Managing your finances can be a daunting task, especially when you’re juggling various expenses and sources of income. This is where a monthly budget planner comes in handy.

By tracking your income and expenses, a budget planner helps you take control of your finances, make informed decisions about spending and saving, and ultimately achieve your financial goals.

Let’s dive into the world of monthly budget planning and explore how it can empower you to build a secure financial future.

What is a Monthly Budget Planner?

A monthly budget planner is a tool that allows you to keep track of your income and expenses over a specific period, usually a month. By recording all your financial transactions, you can gain a clear picture of your financial situation and identify any areas where you may be overspending.

This tool enables you to set realistic financial goals, such as paying off debt, saving for a house, or preparing for unexpected costs, and helps you stay on track to achieve them.

Why Use a Monthly Budget Planner?

There are several compelling reasons to utilize a monthly budget planner to manage your finances:

Financial Clarity

One of the primary benefits of using a monthly budget planner is gaining clarity about your financial situation. By tracking your income and expenses, you can see exactly where your money is going each month. This clarity allows you to make informed decisions about your spending, savings, and long-term financial goals.

Identify Wasteful Spending

A budget planner can help you pinpoint areas where you may be overspending or making unnecessary purchases. By tracking your expenses, you can identify patterns of wasteful spending and make adjustments to ensure that your money is being used wisely.

Set and Achieve Financial Goals

Setting financial goals is essential for building a secure financial future. A budget planner enables you to establish realistic goals based on your income and expenses. Whether you’re saving for a down payment on a house, paying off student loans, or building an emergency fund, a budget planner can help you track your progress and stay motivated.

Prepare for Unexpected Costs

Life is full of surprises, and unexpected expenses can quickly derail your budget if you’re not prepared. A monthly budget planner helps you set aside funds for emergencies, such as car repairs, medical bills, or home maintenance. By planning for the unexpected, you can avoid financial stress and stay on track with your financial goals.

Reduce Financial Stress

Money problems are a common source of stress for many people. By using a monthly budget planner to track your finances, you can gain peace of mind knowing that you’re in control of your money. Budgeting can help you avoid the anxiety and uncertainty that often accompany financial instability, allowing you to focus on other aspects of your life with confidence.

Build Confidence

Successfully managing your budget can boost your financial confidence and empower you to make better financial decisions. By staying on top of your income and expenses, setting and achieving financial goals, and making informed choices about your money, you can build a solid foundation for your financial future. With each budgeting success, you’ll gain the confidence to tackle larger financial challenges and make smart choices that align with your long-term objectives.

Key Elements of a Monthly Budget Planner

A comprehensive monthly budget planner typically includes the following key elements:

Income Tracking

Income tracking involves recording all sources of income, including your salary, bonuses, freelance earnings, and any other money coming in each month. By keeping a detailed record of your income, you can accurately assess your financial resources and plan your budget accordingly.

Expense Tracking

Expense tracking is a critical component of budget planning. It involves logging all your expenses, from fixed costs like rent and utilities to variable expenses like groceries, dining out, and entertainment. By categorizing and tracking your expenses, you can identify areas where you may be overspending and make adjustments to align your spending with your financial goals.

Category Allocation

Dividing your expenses into categories is a helpful way to organize your budget and understand where your money is going. Common expense categories include housing, transportation, food, utilities, entertainment, savings, and debt repayment. By allocating your income to these categories, you can prioritize essential expenses, save for the future, and track your progress towards achieving your financial goals.

Goal Setting

Setting financial goals is an essential part of budget planning. Whether you’re saving for a major purchase, paying off debt, or building an emergency fund, establishing clear objectives can help you stay motivated and focused on your financial priorities. Your budget planner should include specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with your values and long-term aspirations.

Savings Plan

A savings plan is crucial for building financial security and achieving your long-term goals. Your budget planner should include a dedicated section for savings, where you allocate a portion of your income towards savings or investments. Whether you’re saving for retirement, a vacation, or a rainy day fund, consistent contributions to your savings account can help you build wealth and prepare for the future.

Debt Repayment

If you have outstanding debt, such as credit card balances, student loans, or a mortgage, debt repayment should be a priority in your budget planner. Allocating funds towards debt repayment can help you reduce interest charges, improve your credit score, and ultimately achieve financial freedom. By creating a debt repayment plan and sticking to it, you can eliminate debt systematically and work towards a debt-free future.

How to Use a Monthly Budget Planner

Utilizing a monthly budget planner effectively involves the following steps:

Gather Financial Information

When starting with a monthly budget planner, the first step is to gather all relevant financial information. This includes collecting your pay stubs, bank statements, bills, receipts, and any other documentation related to your income and expenses. Having a clear understanding of your financial situation will help you create an accurate and realistic budget.

Create Categories

Once you have all your financial information in hand, the next step is to categorize your expenses. Divide your spending into categories such as housing, transportation, food, utilities, entertainment, savings, and debt repayment. Organizing your expenses in this way will allow you to see where your money is going and identify areas where you can cut back or reallocate funds.

Set Realistic Goals

Setting realistic financial goals is essential for staying motivated and on track with your budget. Whether your goal is to save for a vacation, pay off a credit card, or build an emergency fund, make sure your goals are specific, measurable, achievable, relevant, and time-bound. Having clear objectives will help you prioritize your spending and make informed financial decisions.

Track Transactions

Consistently tracking your income and expenses is key to maintaining an effective budget. Record all your financial transactions in your budget planner, including income sources, bills, purchases, and savings contributions. By staying on top of your transactions, you can ensure that your budget remains accurate and up-to-date, allowing you to make informed decisions about your money.

Review Regularly

Regularly reviewing your budget is essential for staying on track with your financial goals. Set aside time each month to review your budget planner, compare your actual spending to your budgeted amounts, and identify any discrepancies or areas for improvement. By keeping a close eye on your finances, you can make adjustments as needed and ensure that you’re working towards your financial objectives.

Adjust as Needed

Financial circumstances can change, and unexpected expenses can arise. It’s important to be flexible with your budget and make adjustments as needed. If you overspend in one category, look for areas where you can cut back to stay within your budget. Likewise, if you receive a windfall or a salary increase, consider allocating the extra funds towards savings or debt repayment to accelerate your financial goals.

Seek Professional Help

If you’re struggling to create or stick to a budget, don’t hesitate to seek professional help. Financial advisors and planners can provide personalized guidance tailored to your unique financial situation. They can help you create a comprehensive financial plan, set realistic goals, identify areas for improvement, and make informed decisions about your money. Working with a professional can give you the confidence and support you need to achieve your financial objectives.

Tips for Maximizing Your Monthly Budget Planner

To make the most of your monthly budget planner, consider the following tips:

Be Realistic

Set achievable financial goals that align with your income, expenses, and financial priorities. Avoid setting overly ambitious goals that may be difficult to reach, as this can lead to frustration and discouragement. By setting realistic goals, you’ll be more likely to stay motivated and on track with your budget.

Track Every Expense

Record every single expense, no matter how small, to get a complete picture of your spending habits. Small purchases can add up quickly and impact your budget, so it’s crucial to track all your transactions. Consider using apps or software that can automatically categorize your expenses and provide insights into your spending patterns.

Automate Savings

Set up automatic transfers to your savings account to make saving effortless. By automating your savings, you can ensure that a portion of your income is consistently set aside for the future. Treat your savings like a recurring expense and prioritize building your financial cushion for emergencies and long-term goals.

Review Regularly

Check your budget planner regularly to monitor your progress and identify any areas where adjustments may be necessary. Make it a habit to review your budget weekly or biweekly to ensure that you’re staying on track with your financial goals. Regular reviews can help you catch any budget leaks early on and make corrections before they become significant issues.

Seek Accountability

Share your budgeting goals with a trusted friend, family member, or partner to help you stay accountable. Having someone to check in with regularly can provide motivation and encouragement to stick to your budget. Consider setting up regular check-ins or budgeting sessions to discuss your progress, challenges, and successes on your financial journey.

Celebrate Milestones

Recognize and celebrate your budgeting milestones, no matter how small. Whether you successfully stick to your budget for a month, reach a savings goal, or pay off a debt, acknowledge your achievements and reward yourself for your hard work. Celebrating milestones can help you stay motivated, stay positive, and stay on track with your financial goals.

Stay Flexible

Be willing to adjust your budget as needed to accommodate unexpected expenses or changes in your financial situation. Life is unpredictable, and your budget should be able to adapt to new circumstances. Don’t be afraid to make changes to your budget to reflect your current priorities, goals, and financial needs.

Practice Patience

Building financial stability and achieving your goals takes time and patience. Rome wasn’t built in a day, and neither is a sound financial future. Be patient with yourself as you work towards your financial objectives, and remember that progress is more important than perfection. Stay committed to your budgeting journey, and you’ll reap the rewards of your hard work in the long run.

Stay Motivated

Find ways to stay motivated and inspired on your budgeting journey. Whether it’s visualizing your financial goals, creating a vision board, or tracking your progress in a journal, find methods that work for you to keep you focused and motivated. Remind yourself of why you’re budgeting, what you hope to achieve, and how it will benefit your future.

Practice Self-Care

Don’t forget to take care of yourself and prioritize your well-being as you navigate your financial journey. Budgeting can be stressful at times, so make sure to practice self-care, engage in activities that bring you joy, and seek support when needed. Remember that your financial health is just one aspect of your overall well-being, and taking care of yourself is essential for long-term success.

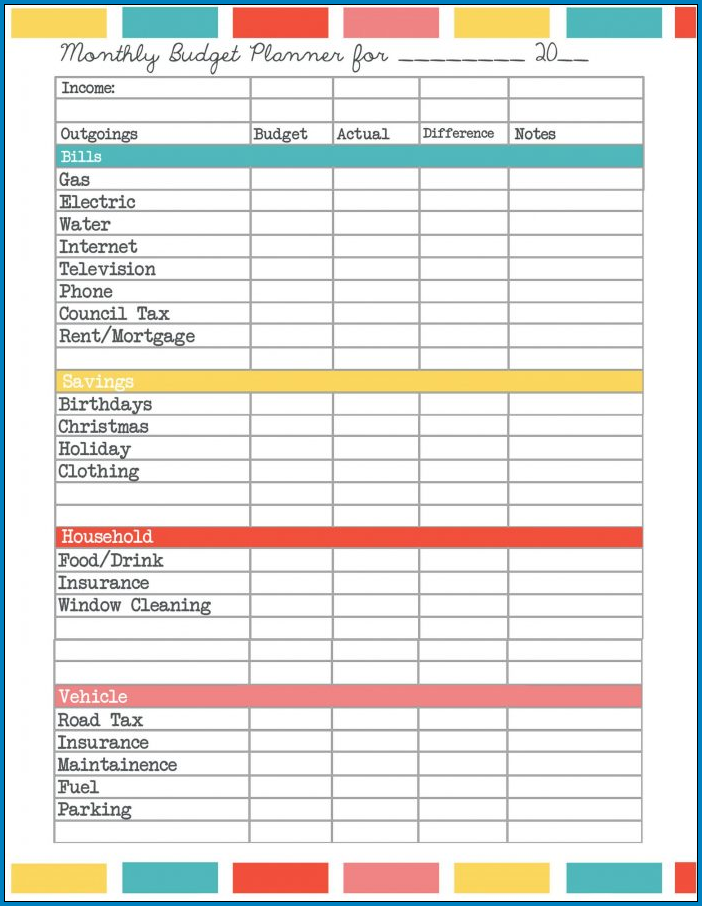

Monthly Budget Planner Template

A monthly budget planner helps you organize your income, expenses, and savings on a month-by-month basis. It provides a clear overview of your financial habits, allowing you to identify areas where you can save and plan for future expenses more effectively. Perfect for individuals, families, or small businesses, this template makes budgeting simple and stress-free.

Download and use our monthly budget planner template today to stay on top of your finances and reach your financial goals with ease.

Monthly Budget Planner Template | Excel – Download