In the world of business, keeping track of financial transactions is crucial for the success and growth of a company.

An accounting ledger plays a vital role in this process, providing a comprehensive and organized record of all financial activities undertaken by a business. It serves as the foundation for financial reporting and analysis, ensuring accuracy and facilitating the preparation of essential financial statements such as the income statement, balance sheet, and cash flow statement.

What is an Accounting Ledger?

An accounting ledger is a book or computer file where all financial transactions of a business are recorded in a systematic manner. It is like a central repository for financial data, ensuring that all transactions are accurately documented, classified, and summarized.

The ledger serves as a detailed record of all inflows and outflows of money, providing a clear picture of a company’s financial health.

Why Do You Need It?

Having an accounting ledger is essential for several reasons. Firstly, it helps in tracking and monitoring all financial transactions, making it easier to identify errors or discrepancies. Secondly, the ledger provides a historical record of all financial activities, which is crucial for making informed business decisions.

Additionally, an accounting ledger is necessary for preparing accurate financial statements, complying with tax regulations, and demonstrating transparency to stakeholders.

The Difference Between a Journal And a Ledger

While both journals and ledgers are used in accounting, they serve different purposes. A journal is where all financial transactions are initially recorded in chronological order. On the other hand, a ledger is a more organized and detailed record that classifies and summarizes the information from the journal into specific accounts. In essence, the journal is like a diary of transactions, while the ledger is a structured compilation of accounts.

5 Types of Accounts Found in an Accounting Ledger

- Asset Accounts: These accounts represent the resources owned by a business, such as cash, inventory, and equipment.

- Liability Accounts: These accounts reflect the obligations or debts of a company, such as loans, accounts payable, and accrued expenses.

- Equity Accounts: These accounts show the ownership interest in a company, including common stock and retained earnings.

- Revenue Accounts: These accounts record the income generated from the primary operations of a business, such as sales revenue and service fees.

- Expense Accounts: These accounts track the costs incurred in running a business, such as salaries, rent, utilities, and advertising expenses.

The Role of the Accounting Ledger

The accounting ledger serves as the backbone of a company’s financial record-keeping system. It helps in organizing and summarizing financial data, ensuring that all transactions are accurately recorded and classified. The ledger also plays a crucial role in preparing financial statements, analyzing business performance, and monitoring cash flow. Ultimately, a well-maintained accounting ledger provides valuable insights into a company’s financial position and helps in making informed decisions.

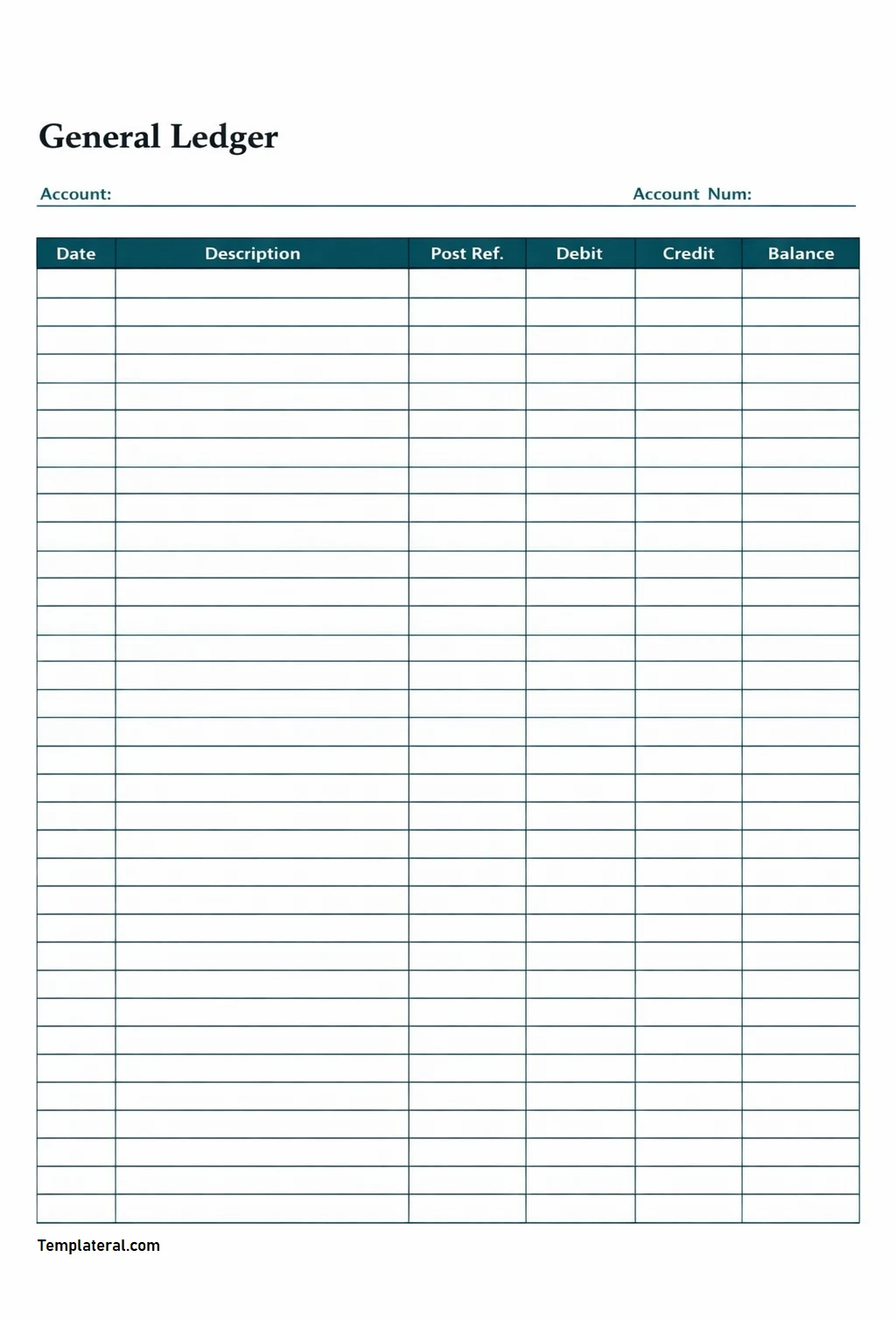

How to Write a Ledger

Writing a ledger involves several steps. Firstly, all transactions need to be recorded in a journal, including the date, description, and amount. Then, the information from the journal is transferred to the appropriate accounts in the ledger, following the double-entry accounting system. Each account in the ledger should have a debit and a credit side, ensuring that the accounting equation (Assets = Liabilities + Equity) balances. Regularly updating and reconciling the ledger is essential to ensure accuracy and reliability in financial reporting.

Accounting Ledger Template – Download