Starting a business can be an exciting endeavor, but it is crucial to establish clear guidelines and rules from the outset to ensure smooth operations and minimize potential conflicts among owners. One way to achieve this is by creating a business operating agreement, particularly for Limited Liability Companies (LLCs).

This internal document acts as a contract among owners, defining the company’s structure, management, ownership, and operational procedures. By setting out these parameters, the operating agreement provides crucial clarity, prevents future disputes, protects personal assets through limited liability, and allows for customization of rules beyond state defaults.

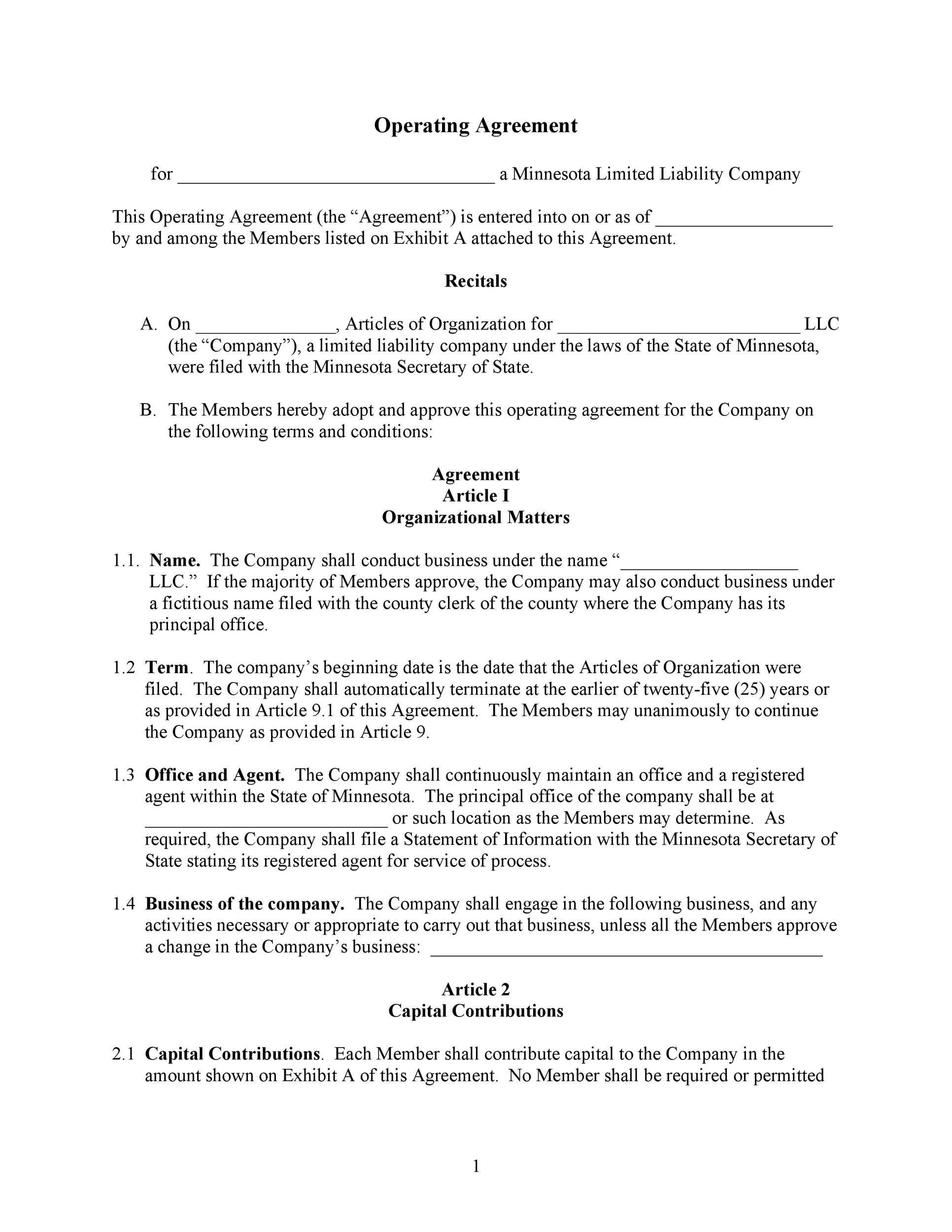

What is a Business Operating Agreement?

A business operating agreement is a legal document that outlines the framework for how an LLC will be managed and operated. This agreement acts as a rulebook for the company, establishing the rights, responsibilities, and relationships of the owners (referred to as members) within the business.

While not all states legally require an operating agreement for LLCs, having one in place is highly recommended to protect the interests of all parties involved.

Why is a Business Operating Agreement Necessary?

Creating a business operating agreement is a proactive step that can help mitigate potential conflicts and uncertainties within an LLC. Without such an agreement in place, owners may find themselves navigating disagreements, misunderstandings, and legal issues that could have been avoided with clear guidelines in writing. The following reasons highlight the necessity of a business operating agreement:

Preventing Future Disputes

One of the primary reasons to establish a business operating agreement is to prevent future disputes among owners. By clearly outlining the rights, responsibilities, and expectations of each member, the operating agreement can help address potential sources of conflict before they escalate. This proactive approach can save time, money, and energy that would otherwise be spent resolving disputes through legal means.

Protecting Personal Assets

Another crucial aspect of the operating agreement is its role in protecting the personal assets of LLC owners through limited liability. Without such an agreement in place, owners may be personally liable for the debts and obligations of the business, putting their personal assets at risk. By establishing clear guidelines for limited liability in the operating agreement, owners can safeguard their financial interests and assets.

Customizing Rules Beyond State Defaults

State laws provide a basic framework for the operation of LLCs, but they may not address all the specific needs and preferences of individual businesses. By creating a business operating agreement, owners can customize rules and provisions to better suit their unique circumstances. This customization allows for greater flexibility in decision-making, profit-sharing, and other operational aspects of the business.

Clarifying Ownership and Management

The operating agreement serves as a roadmap for ownership and management within the LLC, clarifying the roles and responsibilities of each member. By defining ownership interests, voting rights, and decision-making processes, the agreement establishes a clear structure for how the business will be governed. This clarity helps prevent misunderstandings and ensures that all members are on the same page regarding their rights and obligations.

Enhancing Business Stability

Having a business operating agreement in place can enhance the stability of an LLC by providing a framework for decision-making and conflict resolution. When issues arise, the agreement serves as a reference point for resolving disputes and addressing concerns in a structured manner. By promoting transparency and accountability among members, the operating agreement helps maintain a stable and cohesive business environment.

Supporting Long-Term Growth

As an LLC grows and evolves, having a comprehensive operating agreement becomes increasingly important. The agreement can be updated and amended to reflect changes in the business environment, ownership structure, or operational procedures. By adapting the agreement to accommodate growth and expansion, owners can ensure that the company’s governance remains effective and sustainable over the long term.

What to Include in a Business Operating Agreement?

A well-drafted operating agreement should cover a range of essential topics to ensure comprehensive governance and management of the LLC. Some key elements to include in the agreement are:

Ownership Structure

The operating agreement should clearly outline the ownership structure of the LLC, including the ownership interests of each member. This section should specify each member’s percentage of ownership, their capital contributions to the business, and any voting rights associated with their ownership stake. By defining the ownership structure in detail, the agreement helps establish a clear framework for ownership and control within the company.

Management Structure

Defining the management structure of the LLC is another critical component of the operating agreement. This section should outline how the company will be managed, including the roles and responsibilities of each member. It should detail the decision-making processes, organizational hierarchy, and any limitations on the authority of certain members. By clarifying the management structure, the agreement helps ensure effective governance and operational efficiency.

Profit and Loss Allocation

The operating agreement should address how profits and losses will be allocated among members of the LLC. This section should outline the criteria for distributing profits, such as the percentage of ownership or other factors that may influence profit-sharing. It should also specify how losses will be apportioned and whether members have any liability beyond their capital contributions. By establishing clear guidelines for profit and loss allocation, the agreement helps prevent misunderstandings and disputes over financial matters.

Voting Rights

Detailing the voting rights of each member is essential for decision-making within the LLC. The operating agreement should specify how votes will be cast, what constitutes a quorum for important decisions, and any voting restrictions that may apply. It should also outline how major decisions will be made, such as amending the operating agreement or approving significant business transactions. By clarifying voting rights in writing, the agreement ensures that all members understand their role in the decision-making process.

Member Responsibilities

Defining the responsibilities of each member is crucial for effective governance and operational success. The operating agreement should outline the duties and obligations of each member, including their roles within the company and any specific tasks they are responsible for. It should also address issues such as member contributions, attendance requirements, and performance expectations. By clearly defining member responsibilities, the agreement helps establish accountability and promote cooperation among owners.

How to Draft a Business Operating Agreement

When creating a business operating agreement, it is advisable to seek the assistance of a legal professional with experience in business law to ensure that the document is comprehensive and legally sound. While templates and online resources can be helpful starting points, each operating agreement should be tailored to the specific needs and circumstances of the LLC.

Conducting Thorough Discussions with Members

One of the first steps in drafting an operating agreement is to conduct thorough discussions with all members of the LLC. This process involves addressing each member’s concerns, priorities, and expectations for the agreement. By soliciting input from all stakeholders, owners can ensure that the agreement reflects the collective interests of the group and promotes consensus among members.

Documenting Agreed-Upon Terms and Provisions

After gathering input from all members, the next step is to document the agreed-upon terms and provisions in the operating agreement. This includes specifying ownership percentages, management roles, profit-sharing arrangements, voting rights, and other key aspects of the business. By clearly outlining these details in writing, the agreement serves as a reference point for how the LLC will be governed and operated.

Reviewing and Finalizing the Agreement

Once the operating agreement has been drafted, it should be carefully reviewed by all members and legal counsel to ensure accuracy and completeness. This review process may involve identifying any areas of ambiguity, addressing potential conflicts or inconsistencies, and making any necessary revisions. It is essential to finalize the agreement only after all parties are satisfied with its contents and have had the opportunity to provide input.

Regularly Reviewing and Updating the Agreement

While the operating agreement serves as a foundational document for the LLC, it is important to recognize that business circumstances may change over time. As such, the agreement should be regularly reviewed and updated to reflect any changes in the company’s structure, ownership, or operational procedures. By keeping the agreement current, owners can ensure that it remains an accurate reflection of the business’s governance and management practices.

Tips for Successful Business Operations with an Operating Agreement

Once a business operating agreement is in place, there are several strategies that owners can implement to maximize its effectiveness and promote smooth operations within the LLC. The following tips offer guidance for successful business operations with an operating agreement:

Communicate Openly

Fostering clear and open communication among members is essential for maintaining transparency and alignment within the LLC. By promoting a culture of openness and collaboration, owners can ensure that all stakeholders are informed and engaged in decision-making processes. Regular communication can help prevent misunderstandings and promote a shared vision for the company’s success.

Adhere to the Agreement

Respecting the terms and provisions outlined in the operating agreement is crucial for maintaining trust and accountability within the organization. Owners should adhere to the guidelines outlined in the agreement and refrain from deviating from established protocols without proper consideration and consensus. By upholding the agreement, owners demonstrate their commitment to operating the business fairly and consistently.

Regularly Review and Update

Keeping the operating agreement current is essential for ensuring that it remains relevant and reflective of the LLC’s operations. Owners should schedule regular reviews of the agreement to identify any necessary updates or revisions based on changes in the business environment or ownership structure. By proactively reviewing and updating the agreement, owners can avoid potential conflicts and ensure that it continues to support the company’s goals and objectives.

Seek Legal Guidance

Consulting with legal professionals when drafting or amending the operating agreement can provide valuable insight and guidance on best practices for compliance and risk management. Legal counsel can help owners navigate complex legal requirements, identify potential pitfalls, and ensure that the agreement aligns with relevant laws and regulations. By seeking expert advice, owners can enhance the effectiveness and enforceability of the operating agreement.

Use the Operating Agreement as a Guide

Referring to the operating agreement as a guide for resolving conflicts, making decisions, and clarifying responsibilities can help owners navigate challenges and uncertainties more effectively. By using the agreement as a reference point, owners can promote consistency and fairness in their decision-making processes and ensure that all members are held accountable to the same standards. The operating agreement serves as a roadmap for the LLC’s governance and helps maintain order and structure within the organization.

Business Operating Agreement Template – DOWNLOAD