In today’s digital age, many individuals and organizations are opting for the convenience of using blank check templates. A blank check template is a ready-made digital design and layout of a physical check.

These templates serve as a base for users to fill in their details, such as the payee name, amount, memo, and signature, either manually or electronically.

What is a Blank Check Template?

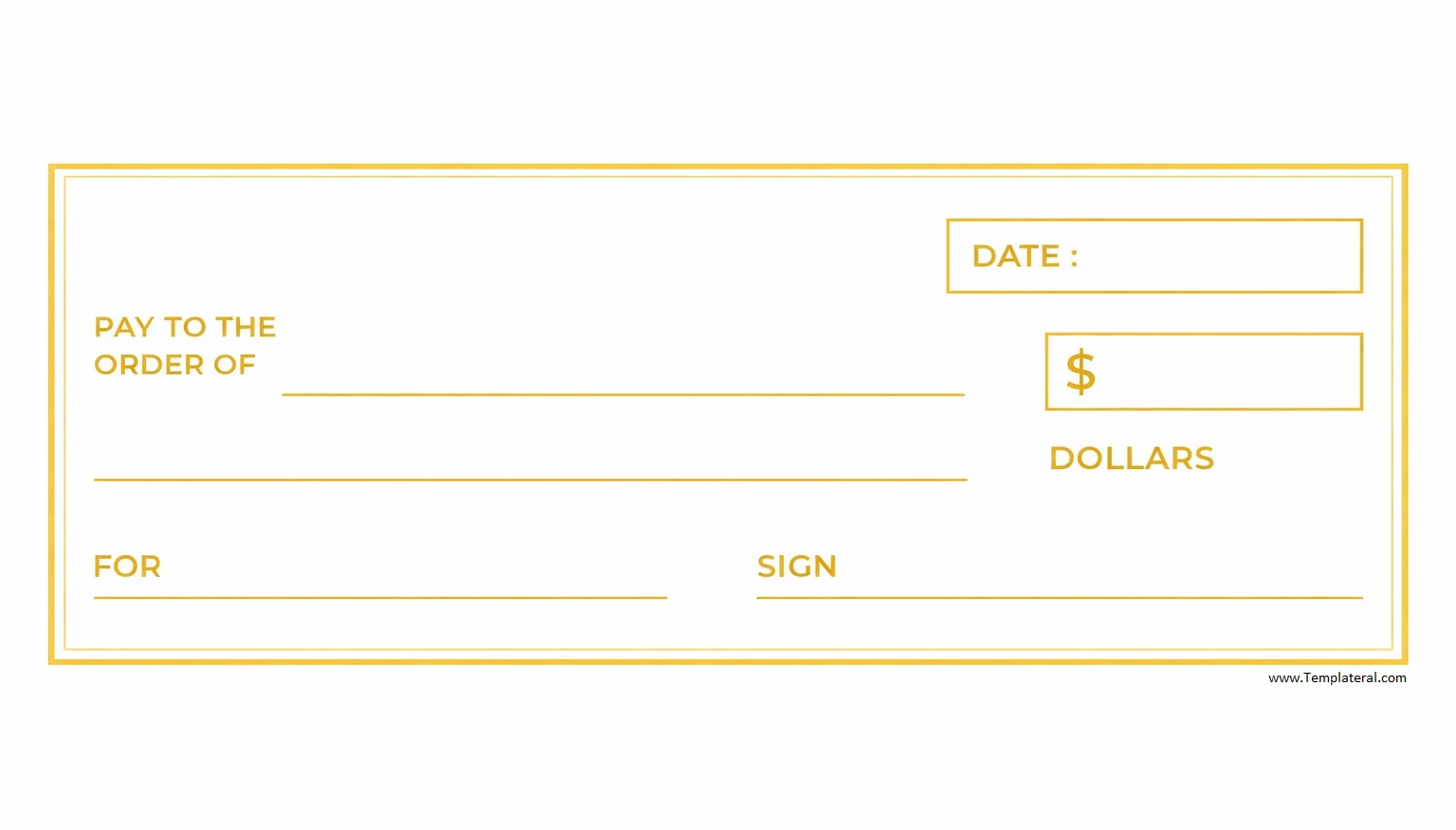

A blank check template is a pre-designed format that resembles a physical check. It typically includes all the necessary elements of a check, such as the routing number, account number, and the payee and payer details. These templates can be easily customized to suit the user’s preferences and can be printed out for use.

Using a blank check template can save time and effort, as it eliminates the need to manually fill in all the details every time a check needs to be written. It also helps in maintaining consistency and accuracy in the information provided on the check.

Why Do You Need a Check Template?

There are several reasons why using a blank check template can be beneficial. One of the main advantages is the convenience it offers in filling out checks quickly and accurately. By using a template, you can ensure that all the necessary information is included and that there are no errors in the details provided.

Additionally, using a blank check template can help in budgeting and keeping track of expenses. Having a standardized format for writing checks can make it easier to monitor and manage your finances. It also reduces the chances of making mistakes, such as writing the wrong amount or forgetting to include essential information.

Types of Checks

Different types of checks can be used with a blank check template, depending on the user’s requirements. Some common types include:

- Personal Checks: These are checks issued by individuals for personal use, such as paying bills or making purchases.

- Business Checks: These are checks issued by businesses for commercial transactions, such as paying vendors or employees.

- Payroll Checks: These are checks issued by employers to employees as payment for their wages.

- Cashier’s Checks: These are checks issued by a bank, guaranteed by the bank, and paid to a specific payee.

Components of a Blank Check Template for Printing

A typical blank check template for printing consists of several key components that are essential for a check to be valid and usable. These components include:

- Payee Name: The name of the person or entity to whom the check is written.

- Amount in Numbers and Words: The numerical amount of the check is written in digits and spelled out in words.

- Date: The date on which the check is issued.

- Signature Line: The space for the payer to sign the check to authorize the payment.

Tips for Using Blank Check Templates

When using blank check templates, there are a few tips to keep in mind to ensure that the process goes smoothly and without any issues. Some useful tips include:

- Double-Check Information: Always verify the accuracy of the information filled in the check before printing it.

- Secure Storage: Store blank check templates in a safe and secure location to prevent unauthorized access.

- Use High-Quality Paper: Print checks on high-quality paper to ensure that they are durable and tamper-proof.

- Keep Records: Maintain a record of all checks issued using the templates for reference and tracking purposes.

Impact of Considering Online Check Writing for Your Business

In today’s digital world, many businesses are shifting towards online check-writing services for added convenience and efficiency. Online check writing platforms offer various benefits, such as:

- Time-Saving: Writing checks online is faster and more efficient than manual methods.

- Cost-Effective: Online check writing services are often more cost-effective than traditional methods.

- Security: Online platforms offer secure encryption and protection for sensitive financial information.

- Convenience: Access to online check writing services from anywhere with an internet connection.

Steps for Writing a Check

Writing a check using a blank check template is a straightforward process that involves a few simple steps. To write a check correctly, follow these steps:

- Fill in the Date: Write the current date on the designated line on the check.

- Enter the Payee Name: Write the name of the person or entity to whom the check is payable on the “Pay to the Order of” line.

- Enter the Amount: Write the amount in numbers in the box provided and in words on the line below.

- Sign the Check: Sign the check on the signature line to authorize the payment.

Using blank check templates can streamline the process of writing checks and ensure accuracy in the information provided. By following the tips and guidelines outlined in this guide, you can make the most of blank check templates for your personal or business needs.

Blank Check Template – DOWNLOAD