectations of both the buyer and the seller. By clearly outlining the terms of the deal, including the purchase price, payment terms, and other key details, the LOI helps to ensure that both parties are on the same page. This clarity can help to prevent misunderstandings or disagreements later on in the process, fostering a more positive and productive negotiation environment.

Minimizing Misunderstandings

One of the main benefits of using a Letter of Intent is that it helps to minimize misunderstandings between the buyer and the seller. By clearly documenting the key terms of the transaction, the LOI reduces the likelihood of miscommunication or confusion during the negotiation process. This can help to build trust between the parties and create a more efficient and effective deal-making environment.

Providing a Roadmap for the Acquisition Process

By serving as a roadmap for the acquisition process, the Letter of Intent provides a structured outline of the steps that need to be taken to complete the transaction. This roadmap can help to keep both parties on track and ensure that the deal progresses smoothly and efficiently. The LOI can also help to identify potential roadblocks or issues early on, allowing the parties to address them before they become major obstacles.

Pros and Cons of Using an LOI in Business Acquisitions

Pros of Using a Letter of Intent

- Establishes Clear Terms: By outlining the key terms of the potential transaction, the LOI helps to establish clear expectations for both parties.

- Facilitates Negotiations: The LOI provides a structured framework for negotiations, making it easier for both parties to reach a mutually agreeable deal.

- Helps to Avoid Misunderstandings: By clarifying the intentions and expectations of both parties, the LOI helps to reduce the likelihood of misunderstandings or disputes.

- Guides Due Diligence Process: The LOI can serve as a roadmap for the due diligence process, ensuring that both parties are aware of the steps that need to be taken to complete the transaction.

Cons of Using a Letter of Intent

- Not Legally Binding: One of the main drawbacks of using a Letter of Intent is that it is not legally binding, meaning that either party can back out of the deal without penalty.

- Potential for Delays: In some cases, the use of an LOI can lead to delays in the deal process, as both parties may need to negotiate additional terms or conditions before moving forward.

- Risk of Confusion: If not drafted carefully, a Letter of Intent can create confusion or misunderstandings between the buyer and the seller, leading to potential disputes or disagreements.

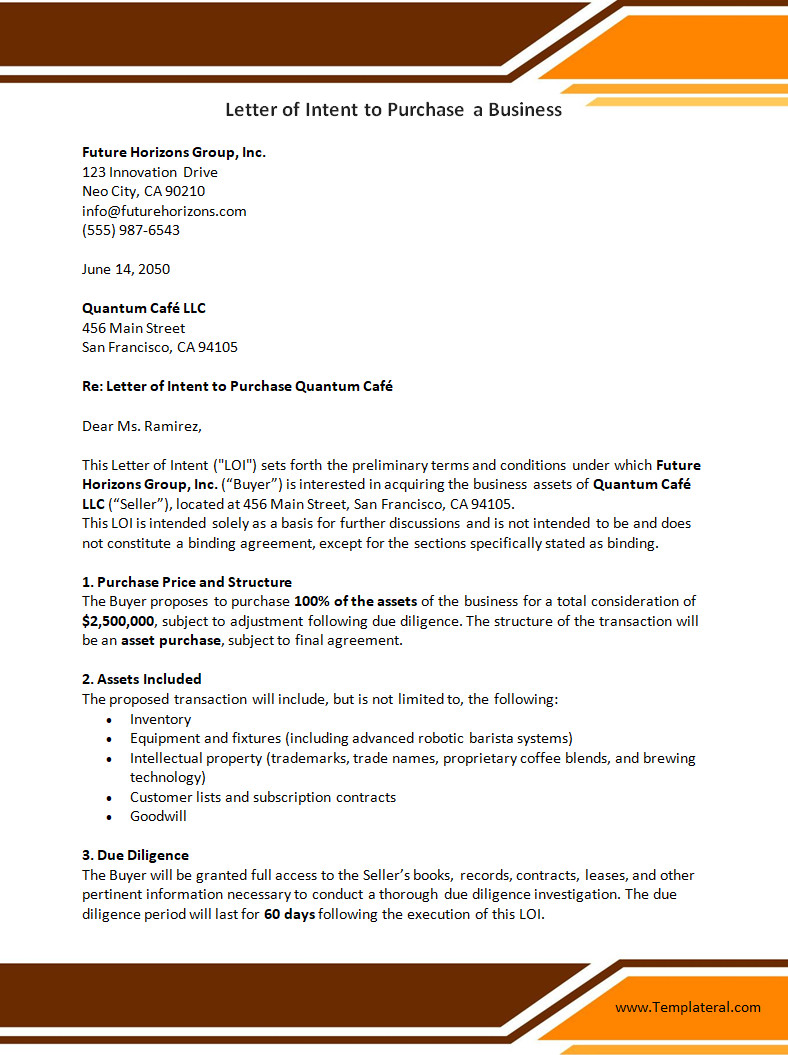

What Should a Letter of Intent Include?

Identification of the Parties

One of the first things that should be included in a Letter of Intent is the identification of the parties involved in the transaction. This should include the full legal names of both the buyer and the seller, as well as their contact information and any relevant business details. Clearly identifying the parties helps to ensure that there is no confusion about who is involved in the deal.

Purchase Price and Payment Terms

Another key component of a Letter of Intent is the purchase price and payment terms for the transaction. The LOI should clearly outline the proposed purchase price for the business, as well as any details regarding payment, such as whether the buyer will be paying in cash, through financing, or through installment payments. Including these details helps to set expectations and avoid misunderstandings later on.

Assets and Liabilities

The Letter of Intent should also specify which assets and liabilities will be included in the transaction. This may include tangible assets such as equipment and inventory, as well as intangible assets such as intellectual property or customer contracts. Clearly defining which assets and liabilities are part of the deal helps to prevent disputes over ownership or responsibility after the transaction is completed.

Due Diligence

A Letter of Intent needs to establish a timeline and process for conducting due diligence on the business. Due diligence is a critical step in the acquisition process, allowing the buyer to assess the financial health and legal standing of the business before finalizing the deal. By including provisions for due diligence in the LOI, both parties can ensure that this process is completed in a timely and efficient manner.

Confidentiality

Another important component of a Letter of Intent is confidentiality provisions. The LOI should include clauses that protect the confidential information of both parties, ensuring that sensitive business details are not disclosed to third parties without permission. Confidentiality provisions help to build trust between the buyer and the seller and protect valuable business information from being misused or shared inappropriately.

Exclusivity

Determining whether the buyer will have exclusive rights to negotiate with the seller for a specified period of time is also an important consideration in a Letter of Intent. Exclusivity provisions prevent the seller from negotiating with other potential buyers during the specified period, giving the buyer time to conduct due diligence and finalize the deal without competition. Including exclusivity agreements in the LOI helps to ensure that the buyer has a fair chance to complete the transaction.

How to Write a Letter of Intent to Purchase a Business

Start with a Clear Introduction

When writing a Letter of Intent to purchase a business, it is important to start with a clear introduction that outlines the purpose of the document and introduces the parties involved. The introduction should set the tone for the rest of the LOI and provide context for the key terms that will be outlined in the document.

Outline the Terms of the Transaction

One of the most important steps in writing a Letter of Intent is to clearly outline the key terms of the transaction. This should include details such as the purchase price, payment terms, assets and liabilities included, and any conditions of the sale. Being specific and detailed in this section helps to ensure that both parties have a clear understanding of what is being proposed and agreed upon.

Include Contingencies

In addition to outlining the key terms of the deal, it is important to include any contingencies that must be met for the transaction to proceed. This may include conditions such as obtaining financing, completing a satisfactory due diligence process, or securing necessary approvals. Including contingencies in the LOI helps to protect both parties and ensure that the deal is only finalized if certain conditions are met.

Set a Timeline

Establishing a timeline for the acquisition process is essential for keeping the deal on track and ensuring that key milestones are met on time. In the Letter of Intent, include deadlines for completing due diligence, finalizing the purchase agreement, and any other important steps in the process. Setting a timeline helps to maintain momentum and avoid unnecessary delays.

Close with a Strong Conclusion

Finally, when writing a Letter of Intent, it is important to close with a strong conclusion that summarizes the key terms agreed upon and outlines the next steps in the process. This conclusion should reiterate the main points of the LOI, confirm the mutual understanding of the terms, and provide clarity on what will happen next. Ending the document with a clear and concise conclusion helps to wrap up the negotiation process and set the stage for moving forward with the deal.

The Legal Aspects of a Letter of Intent

Non-Binding Nature of an LOI

It is important to note that a Letter of Intent is typically a non-binding document, meaning that either party can walk away from the deal without legal consequences. However, while the LOI itself may not be legally enforceable, it sets the stage for the formal contract that will be binding. Therefore, it is crucial to ensure that the terms outlined in the LOI are clear and accurate to avoid misunderstandings later on.

Importance of Legal Review

Despite its non-binding nature, it is highly recommended to have a Letter of Intent reviewed by legal counsel before signing. Legal review can help to identify any potential legal issues or risks associated with the transaction, ensuring that both parties are protected and fully understand the implications of the deal. An experienced attorney can also help to draft the LOI in a way that minimizes potential disputes and maximizes legal clarity.

Enforceability of Certain Provisions

While the main purpose of a Letter of Intent is to outline the key terms of a potential transaction, some provisions within the LOI may be considered legally binding. For example, confidentiality clauses and exclusivity agreements are typically enforceable, even if the rest of the document is non-binding. It is important to clearly delineate which provisions are binding and which are non-binding to avoid confusion and ensure that both parties adhere to their obligations.

Risk Mitigation Strategies

Another important aspect of the legal considerations surrounding a Letter of Intent is the inclusion of risk mitigation strategies. This may include indemnification clauses, representations and warranties, and dispute resolution mechanisms to protect both parties in the event of unforeseen circumstances or disagreements. By including these provisions in the LOI, both parties can minimize potential risks and liabilities associated with the transaction.

Common Mistakes to Avoid in a Letter of Intent

Being Overly Vague

One common mistake in drafting a Letter of Intent is being overly vague or ambiguous in the terms outlined. This can lead to misunderstandings or disputes down the line, as both parties may have different interpretations of what was agreed upon. To avoid this, it is essential to be specific and detailed in outlining the key terms of the deal.

Not Including Key Terms

Another mistake to avoid is not including all the key terms of the transaction in the LOI. Failing to address important details such as the purchase price, payment terms, and assets included can lead to confusion and delays in the negotiation process. It is important to be thorough in documenting all aspects of the deal to ensure a smooth and successful transaction.

Missing Contingencies

Omitting important contingencies in a Letter of Intent is another common mistake that can have significant consequences. Including contingencies such as financing approval, due diligence completion, or regulatory approvals is crucial to protect both parties and ensure that the deal is contingent on certain conditions being met. Failure to include these provisions can result in unexpected challenges or breakdowns in the negotiation process.

Skipping Legal Review

One of the most critical mistakes to avoid when drafting a Letter of Intent is skipping legal review. While the LOI may not be legally binding, having it reviewed by legal counsel can help to identify potential risks and ensure that the terms are clear and enforceable. Legal review can also help to protect both parties from legal pitfalls and ensure a smooth and successful transaction.

Not Communicating Clearly

A lack of clear communication in a Letter of Intent can also be a significant mistake. Both parties should ensure that they understand and agree on the terms outlined in the LOI to prevent misunderstandings or disagreements later on. It is essential to maintain open and transparent communication throughout the negotiation process to foster a positive and productive deal-making environment.

Best Practices for Writing a Letter of Intent

Start Early

One of the best practices for writing a Letter of Intent is to start early in the negotiation process. Taking the time to draft a thorough and detailed LOI can help to set the stage for a successful transaction and minimize potential delays or misunderstandings. By starting early, both parties can ensure that all key terms are addressed and agreed upon before moving forward.

Consult with Legal Counsel

Another best practice is to consult with legal counsel throughout the drafting process. An experienced attorney can help to ensure that the terms of the LOI are clear, enforceable, and protect the interests of both parties. Legal counsel can also provide valuable guidance on risk mitigation strategies and help to identify any potential legal issues that may arise during the negotiation process.

Be Specific and Detailed

When writing a Letter of Intent, it is crucial to be specific and detailed in outlining the key terms of the deal. Including specific details such as the purchase price, payment terms, assets included, and contingencies helps to ensure that both parties have a clear understanding of the transaction. Being specific and detailed can also help to prevent misunderstandings and disputes down the line.

Communicate Effectively

Effective communication is essential when drafting a Letter of Intent. Both parties should be transparent and open in their communication, ensuring that they understand and agree on the terms of the deal. Clear and consistent communication throughout the negotiation process can help to build trust between the parties and foster a positive and productive deal-making environment.

Review and Revise

Before finalizing a Letter of Intent, it is important to review and revise the document carefully. Both parties should take the time to ensure that all key terms are accurately reflected in the LOI and that any contingencies or conditions are clearly outlined. Reviewing and revising the document can help to catch any errors or omissions and ensure that both parties are in agreement before signing.

Letter of Intent to Purchase a Business – Word