What Is A Credit Card Authorization Form?

A credit card authorization form is a document that serves as written permission from a customer to a merchant to charge their credit card for goods or services. It is commonly used in situations where the cardholder is not physically present, such as online or over-the-phone transactions. The form includes essential details such as the cardholder’s name, credit card number, expiration date, CVV code, billing address, and the amount to be charged. By signing the form, the cardholder grants the merchant permission to process the payment securely.

How Does Card Authorization Work?

1. Verification Process

Upon receiving a credit card authorization form from a customer, the merchant enters the cardholder’s information into their payment processing system. The system then communicates with the cardholder’s bank to verify the validity of the card and the availability of funds for the transaction. This verification process is essential to ensure that the transaction is legitimate and that the merchant has the authorization to charge the card for the specified amount.

2. Communication with Issuing Bank

During the card authorization process, the merchant’s payment processor sends a request to the issuing bank to approve the transaction. The bank checks the cardholder’s account for sufficient funds and verifies that the card has not been reported lost or stolen. If the authorization is successful, the bank provides an approval code to the merchant, allowing them to proceed with charging the card. This real-time communication between the merchant, payment processor, and issuing bank ensures the security and accuracy of the transaction.

3. Authorization Codes

Authorization codes play a vital role in the card authorization process, as they indicate whether a transaction has been approved or declined. When a customer’s credit card is charged, the merchant’s payment processor generates a unique authorization code that confirms the transaction’s approval. This code acts as proof that the issuing bank successfully authorized the payment and provides a reference for future inquiries or disputes. Without a valid authorization code, a transaction may be declined or flagged for further investigation.

4. Risk Management

By utilizing a secure card authorization process, merchants can effectively manage the risk associated with fraudulent transactions and chargebacks. Verifying the cardholder’s information and obtaining explicit authorization through a credit card authorization form helps protect merchants from unauthorized charges and potential losses. Additionally, monitoring authorization rates and tracking transaction data can help businesses identify and address any suspicious activities or discrepancies in payment processing.

Why Do Credit Card Authorization Rates Matter To Small Businesses?

1. Financial Impact

For small businesses, credit card authorization rates have a direct impact on cash flow and profitability. High authorization rates indicate that a business is effectively processing payments and minimizing the risk of chargebacks. By optimizing their authorization rates, small businesses can ensure that a higher percentage of transactions are approved, leading to increased revenue and improved financial stability. Monitoring and improving authorization rates are essential for small businesses to thrive in a competitive market.

2. Customer Trust

Maintaining high credit card authorization rates is essential for building and maintaining customer trust. When customers see that their transactions are consistently approved and processed quickly, they are more likely to continue doing business with the merchant. By providing a secure and efficient payment experience, small businesses can instill confidence in their clientele and foster long-term relationships. Trustworthy payment processes contribute to positive customer experiences and encourage repeat business and referrals.

3. Fraud Prevention

Effective credit card authorization practices are a critical component of fraud prevention for small businesses. By implementing strict verification procedures and using credit card authorization forms, merchants can reduce the risk of fraudulent transactions and unauthorized charges. Monitoring authorization rates can help businesses identify any suspicious activities or patterns that may indicate potential fraud. Preventing fraud not only protects the business from financial losses but also preserves its reputation and credibility among customers.

4. Regulatory Compliance

Small businesses must comply with industry regulations and payment card security standards to protect customer data and maintain trust. By prioritizing credit card authorization rates and following best practices for secure transactions, businesses can demonstrate their commitment to safeguarding sensitive information. Adhering to regulatory requirements not only reduces the risk of penalties or fines but also enhances the business’s reputation as a trustworthy and responsible service provider.

Do Credit Card Authorization Forms Help Prevent Chargeback Abuse?

Credit card authorization forms help prevent chargeback abuse by requiring customers to give clear consent for charges. Signed forms confirm the customer agreed to the transaction and can be used as evidence in disputes. This helps businesses avoid false chargebacks and financial losses.

Keeping a signed authorization form is key to stopping chargeback abuse. It provides proof of consent, with details like the signature, card info, and transaction terms. This helps merchants challenge false claims and protect their finances.

In disputes, merchants can use these forms to prove the charge was authorized. The signed document supports the merchant’s case and boosts the chances of a favorable outcome. It helps protect revenue from fraud.

These forms also improve clarity between merchants and customers. They explain the terms upfront, reducing confusion and disputes. Customers value the transparency, which leads to smoother transactions and fewer chargebacks.

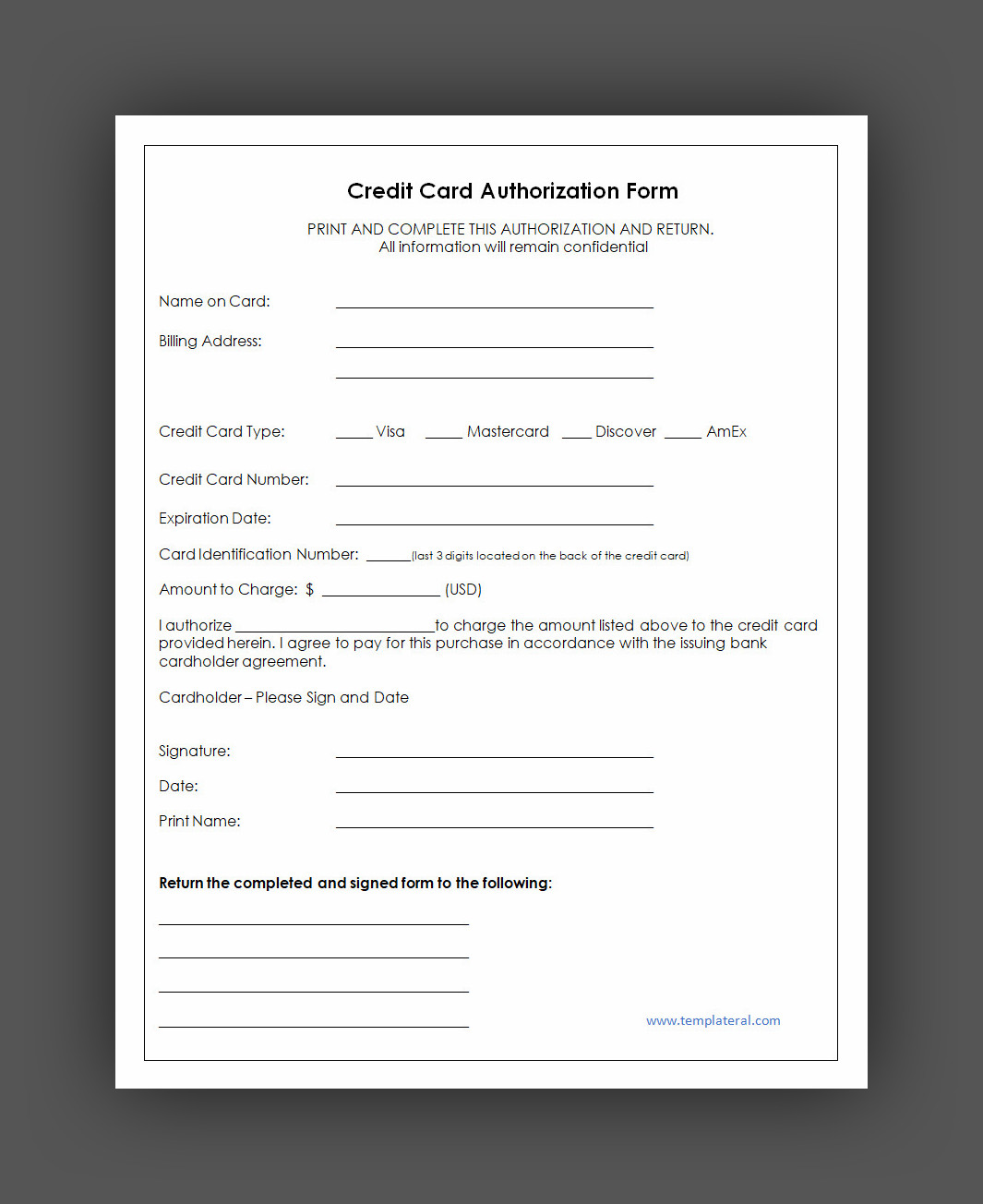

What Is Included In A Credit Card Authorization Form?

1. Cardholder Information

A credit card authorization form typically includes essential details about the cardholder, such as their name, billing address, and contact information. This information helps verify the identity of the cardholder and ensure that the transaction is authorized by the rightful owner of the credit card. Collecting accurate cardholder information is crucial for fraud prevention and compliance with payment card security standards.

2. Credit Card Details

The form also captures specific details about the credit card being used for the transaction, including the card number, expiration date, and CVV code. This information is necessary to process the payment securely and validate the card’s authenticity. By including the credit card details on the form, merchants can verify the card’s legitimacy and ensure that the transaction meets the necessary security requirements.

3. Transaction Amount

Another essential element of a credit card authorization form is the specified transaction amount that the customer authorizes the merchant to charge. Indicating the total dollar amount to be charged helps prevent misunderstandings or disputes about the billing amount. Customers can review and confirm the transaction amount before signing the form, ensuring that they consent to the charges being processed.

4. Authorization Signature

One of the most critical components of a credit card authorization form is the customer’s signature, indicating their consent for the transaction. By signing the form, the customer acknowledges and agrees to the terms of the transaction, including the amount to be charged and the services or products provided. The signature serves as a legally binding agreement between the merchant and the cardholder, providing evidence of the customer’s authorization for the payment.

When Should You Use A Form To Authorize CreditCard Payments?

1. Recurring Payments

Recurring payments, such as subscription services or membership fees, often require authorization forms to facilitate regular billing cycles. By having customers complete a credit card authorization form for recurring payments, merchants can ensure that they have the necessary consent to charge the card regularly. This streamlines the payment process for both the merchant and the customer, eliminating the need for manual authorization for each billing cycle.

2. Reservations

Reservations for services or accommodations, such as hotel bookings or rental car reservations, may also necessitate the use of credit card authorization forms. Customers providing their credit card information on a reservation form authorize the merchant to charge the card for the specified service or booking. This helps secure the reservation and guarantees payment for the service, reducing the risk of no-shows or cancellations without proper compensation.

3. Larger Purchases

For high-value items or services that require upfront payment, using a credit card authorization form is essential to ensure the transaction’s security and validity. By obtaining the customer’s authorization through a formal form, merchants can mitigate the risk of chargebacks or disputes related to larger purchases. Customers can review and confirm the transaction details before providing their consent, establishing a clear agreement between the parties involved.

4. Remote Transactions

Remote transactions, where the cardholder is not physically present to swipe or insert their card, often require credit card authorization forms to verify the legitimacy of the transaction. By collecting the necessary cardholder information and authorization through a form, merchants can securely process payments for remote transactions, such as online purchases or phone orders. This extra layer of security helps protect against fraudulent activities and ensures that only authorized transactions are approved.

5. International Transactions

When conducting international transactions, merchants may encounter additional challenges related to currency exchange rates, cross-border fees, and compliance with foreign regulations. Using a credit card authorization form for international transactions is crucial to ensure that the payment is authorized by the cardholder and meets the necessary security standards. By obtaining explicit consent and verifying the customer’s identity, merchants can minimize risks associated with cross-border payments and enhance the security of international transactions.

6. Subscription Services

Subscription-based services, such as streaming platforms or monthly box subscriptions, rely on recurring payments to maintain customer memberships. By utilizing credit card authorization forms for subscription services, merchants can streamline the billing process and ensure that customers provide consent for regular charges. This practice not only simplifies payment management for both parties but also helps prevent unauthorized cancellations or disruptions to the subscription service.

7. Event Registrations

Event registrations, such as conferences, workshops, or seminars, often require upfront payment to secure a spot at the event. Using credit card authorization forms for event registrations ensures that attendees provide their consent for the registration fee to be charged to their credit card. This process helps event organizers manage registrations efficiently, confirm attendance, and avoid no-shows by securing payments in advance.

8. Professional Services

Professional service providers, such as consultants, freelancers, or contractors, may use credit card authorization forms to secure payments for their services. By having clients complete a form authorizing the charge for professional services rendered, providers can ensure that they receive timely payments for their work. This practice establishes a clear agreement between the service provider and the client, outlining the scope of services and payment terms in advance.

9. Online Purchases

Online retailers and e-commerce businesses rely on credit card authorization forms to process payments securely for online purchases. By capturing the necessary cardholder information and authorization through a form, merchants can verify the legitimacy of the transaction and prevent fraud. Customers feel confident providing their credit card details for online purchases when they know that their information is protected and that the transaction is authorized through a formal process.

10. Phone Orders

Phone orders, where customers provide their credit card information over the phone to place an order, require credit card authorization forms to confirm the transaction’s legitimacy. By documenting the customer’s authorization through a form, merchants can securely process payments for phone orders and verify the cardholder’s consent. This practice helps prevent unauthorized charges and ensures that the transaction is authorized by the rightful cardholder.

Credit Card Authorization Form Template

A credit card authorization form is a key tool for securing payments and reducing the risk of fraud or chargeback disputes. It provides written consent from the cardholder and ensures transparency and protection for both businesses and customers.

Download our free Credit Card Authorization Form Template today to streamline your billing process and protect your transactions. Fully customizable, easy to use, and ideal for one-time or recurring payments—perfect for businesses of any size.

Credit Card Authorization Form Template – Word